-- Published: Tuesday, 26 April 2016 | Print | Disqus

As some of you might know, I am a big Bowie fan. He lives on in his music and his passing has left us all with less.

David Bowie was in touch with both himself and the world like few others, and was able to express feelings on subjects through his art in profound fashion, an increasingly rare commodity these days in an authoritarian society that punishes free thinking. Of course today’s dystopian world order was seen by few back in the 90’s when he released I’m Afraid of Americans, where in his own words the song was ‘merely sardonic’ in observing a MacDonald’s going up in previously untouched (by corporate America) Java, because this ‘strangles the indigenous culture and narrows expression of life’. And in his more recent work, it’s not difficult to tell he had become horrified at what the Americanized world had developed into in crossing the millennium, which must have been torture for someone who loved life so well as his pulse grew weaker.

Good-bye David – we will miss you.

Fast-forward to today, and you can’t help but think that David’s warning in the above was not naïve, but ahead of its time – Orwellian in nature. Because if you were not afraid of Americans back in the 90’s, and more specifically corporate America with all its cronies and corruption, you damn well should be today. Both America and the world are controlled by these characters, and you should be deathly afraid of them because that’s what they deal in – death for profits. And while such a sentiment could have been reserved for the colonies up until more recently, they have brought home the exploitation now in the food, culture, and economy – and the people are waking up to this fact. Nowhere is this more overtly evident than in the rapidly changing political scene in the States, where feelings of being ‘united’ are becoming increasingly strained as the pathology of insanity is revealed.

But it’s not just corporate America that one should be afraid of – you can safely include the embedded fascists in Washington as well – America’s political duopoly – better known as the two-party system. These are the people who would have you be afraid of Donald Trump, exclaiming he’s not the benevolent dictator he puts himself out as, but a well disguised fascist nut bar, just like them (they don’t mention that part). They would have you believe Ted Cruz is better (because he’s an undeclared status quo lapdog), however when one looks under the hood he’s far worse. And while it’s true all the candidates are hammers looking for nails, at the same time it’s not hard to conclude if some version of America is to survive what’s coming, change is necessary, and neither of the established parties will be able to facilitate such an outcome – especially if the Presidency is stolen from the popular vote.

And while it’s true they did it to Gore with no repercussion, people were eating well back then. Now, one third of America is on food stamps and they are getting tired of living the two-tiered system – the haves and have-nots – it’s Animal Farm. It’s Orwell to a ‘T’ in America today – it’s the lying pigs (and their dogs) set against the naïve barnyard animals now awakening from their sleepy stupor due to empty bellies and increasingly authoritarian rule. And now that they are awake, they are becoming increasingly angry. They are angry at the top 1%, Wall Street bankers, and mainstream media. In other words, put in Orwellian speak – they are angry at the pigs (oligarchs) and their dogs (bureaucrats) – and they are going to do something about it at the polls this time around. And again, they don’t care about what establishment cronies have to say anymore because they are known liars.

The political establishment’s response so far has been quite predictable given who you are dealing with (psychopaths, scoundrels, and worse) – screw you – the status quo is here to stay – however process will continue to unfold no matter. The barnyard animals (what sociopath Hillary thinks of you) are mad as hell and aren’t going to take it anymore because they are sick and tired of being treated as such, so if the election is stolen from the popular vote, the disenfranchised will simply continue to turn the screws until they get their way. Soft revolution will turn hard – and before you know it America will resemble some version of Mad Max – beyond salvation. The zombies will come to life and devour those not yet infected. Because again – people are disenfranchised, hungry, and angry. And they do crazy things when that happens.

So you should be afraid of what’s coming no matter who wins the election, because whether it’s Trump or Sanders, or an establishment candidate, the true state of affairs in America (and the rest of the world) will be exposed because it’s too late – America is an increasingly distant memory. If you want to know how things could look here in a year or two, take a peak at Brazil. They are South America’s largest economy and exemplar of ‘democracy’ and ‘capitalism’. Unfortunately corruption has run amuck in Brazil, however it’s no better in America – don’t kid yourself. The status quo naybobs would have you believe Brazilians are savages; just more of the world’s great unwashed. But what’s the difference between goings on in any other banana republic and Hillary’s pardon? Remember we are talking about Neocon Hillary here – completely unqualified in the trust department.

But hopefully we won’t have to worry about that soon. Apparently sociopath Hillary has been caught in yet another snafu exactly at the wrong time – right in front of the New York primary. So let’s hope Sanders can turn this into political capital because as warned by Nassim Taleb, America can survive Sanders or Trump in the White House, but “no Hillary”. But don’t tell that to all the other psychopath’s trying to ‘get ahead’ out there by any means – they love her as a role model. The majority of them are the bureaucrats behind the scenes who are riding her (big government’s) coat tails. Only thing is, like Hillary, these bozos are getting older and outnumbered by the young and disenfranchised now. So with a little luck and a newfound determination on their part, this election will turn out for the good – because the status quo has got to go.

