-- Published: Wednesday, 10 June 2015 | Print | Disqus

In the real world there is money supply and there is money demand. There is no such thing as money velocity. “Money velocity” only exists in academia and is not a useful concept in economics or financial-market speculation.

As is the case with the price of anything, the price of money is determined by supply and demand. Supply and demand are always equal, with the price adjusting to maintain the balance. A greater supply will often lead to a lower price, but it doesn’t have to. Whether it does or not depends on demand. For example, if supply is rising and demand is attempting to rise even faster, then in order to maintain the supply-demand balance the price will rise despite the increase in supply.

When it comes to price, the main difference between money and everything else is that money doesn’t have a single price. Due to the fact that money is on one side of almost every economic transaction, there will be many (perhaps millions of) prices for money at any given time. In one transaction the price of a unit of money could be one potato, whereas in another transaction happening at the same time the price of a unit of money could be 1/30,000th of a car. This, by the way, is why all attempts to come up with a single number — such as a CPI or PPI — to represent the price of money are misguided at best.

If money “velocity” doesn’t exist in the real world, why do so many economists and commentators on the economy harp on about it?

The answer is that the velocity of money is part of the very popular equation of exchange, which can be expressed as M*V = P*Q where M is the money supply, V is the velocity of money, Q is the total quantity of transactions in the economy and P is the average price per transaction. The equation is a tautology, in that it says nothing other than the total monetary value of all transactions in the economy equals the total monetary value of all transactions in the economy. In this ultra-simplistic tautological equation, V is whatever it needs to be to make the left hand side equal to the right hand side. In other words, ‘V’ is a fudge factor that makes one side of a practically useless equation equal to the other side.

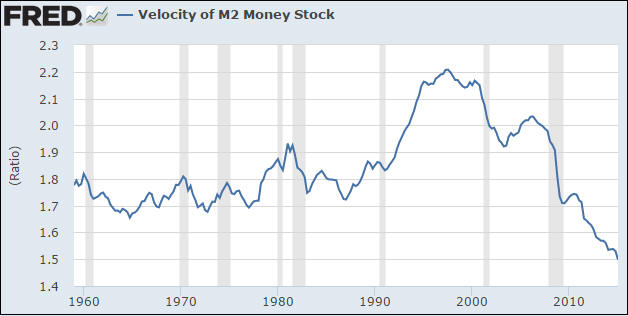

Another way to express the equation of exchange is M*V = nominal GDP, or V = GDP/M. Whenever you see a chart of V, all you are seeing is a chart of nominal GDP divided by some measure of money supply. That’s why a large increase in the money supply will usually go hand-in-hand with a large decline in V. For example, the following chart titled “Velocity of M2 Money Stock” shows GDP divided by M2 money supply. Given that there was an unusually-rapid increase in the supply of US dollars over the past 17 years, this chart predictably shows a 17-year downward trend in “money velocity”.

Note that over the 17-year period covered by the following chart there were multiple economic booms and busts, not one of which was predicted by or reliably indicated by “money velocity”. However, every boom and every bust was led by a change in the rate of growth of True Money Supply (TMS).

Chart source: https://research.stlouisfed.org/

In conclusion, “money velocity” doesn’t exist outside of a mathematical equation that, due to its simplistic and tautological nature, cannot adequately explain real-world phenomena.

http://tsi-blog.com/blog/blog-default/

| Digg This Article

-- Published: Wednesday, 10 June 2015 | E-Mail | Print | Source: GoldSeek.com