-- Published: Tuesday, 10 July 2018 | Print | Disqus

As Iíve noted in the past, the Commitments of Traders (COT) information is nothing other than a sentiment indicator. Moreover, for some markets, including gold, silver, copper, the major currencies and Treasury bonds, the COT reports are by far the best indicators of sentiment. This is because they reflect how the broad category known as speculators is betting. Sentiment surveys, on the other hand, focus on a relatively small sample and are, by definition, based on what people say rather than what they are doing. Thatís why for some markets, including the ones mentioned above, I put far more emphasis on the COT data than on sentiment surveys.

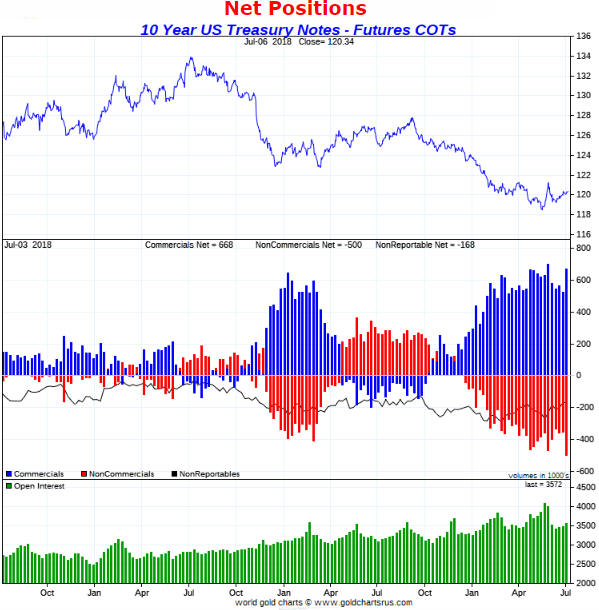

In this post Iíll summarise the COT situations for five markets with the help of charts from ďGold Charts ĎRí Usď. Iíll be focusing on the net positioning of speculators in the futures markets, although useful information can also be gleaned from gross positioning and open interest.

Note that what I refer to as the total speculative net position takes into account the net positions of large speculators (non-commercials) and small traders (the Ďnon-reportablesí) and is the inverse of the commercial net position. The blue bars in the middle sections of the charts that follow indicate the commercial net position, so the inverse of each of these bars is considered to be the total speculative net position.

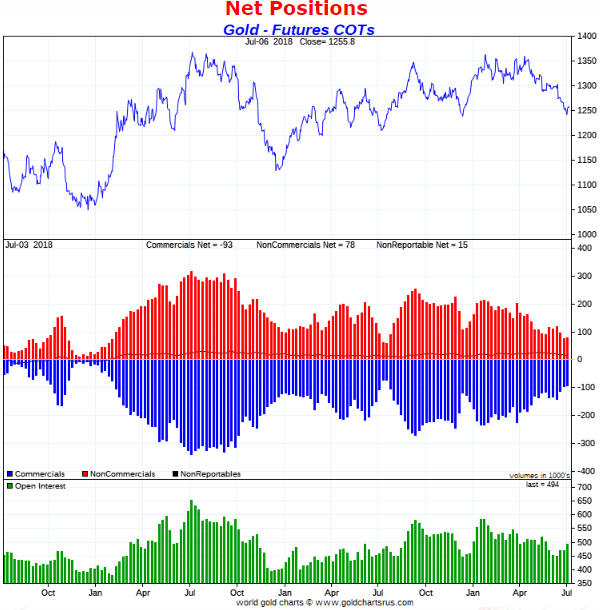

Iíll start with gold.

Goldís COT situation was almost unchanged over the latest week. Ignoring everything except sentiment (as indicated by the COT data), gold is in a similar position now to where it was in early-July and early-December of last year. This suggests the potential for a 2-month rally to the $1350-$1400 range, but not much more than that.