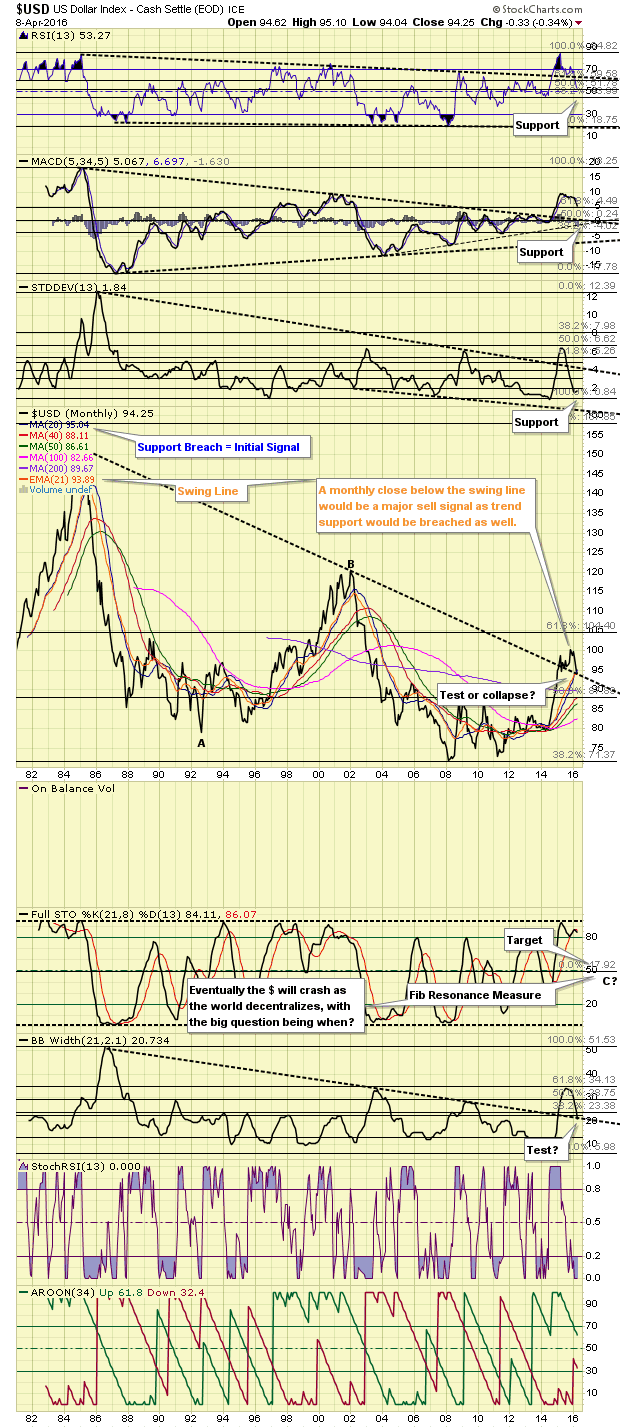

Certainly if the record performance of gold in the first quarter this year is any indication, investors are thinking radical change in America’s political scene is an increasing likelihood. And again, this likelihood could grow considerably in coming days if Sanders does well in New York, which would give the DNC and superdelegates (democrat establishment) a real scare – that’s for sure. Why? Because of loss of power, money and the overpaid / cushy jobs these sorts have been gorging on all these years. You know they are worried about it because top level bureaucrats and power barons attempting to talk it away. Only thing is Hank, if you guys try to steal the election, this time some really pissed off people won’t be as trusting the last time you gave it to them because again – they are disenfranchised, hungry, and angry – you said it yourself. (See Figure 1)

Figure 1

And again, the gold market is telling you this. The risk is the world starts treating the dollar($) as the valueless promise it is, and breaks down below critical support(s) denoted in the plot above, with the trigger likely the election outcome. Of course it could be argued the collapsing economy will trigger this no matter what happens in the election; or it could be both. Because one must wonder why the Fed called that moog fest last week and special meeting today. We know they are worried about their jobs from our discussion last week, where both Sanders and Trump would make life considerably more difficult to maintain the untouchable aura. So who knows – maybe they throw the $ under the bus ahead of the election. Nobody is expecting this, so the reaction(s) would likely be extremely violent. (See Figure 2)

