-- Published: Tuesday, 18 September 2018 | Print | Disqus

If you rely on the mainstream financial press for your information then you could be forgiven for believing that financial crises happen with no warning. However, there are always warnings if you know where to look.

Here are four leading indicators of financial stress and/or economic confidence that are both easy to monitor and worth monitoring. It’s likely that all four of these indicators will issue timely warnings prior to the next financial crisis and a virtual certainty that at least two of them will.

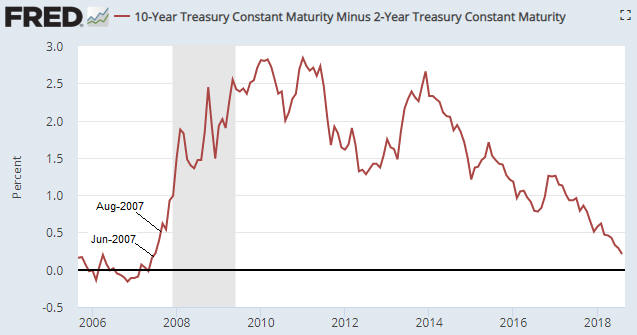

1) The yield curve, as depicted on the following chart by the 10yr-2yr yield spread.

As explained in many previous commentaries, the yield curve ‘flattening’ to an extreme and then beginning to steepen warns that an inflation-fueled boom has begun to unravel. For example, the yield curve reached its maximum ‘flatness’ in November-2006 and provided clear evidence of a reversal in June-2007. That was the financial crisis warning. By August of 2007 the ‘steepening’ trend was accelerating.

The yield curve’s current situation looks more like Q4-2006 than Q3-2007. It is nothing like 2008.

2) Credit spreads, as depicted on the following chart by the difference between the Merrill Lynch US High Yield Master II Effective Yield and the yield on the 10-Year T-Note.

Credit spreads start to widen, indicating a decline in economic confidence and/or a rise in the perceived risk of default at the junk end of the debt market, well before a recession or crisis. For example, evidence of a new widening trend in credit spreads emerged in July-2007 and by November-2007 it was very obvious that trouble was brewing.

Note that when it comes to warning of a coming crisis, credit spreads are far more likely to generate a false positive signal than a false negative signal, that is, they are far more likely to cry wolf when there’s no wolf than to remain silent when there is a wolf.

Right now they are silent.

3) The short-term interest rate at which banks lend to other banks versus the equivalent interest rate at which the US federal government borrows money, as depicted on the following chart by the LIBOR-UST3M spread.

When trouble begins to brew in parts of the banking system it gets reflected by higher interest rates being charged for short-term inter-bank loans well before it becomes common knowledge. This causes the spread between 3-month LIBOR (the average 3-month interbank lending rate) and the 3-month T-Bill yield to increase. For example, the LIBOR-UST3M spread was languishing at around 0.20% in early-2007, indicating minimal fear within the banking system, but then began to rise steadily and reached 0.75% in June-2007. This was an early warning sign of trouble. The spread then pulled back into July-2007 before rocketing up to 2.25% in August-2007. This constituted a very loud warning. After that the spread became very volatile and moved as high as 4.5% at the peak of the Global Financial Crisis in October-2008.

At the moment the LIBOR-UST3M spread is languishing at around 0.20%.

4) The gold price relative to industrial metals prices, as depicted on the following chart by the gold/GYX ratio (the US$ gold price divided by the Industrial Metals Index).

The gold/GYX ratio acts like a credit spread. This is because gold’s performance relative to the industrial metals sector tends to go in the same direction as economic confidence. In particular, when confidence begins to decline in the late stage of a boom or the early stage of a bust, the gold/GYX ratio begins to trend upward.

The following chart illustrates the long-term positive correlation between gold/GYX and a credit spread indicator in the form of the IEF/HYG ratio.

The gold/GYX ratio recently bounced from the bottom of its 7-year range. If the bounce continues and gold/GYX exceeds its early-2018 high it would be the first sign of a declining trend in economic confidence.

Currently, none of the above indicators is warning that a financial crisis is imminent or even that a financial crisis is starting to develop. The probability could change as new information becomes available, but based on the present values of the best leading indicators there is almost no chance that a financial crisis will erupt within the next three months.

A stock market crash is a different ‘kettle of fish’, because while a financial crisis always will be accompanied by a large decline in the stock market it is possible for a large decline in the stock market to occur in the absence of a financial crisis. The 1987 stock market crash is an excellent example.

While the four indicators mentioned above should issue timely warnings prior to a financial crisis, they may not warn of a stock market crash that isn’t part of a broader crisis. As is the case with a financial crisis, though, a stock market crash won’t happen ‘out of the blue’. In particular, the stock market won’t make a new all-time high one day and crash the next. This is because it takes time (generally at least two months) from the ultimate price high to create the sentiment backdrop that makes a crash possible.

In summary, short-term stock market risk is high, but there are no warning signs that a financial crisis is brewing or that a stock market crash (as opposed to, say, a 10% correction) is a realistic short-term possibility.

| Digg This Article

-- Published: Tuesday, 18 September 2018 | E-Mail | Print | Source: GoldSeek.com