-- Published: Wednesday, 5 August 2015 | Print | Disqus

The belief that the Fedís QE (Quantitative Easing) does not directly boost the US money supply remains popular, even though it is obviously wrong. This is remarkable. Itís even more remarkable, however, that this wrongheaded belief is dearly held by some analysts who are generally astute, a fact I was reminded of when reading a recent post by Doug Noland.

The above-linked Noland post contains the following quote from Russell Napier. The quote is extraordinary due to a) the large number of errors that have been crammed into a few lines, b) the supreme confidence with which blatantly-wrong information is stated, and c) the fact that Russell Napier usually comes across as a smart analyst.

ďMost investors still believe that we live in a fiat currency world. They believe central bankers can create as much money as they believe to be necessary. Such truths are on the front page of every newspaper, but they may contain just as much truth as the headlines of their tabloid cousins. A belief in this ability to create money is the biggest mistake in analysis ever identified by this analyst. The first reality it ignores is that money, the stuff that buys things and assets, is created by an expansion of commercial bank, and not central bank, balance sheets. The massively expanded central bank balance sheets have not lifted the growth in broad money in the developed world above tepid levels. Until that happens, developed world monetary policy must be regarded as tight and not easy.Ē

This quote is a mindboggling display of ignorance regarding the mechanics of the Fedís QE, but Doug Noland describes it as ďthoughtful and important analysisĒ. As they say in Thailand, oh my Bhudda! Doug Noland, another smart analyst, apparently also labours under false beliefs regarding the relationship between the Fedís QE and the US money supply.

The Fedís money-creation process is not that complicated. Thereís certainly no good reason why professional financial-market analysts couldnít or shouldnít be familiar with it. I explained the process in some detail in a blog post on 16th February.

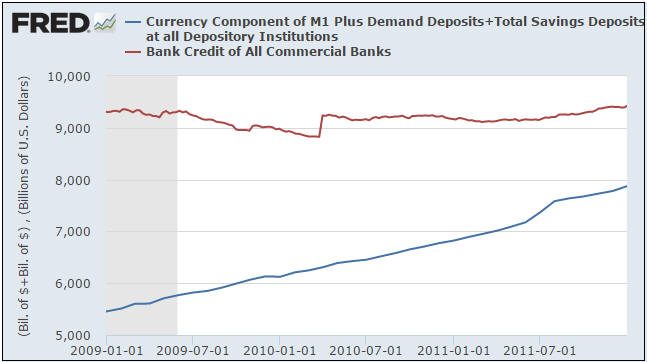

Moreover, even an analyst who doesnít understand the mechanics of the QE process should be able to see, via a quick look at the money-supply and bank credit data, that there has been a lot more money creation in the US over the past several years than can be explained by the expansion of commercial bank balance sheets. For example, the red line on the following chart shows that from the beginning of 2009 through to the end of 2011 the total quantity of US commercial bank credit grew by only $100B (from $9.3T to $9.4T) while the blue line on the chart shows that over the same 3-year period the US money supply (currency in circulation outside the banking system + commercial-bank demand deposits + commercial-bank savings deposits) grew by $2.4T. If not from the Fed, where did the $2.3T of money-supply expansion that cannot be explained by commercial-bank credit expansion come from?

Not coincidentally, the amount by which the increase in commercial-bank credit falls short of the increase in the money supply is approximately the same as the increase in Fed credit. This is not a coincidence because the Fed created the money.

http://tsi-blog.com/blog/blog-default/

| Digg This Article

-- Published: Wednesday, 5 August 2015 | E-Mail | Print | Source: GoldSeek.com