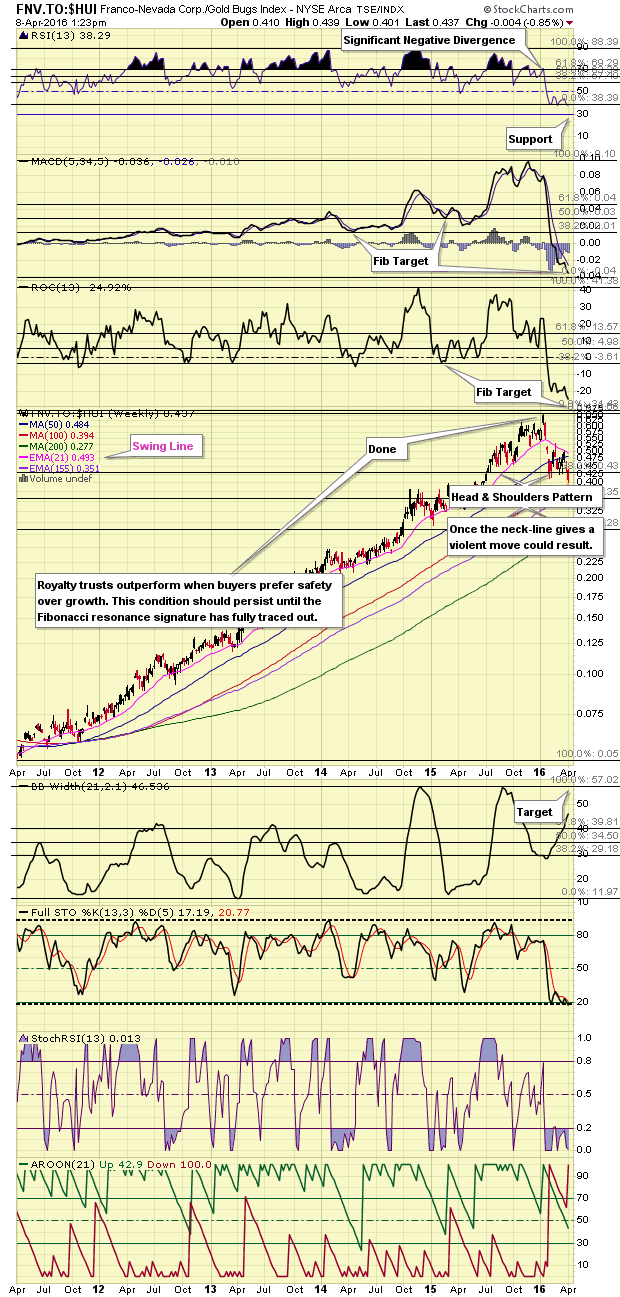

Figure 2

That’s the message in the chart above, measuring the premium investors are willing to pay for safety in the precious metals sector today. As you can see, it’s been collapsing and is oversold on an immediate basis, however in late cycle speculative manias like the one we are in now, such considerations often don’t matter depending on how speculators are betting. (More on this below.) That being said, in looking at a daily HUI / FNV Ratio plot attached here, what we see is a complex a – b – c corrective sequence tracing out, which although ultimately being wildly bullish given it appears high level consolidations are apparently the norm across the sector, still, it points to recent lows being tested, at a minimum. Again, techincals still look wildly bullish across the sector, likely hinging on election expectations, $, and how all the players react to the stimuli. (See Figure 3)

