-- Published: Thursday, 10 March 2016 | Print | Disqus

Brazil, the ‘B’ in the BRIC acronym, was widely considered to be a model of emerging-market economic excellence during 2003-2011. Now it is widely considered to be an economic basket-case. What went wrong?

There are always many factors involved in a major economic turnaround, but for Brazil’s economy — and for many other economies over the past 15 years — the most important point to understand is that the impressive growth was not genuine; it was an artifact of rapid monetary inflation. Brazil’s government was just as corrupt and interventionist as ever during the period of impressive growth, but for a long time nobody noticed (or cared) because rapid domestic monetary inflation in parallel with a commodity bull market driven by rapid global monetary inflation created the illusion of increasing prosperity.

Brazil no longer has a monetary inflation problem. In fact, as depicted in the True Money Supply (TMS) chart below, it is now experiencing monetary DEFLATION.

And yet, Brazil’s central bank is still ‘tightening the monetary screws’. As illustrated by the following chart, it moved its targeted interest rate to an 8-year high of 14.25% in mid-2015 and has kept it there.

The current situation in Brazil underlines the problem of having monetary central planners. Even the smartest and most incorruptible of central planners will make the economy less efficient, because the right level for a price is the price that would exist in the absence of government or central-bank interference. However, monetary central planners tend to make matters even worse by reacting to backward-looking economic data and to the lagged effects of earlier policies.

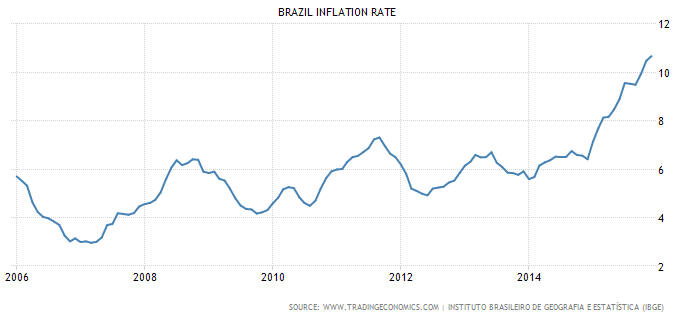

In Brazil’s case, rather than acknowledging the extreme current tightness of monetary conditions and acting accordingly, the central bank is fixating on the CPI, which is, in turn, accelerating upward due to the lagged effects of the monetary inflation that happened years ago. This is a good example of how central bankers not only fail in their self-proclaimed mission to smooth-out the business cycle, but also greatly amplify the economic oscillations.

Brazil’s experience over the past 10 years is another in a long line of real-world demonstrations of Austrian Business Cycle Theory. Rapid monetary inflation and the lowering of interest rates results in an artificial boom, during which the GDP numbers look good at the same time as wealth-destroying investing mistakes are being made on a grand scale. The boom sets the stage for a bust, which wipes out all of the preceding gains and then some.

| Digg This Article

-- Published: Thursday, 10 March 2016 | E-Mail | Print | Source: GoldSeek.com