-- Published: Monday, 20 May 2019 | Print | Disqus

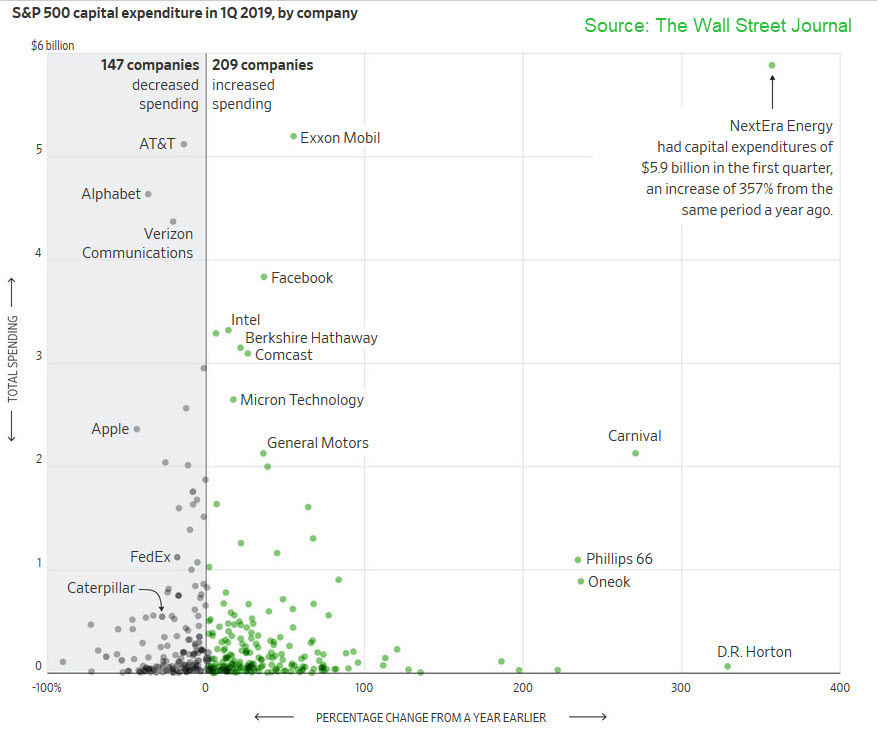

So how does Game of Thrones end? Never having watched the show, I couldn’t care less. But thirty million fans evidently do. We haven’t seen America this worked up about so trivial a concern since Kristin Shephard shot J.R. Ewing nearly 40 years ago in a landmark episode of Dallas. TV was free back then, and so the audience worldwide was more than ten times that of Game of Thrones. Could the current obsession with a hyped-up TV show explain why the stock market is flirting with new record-highs even though the economic world is on the brink of recession? Unfortunately, this is no exaggeration. Europe has been slumping toward growthlessness while China and the U.S. are in a tariff war that seems likely to worsen, reversing a decades-long global trend toward freer trade. This is a very big deal, a watershed change in a seemingly rosy economic picture, but you couldn’t tell this from watching the stock market’s near-vertical ascent since January. The rally continued last week ahead of an ominous report that capital spending, a key driver of economic growth, fell dramatically in Q1 for a broad cross-section of large U.S. companies.

Stocks have risen anyway, not because investors are convinced of a brighter tomorrow, but because the flow of funny money into stocks has become well nigh unstoppable. It is a perpetual-motion machine requiring only a drop of lubrication from sunny unemployment numbers to keep things humming. In reality, low joblessness reflects only a superficial aspect of the U.S. economy’s supposed strength. It is a trickle-down effect that has not helped to alleviate the massive debt burden of Americans one bit. To the contrary, it has only pushed consumers to borrow more, making an inevitable day of reckoning even more traumatic.

Bread and Circuses

Indeed, the tension will only continue to grow between a thousand-year-flood of credit money and a manic bull market that would have died long ago without it. Huge share-buybacks, more than any other source, have helped keep stocks buoyant. But the companies themselves are arguably the poorest judges of the value of their own shares. Clearly, they are oblivious to the hazards posed by a global trade war and the sharp slowdown that is coming. “U.S. companies have been buying back their own shares at a blistering pace for more than a year, and market turbulence isn’t likely to stop them now,” declaimed The Wall Street Journal in Friday’s lead story. Just so. But if market turbulence does not stop them, it is 100% predictable that something else will.

No one can predict what this will be — and in fact my own technical works allows for a rally of about 8% in the broad averages regardless of whether the economic/geopolitical picture worsens. In the meantime, bulls thinking about exit shares should be grateful for the distraction of Game of Thrones and the bread-and-circuses revelry that has sustained the mania and grown their wealth. The smart money will be headed shortly into U.S. Treasury paper, and so should you.

Start a free two-week trial subscription by clicking here. Make the Coffee House chat room your first stop. There you will meet some of the best-informed crypto fanatics in the trading world.

| Digg This Article

-- Published: Monday, 20 May 2019 | E-Mail | Print | Source: GoldSeek.com