-- Published: Friday, 23 June 2017 | Print | Disqus

To paraphrase Jim Grant, gold’s perceived value in US$ terms is the reciprocal of confidence in the Fed and/or the US economy. Consequently, what I refer to as gold’s true fundamentals are measures of confidence in the Fed and/or the US economy. I’ve been covering these fundamental drivers of the gold price in TSI commentaries for almost 17 years. It doesn’t seem that long, but time flies when you’re having fun.

Note that I use the word “true” to distinguish the actual fundamental drivers of the gold price from the drivers that are regularly cited by gold-market analysts and commentators. According to many pontificators on the gold market, gold’s fundamentals include the volume of metal flowing into the inventories of gold ETFs, China’s gold imports, the volume of gold being transferred out of the Shanghai Futures Exchange inventory, the amount of “registered” gold at the COMEX, India’s monsoon and wedding seasons, jewellery demand, the amount of gold being bought/sold by various central banks, changes in mine production and scrap supply, and wild guesses regarding JP Morgan’s exposure to gold. These aren’t true fundamental price drivers. At best, they are distractions.

In no particular order, the gold market’s six most important fundamental price drivers are the trends in 1) the real interest rate, 2) the yield curve, 3) credit spreads, 4) the relative strength of the banking sector, 5) the US dollar’s exchange rate and 6) commodity prices in general. Even though it creates some duplication, the bond/dollar ratio should also be included.

Until recently I took the above-mentioned price drivers into account to arrive at a qualitative assessment of whether the fundamental backdrop was bullish, bearish or neutral for gold. However, to remove all subjectivity and also to enable changes in the overall fundamental backdrop to be charted over time, I have developed a model that combines the above-mentioned seven influences to arrive at a number that indicates the extent to which the fundamental backdrop is gold-bullish.

Specifically, for each of the seven fundamental drivers/influences I determined the weekly moving average (MA) for which a MA crossover catches the most trend changes in timely fashion with the least number of ‘whipsaws’. It’s a trade-off, because the shorter the MA the sooner it will be crossed following a genuine trend change but the more false trend-change signals it will cause to be generated. I then assign a value of 100 or 0 to the driver depending on whether its position relative to the MA is gold-bullish or gold-bearish. For example, if the yield-curve indicator is ABOVE its pre-determined weekly MA then it will be assigned a value of 100 by the model, because being above the MA points to a steepening yield-curve trend (bullish for gold). Otherwise, it will be zero. For another example, if the real interest rate indicator is BELOW its pre-determined weekly MA then it will be assigned a value of 100 by the model, because being below the MA points to a falling real-interest-rate trend (bullish for gold). Otherwise, it will be zero.

The seven numbers, each of which is either 0 or 100, are then averaged to arrive at a single number that indicates the extent to which the fundamental backdrop is gold-bullish, with 100 indicating maximum bullishness and 0 indicating minimum bullishness (maximum bearishness). The neutral level is 50, but the model’s output will always be either above 50 (bullish) or below 50 (bearish). That’s simply a function of having an odd number of inputs.

Before showing a chart of the Gold True Fundamentals Model (GTFM) it’s worth noting that:

1) The fundamental situation should be viewed as pressure, with a bullish situation putting upward pressure on the price and a bearish situation putting downward pressure on the price. It is certainly possible for the price to move counter to the fundamental pressure for a while, although it’s extremely likely that a large price advance will coincide with the GTFM being in bullish territory most of the time and that a large price decline will coincide with the GTFM being in bearish territory most of the time.

2) The effectiveness of fundamental pressure will be strongly influenced by sentiment (as primarily indicated by the COT data) and relative valuation (as primarily indicated by the gold/commodity ratio). For example, if the fundamental backdrop is bullish and at the same time the gold/commodity ratio is high and the COT data indicate that speculators are aggressively betting on a higher gold price then it is likely that the bullish fundamental backdrop has been factored into the current price and that the remaining upside potential is minimal. The best buying opportunities therefore occur when a bullish fundamental backdrop coincides with pessimistic sentiment and a low gold/commodity ratio.

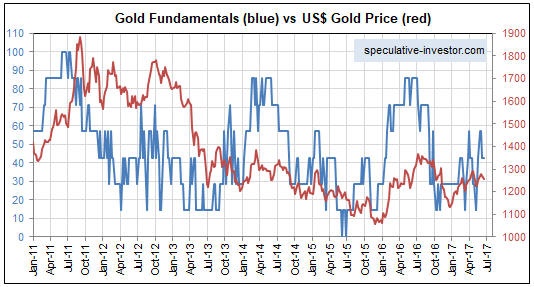

Getting down to brass tacks, here is a weekly chart comparing the GTFM with the US$ gold price since the beginning of 2011.

A positive correlation between the GTFM and the gold price is apparent on the above chart, which, of course, should be the case if the GTFM is a valid model. If you look closely it should also be apparent that the fundamentals (as represented by the GTFM) tend to lead the gold price at important turning points. For example, the GTFM turned down in advance of the gold price during 2011-2012 and turned up in advance of the gold price in 2015 (the GTFM bottomed in mid-2015 whereas the gold price didn’t bottom until December-2015).

The tendency for gold to react to, rather than anticipate, changes in the fundamentals is not a new development, as evidenced by gold’s delayed reaction to a major fundamental change in the late-1970s. I’m referring to the fact that by the second half of 1978 the monetary environment had turned decisively gold-bearish, but the gold price subsequently experienced a massive rally that didn’t culminate until January-1980.

The GTFM was slightly bearish over the past two weeks, but three of the model’s seven components are close to tipping points so it wouldn’t take much from here to bring about a shift into bullish territory or a further shift into bearish territory. The former is the more likely and could occur as soon as today (23rd June).

| Digg This Article

-- Published: Friday, 23 June 2017 | E-Mail | Print | Source: GoldSeek.com