-- Published: Tuesday, 16 January 2018 | Print | Disqus

Some commentators have made a big deal over the Yuan-denominated oil futures contract that will soon begin trading in Shanghai, but in terms of effect on the global currency market this appears to be a very small deal.

With or without a Yuan-denominated oil futures market there is nothing preventing the suppliers of oil to China from accepting payment in Yuan. In fact, some of the oil imported by China is already paid for in Yuan. Having a Yuan-denominated oil futures contract may encourage some additional oil trading to be done in China’s currency because it would enable suppliers to reduce their risk via hedging, but the main issue is that the Yuan is not a useful currency outside China. Unless an international oil exporter was interested in making a large investment in China, getting paid in Yuan would create a problem of what to do with the Yuan.

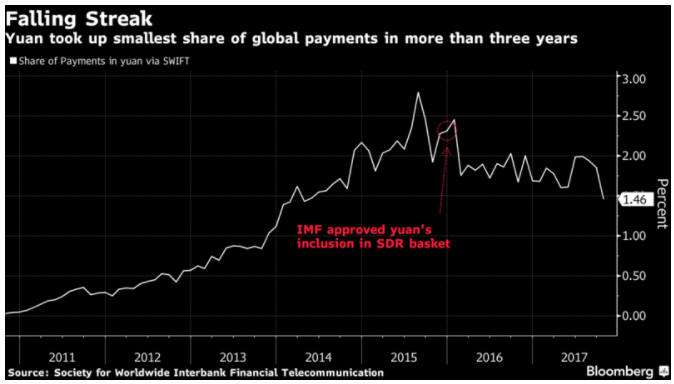

In any case, the monetary value of the world’s daily oil consumption is less than 0.1% of daily trading volume on the foreign exchange market, and the foreign exchange market is dominated by the US$. Despite the popular (in some quarters) notion that the US$ is in danger of losing its leading role within the monetary system, at last count the US$ was on one side of 88% of all international transactions. The euro, the world’s other senior fiat currency, was at around 30% (and falling). The Yuan’s share of the global currency market is very small (less than 3%), and according to the following chart could be in a declining trend.

The point we were trying to make in the above paragraph is that a change in how any country pays for its oil imports will not have a big effect on the global currency market. Actually, the cause-effect works the other way around. The pricing of oil in US dollars is not, or at least is no longer, even a small part of the reason that the US$ dominates the global currency system, but the fact that the US$ dominates the global currency system causes most international oil exporters to demand payment in US dollars.

The US$ sometimes rises and sometimes falls in value relative to other currencies, but it always dominates global money flows. Like it or not, that’s the nature of today’s monetary system.

The current monetary system is US$-based and in all likelihood will remain so until it collapses and gets replaced by something different. In other words, it’s unlikely — we almost would go as far as to say impossible — for the current system to persist while another currency gradually superseded the US$. The reason is that there is no viable alternative to the US$ among today’s other major fiat currencies.

We don’t have a strong opinion on what the post-collapse “something different” will be. One possibility is a system based on gold, but there could also be an attempt to create a global fiat currency. The world’s political leadership and financial establishment would certainly favour the latter possibility, but we fail to see how it could work as it would essentially be the botched euro experiment on a much grander scale.

| Digg This Article

-- Published: Tuesday, 16 January 2018 | E-Mail | Print | Source: GoldSeek.com