-- Published: Monday, 31 August 2015 | Print | Disqus

After China’s government announced a small reduction in the Yuan’s foreign exchange (FX) value early last month, US Presidential aspirant Donald Trump immediately leapt onto the nearest available podium and exclaimed:

“They [the Chinese] continuously cut their currency. They devalue their currency. And I have been saying this for years. They have been doing this for years. This isn’t just starting. This was the largest devaluation they have had in two decades. They make it impossible for our businesses, our companies to compete. They think we’re run by a bunch of idiots. And what’s going on with China is unbelievable, the largest devaluation in two decades. It’s honestly…a disgrace.”

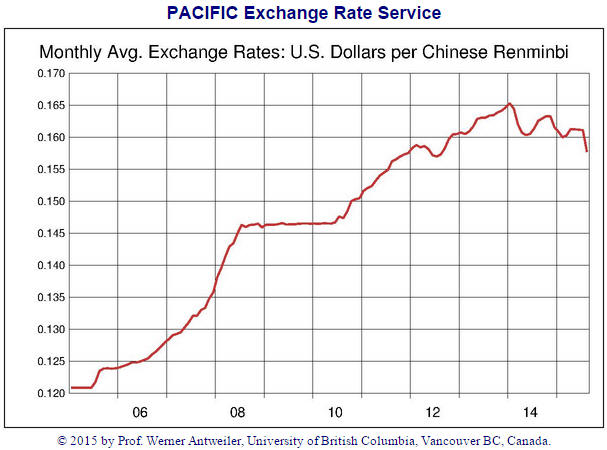

The fact is that even after its recent “devaluation”, relative to the US$ the Yuan is up by 8% over the past 5 years and 30% over the past 10 years. Here’s a chart showing the performance (a rising line on this chart indicates a strengthening of the Yuan relative to the US$). Take a look at this chart and then re-read the above Trump comments.

Is Trump really that poorly informed about what’s going on? Perhaps, but probably not. It’s clear that Trump has become the consummate populist — someone who is willing to say anything that he thinks will strike a chord with a large mass of voters, even if he knows that what he is saying is complete nonsense.

In the case of China’s so-called devaluation, however, it isn’t just bombastic billionaires with a lust for political power who have misrepresented the situation. Anyone who has claimed that the Yuan’s devaluation was primarily about boosting exports has a poor understanding.

The reality is that the Yuan is very over-valued and has begun to fall under the weight of this over-valuation. Furthermore, rather than deliberately devaluing the Yuan, as part of its effort to maintain the semblance of stability China’s government has actually been trying to prevent the Yuan from devaluing. This can be deduced from the fact that China’s government has been selling-down its FX reserves (selling reserve-currency (mostly US$) assets and buying the Yuan puts upward pressure on the Yuan’s relative value). However, trying to prop-up the exchange rate via the selling of FX reserves and the simultaneous buying of the local currency is a form of monetary tightening, which, according to the fatally-flawed Keynesian theories that guide policymakers the world over, is the last thing that China’s economy needs right now.

Faced with the choice of keeping the Yuan’s FX value at an unrealistically high level via a form of monetary tightening or allowing the currency to start falling under the weight of its own over-valuation, China’s policymakers opted for the latter. Actually, they didn’t have much of a choice.

http://tsi-blog.com/

| Digg This Article

-- Published: Monday, 31 August 2015 | E-Mail | Print | Source: GoldSeek.com