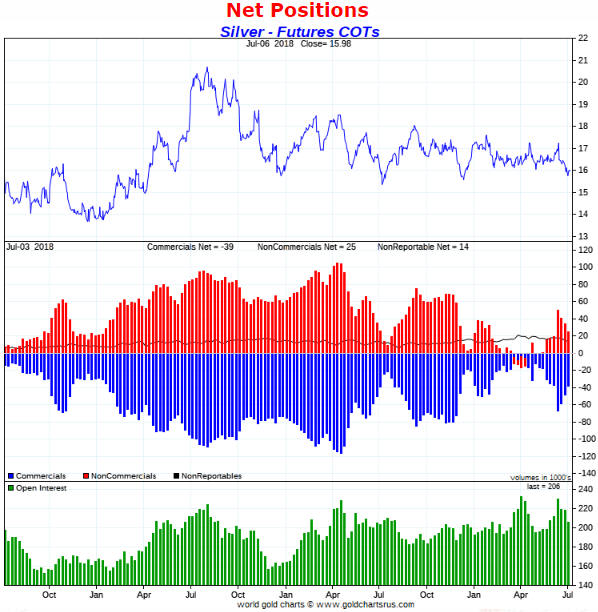

Silverís COT situation has been a source of controversy over the past four months. Some analysts argued that it was extremely bullish, whereas I argued (for example: HERE) that at no point over this period was the COT situation conducive to a significant silver rally. Iím therefore not surprised that there hasnít been a significant silver rally.

Four weeks ago silverís COT situation became slightly bearish, but it has since improved and I now view it as neither a tail-wind nor a head-wind for the silver price. However, silver will rally if gold rallies. Itís that simple.

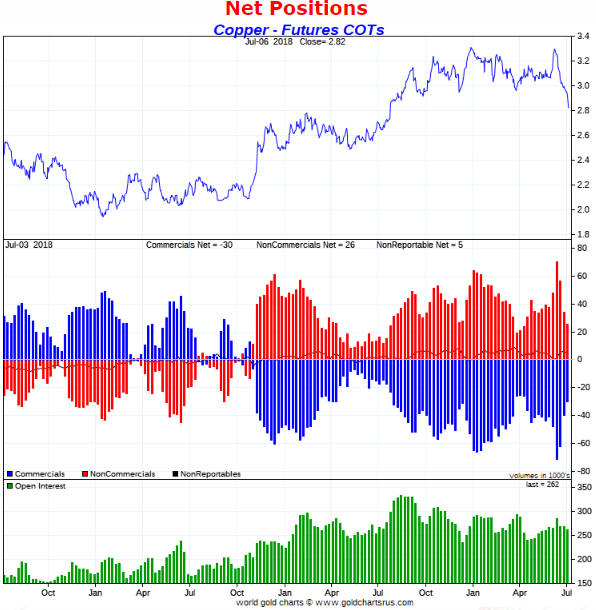

Four weeks ago the speculative net-long position in Comex copper futures became extreme. This didnít guarantee that a large price decline was in store, but it pointed to substantial downside risk in the price.

Copperís COT situation is now similar to what it was near short-term price bottoms in July and December of last year, so thereís a decent chance of a multi-week price rebound.

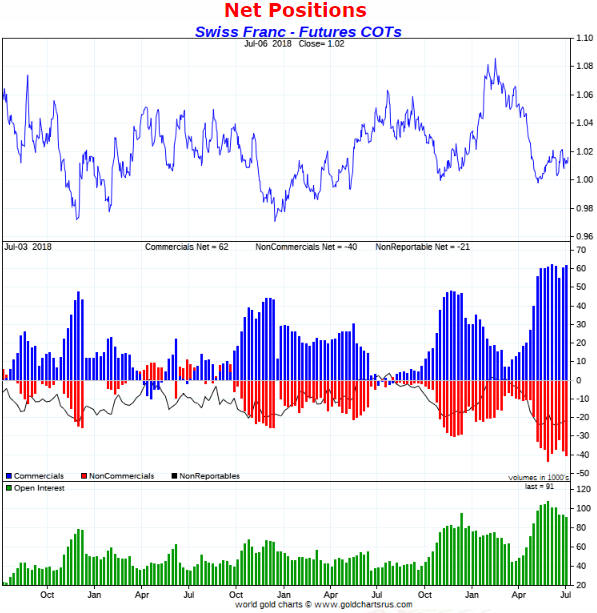

Of the major currencies, the Swiss franc (SF) has the most bullish COT situation. The COT information certainly doesnít preclude one more decline in the SF to a new low for the year, but it suggests that the SF will trade significantly higher within the next three months.

I expect that long-dated US Treasury securities will trade at much lower prices (much higher yields) within the next 2 years, but during April-May of this year I began to anticipate a multi-month price rebound (yield pullback) in this market. This was mainly due to sentiment as indicated by the COT situation. Of particular relevance, the total speculative net-short position in 10-year T-Note futures had risen to an all-time high.

Despite a price rebound from the May low, the speculative net-short position in 10-year T-Note futures remains near the all-time high reached in late-May. Therefore, itís a good bet that the T-Note/T-Bond price rebound is not close to being complete.

| Digg This Article

-- Published: Tuesday, 10 July 2018 | E-Mail | Print | Source: GoldSeek.com