-- Posted Wednesday, 30 December 2009 | Digg This Article | | Source: GoldSeek.com

| | Source: GoldSeek.com

Happy holidays wishes to all, with a special season’s greetings to the permanent gold skeptics.

The decade that ends Thursday is on track to be the worst in recorded history for the U.S. stock market – worse than all of the many boom-and-bust cycles of the 19th century, worse than the Great Depression-era 1930s, worse than the recession-plagued 1970s.

The S&P 500 opened the decade at 1,469.25 on January 3, 2000. When the market closed on Christmas Eve, the S&P 500 stood at 1,125.46 – with four trading days left in the decade, the index’s annual performance over that span is negative 2.6 percent. The Dow Jones Industrials has lost about 1 percent per year over the same period, and the Nasdaq Composite is down a whopping 5.9 percent annually. When adjusted for inflation, the 10-year returns for these indices are even lower.

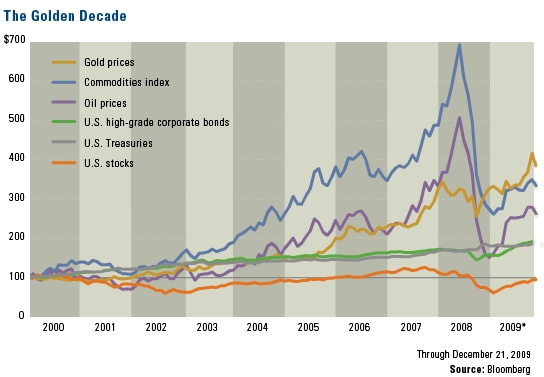

Source: Bloomberg

Meanwhile, what about gold?

The chart above from Bloomberg tells the story – a $100 investment in gold when the market opened on January 3, 2000, was worth about $380 as of this week (data through December 21) – that’s a total return of 280 percent and an annualized return of 14.3 percent. Gold stocks (as measured by the XAU Index) have also had a good decade, climbing 9.4 percent annually.

Commodities (as measured by the S&P GSCI Enhanced Total Return Index) posted average gains of 13.6 percent per year over the period, driven mostly by rapid economic growth in Asia and elsewhere in the developing world.

There are many commentators out there who see no value in gold and who denounce it as an investment at every opportunity. They are certainly entitled to their opinions, but it’s hard to argue with the numbers over the past 10 years – investors on average would have been better off with a gold allocation than having no exposure.

We consider gold a legitimate asset class, and for that reason, we consistently suggest that investors consider a maximum 10 percent allocation to gold-related assets – half in bullion or bullion ETFs and the other half in gold equities – and that they rebalance each year to capture the swings.

What the next decade will bring for gold? Who knows. But we do know one thing – those who held gold for the past 10 years will have a happier New Year than those who listened to the perma-skeptics.

Think you know a lot about oil? Take the quiz and find out.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The S&P GSCI Enhanced Total Return Index reflects the total return available through an unleveraged investment in specific commodity components of the S&P GSCI. The S&P GSCI is an index calculated primarily on a world production-weighted basis and is comprised of the principal physical commodities with active, liquid futures markets. The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. #09-889

-- Posted Wednesday, 30 December 2009 | Digg This Article | Source: GoldSeek.com

| Source: GoldSeek.com