Friday’s subdued rally had more than a faint whiff of distribution about it. DaBoyz had shorts on the run in the early going, with the Dow up about 230 points in the first hour. But instead of reaming bears a new orifice as we might have expected, the erstwhile Masters of the Universe struggled merely to maintain altitude and eventually had to close the broad averages well off their intraday highs.

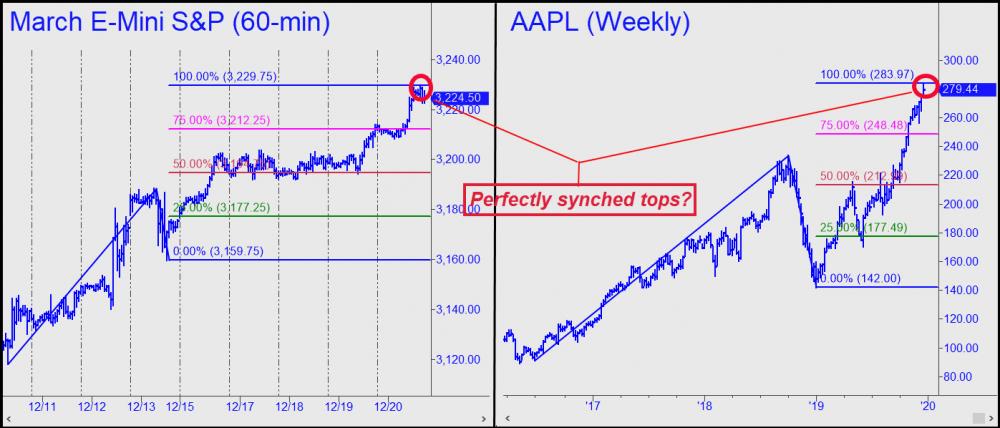

If you took a short position over the weekend there were some encouraging signs. For one, AAPL hit a 283.97 rally target that Rick’s Picks has been drum-rolling since March, when the stock was selling for around 180. The actual high at 283.54 occurred on a dubious spike just ahead of the opening bell. The upthrust turned into a bull trap when AAPL sold off $5 intraday and never recovered. The high stands to be a potentially important one for the bull market, since AAPL is the most popular stock in institutional portfolios. If it has hit a ceiling, then so has the stock market.

Rally Outrunning Earnings

The second encouraging sign for those who faded the rally was a top in the E-Mini S&Ps at 3229.50 that missed the Hidden Pivot rally target shown in the chart by a single tick. It had been sent out to subscribers the night before. Will these coinciding, fleeting peaks mark an important peak for the stock market? We could find out soon if shares head south on Monday and the decline gains momentum as the holiday-shortened week wears on. But even if new record highs are coming, a correction at this point would be constructive, if only to cool a buying fever that has driven equity prices much higher without any corresponding growth in earnings.

|