-- Published: Monday, 13 August 2018 | Print | Disqus

For the first time this year, about two weeks ago the sentiment backdrop became decisively supportive of the gold price and remains so. At the same time, the fundamental backdrop is unequivocally bearish for gold. What will be the net effect of these counteracting forces?

Before attempting to answer the above question let’s briefly review the most important sentiment and fundamental indicators.

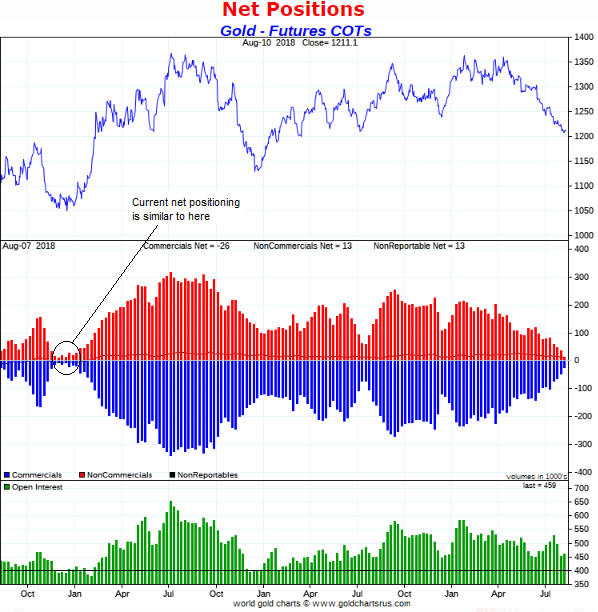

The following chart from goldchartsrus.com shows that at Tuesday 7th August (the date of the latest COT data) the net positioning of traders in gold futures was similar to what it was in December-2015, which is when a powerful 7-month rally was about to begin. Therefore, in terms of net positioning the COT situation (the most useful of all the gold-market sentiment indicators) is as bullish as it has been in many years.

The one concern is that while the open interest (the green bars in the bottom section of the following chart) is well down from where it was a month ago, it is still more than 50K contracts above where it was at the December-2015 and December-2016 price lows (the two most important price lows of the past five years). The open interest may have to drop to 400K contracts or lower before there is a strong, multi-month rally.

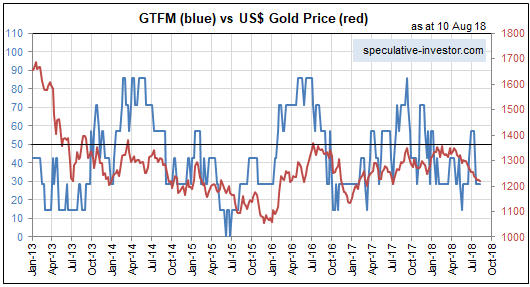

There are a number of important fundamental drivers of the US$ gold price, including credit spreads, the yield curve, the real interest rate (the TIPS yield), the relative strength of the banking sector and the US dollar’s exchange rate. The most important seven gold-market fundamentals are incorporated into our Gold True Fundamentals Model (GTFM), a chart of which is displayed below.

The GTFM was ‘whipsawed’ between late-June and mid-July, in that during this short period it shifted from bearish to bullish and then back to bearish. Apart from this 2-3 week period it has been continuously bearish since mid-January.

Returning to the question posed in the opening paragraph, regardless of what happens on the sentiment front there will not be an intermediate-term upward trend in the gold market until the fundamental backdrop turns gold-bullish. The fundamentals are constantly in flux and potentially will turn bullish within the next few weeks, but at this time there is no good reason to expect that an intermediate-term gold rally is about to begin.

However, with the right sentiment situation a strong short-term rally can occur in the face of bearish fundamentals. This is what happened between late-June and early-September of 2013. During this roughly 2-month period there was a $200 increase in the gold price in the face of a gold-bearish fundamental backdrop.

The gold market was far more ‘oversold’ in late-June of 2013 than it is today, but it is sufficiently depressed today to enable a short-term rebound of at least $100 even without a significant improvement (from gold’s perspective) in the fundamentals.

That doesn’t mean that we should expect a $100+ rebound to get underway in the near future, only that — thanks to the depressed sentiment — the potential is there. Before the potential starts being realised the price action will have to signal a reversal.

| Digg This Article

-- Published: Monday, 13 August 2018 | E-Mail | Print | Source: GoldSeek.com