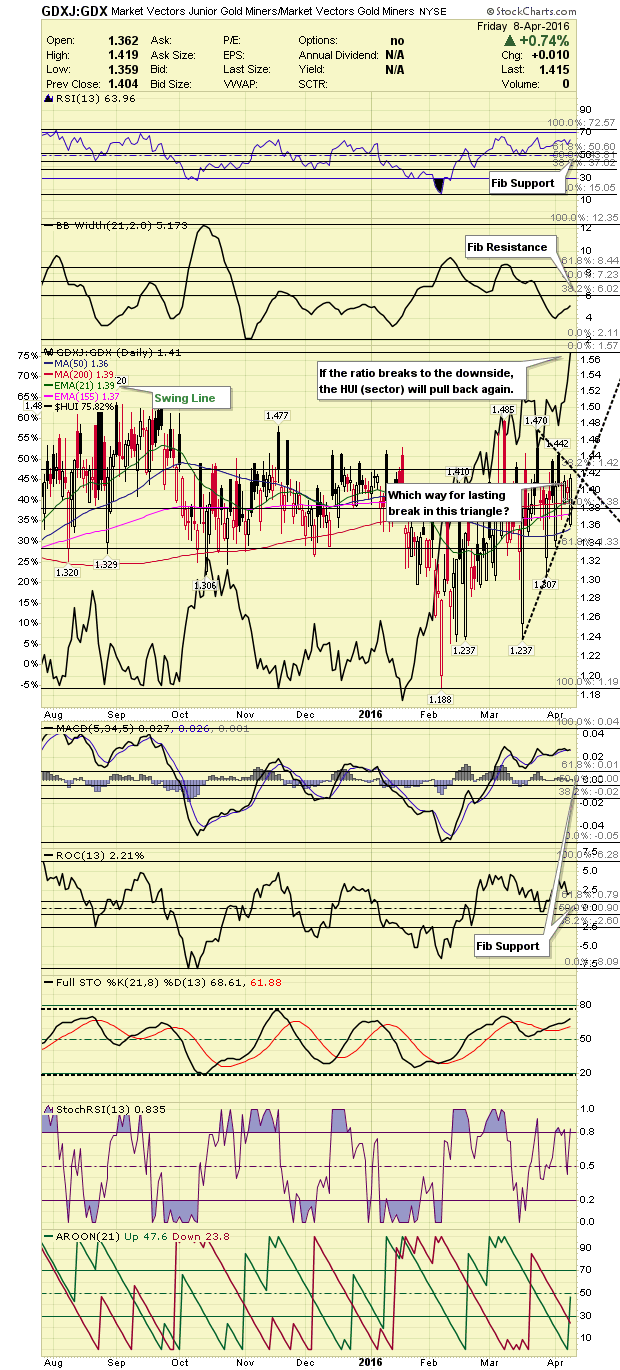

Figure 3

The only other caveat I can find is the above ratio, showing US juniors (GDXJ) set against the large caps (GDX), which is important. What’s happening here is the juniors remain in a relative funk compared to the large caps because the gamblers in the options market still have the open interest put / call ratios at low levels (both absolutely and relative to the large caps) for this strata of stocks (see here). This is not a bad thing in the larger scheme of things if the knuckleheads that keep loading up on GDXJ (and JNUG) calls stop at some point because the large caps should lead anyway. So this is a classic bull move unfolding from that perspective, however if precious metal shares are ever to really rip this must get fixed. Time alone should do that – however a lot of the guys that play the juniors are certifiable idiots, so who knows. (See Figure 4)

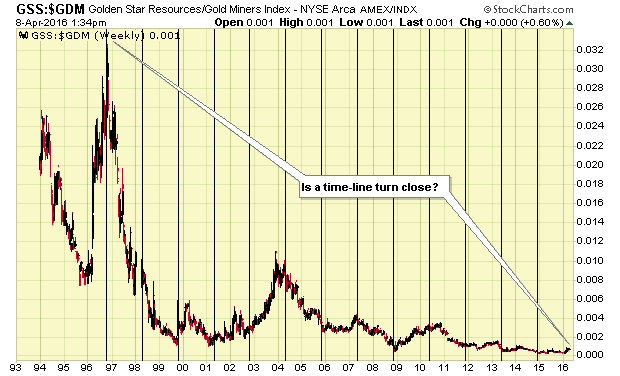

Figure 4

If they do stop their negative behavior at some point soon enough (stop buying more calls than puts), it’s possible some well positioned juniors could actually return to their full previous glory. What's more, even at present prices that appear to be well off the lows, one would still essentially be buying at the bottom, as can be seen directly above with Golden Star Resources (GSS) set against the larger caps (and basket) represented by the Gold Miners Index (GDM). And again, as you can see in Figure 4, if the time lines are any indication, GSS, which we will use as a proxy for the larger group of well positioned juniors, could be about to turn higher with a renewed sense of urgency. Again, could this have anything to do with the fact Fedsters are worried about keeping their jobs because the economy is falling off a cliff right in front of the election – forcing their hand. (i.e. because normally in an election year they would attempt to remain neutral.)

While we can only guess about this right now, if not today, the Fed is scheduled to meet again at month’s end, so stay tune in this regard, especially with what is supposed to be a terrible earnings season dead ahead. You will also remember from last week, April, being the Fibonacci third month of the sector wide rally that started in January, should see another month of gains, suggestive the broads should sputter this month. What’s more, and circling back up to bring the juniors and options players back into the discussion, with this coming Friday being options expiry (a shortened cycle), put / call ratios should work to bring prices back down no matter what the Fed says today, possibly after further gains early in the week. In terms of the Gold Bugs Index (HUI) for example, it wouldn’t be surprising to see it vex the large round number at 200, then retrace back down to the 175 area, with the 50-day moving average (MA) rising to meet prices, followed by a move back up into month end. Again however, this is only a guess.

As such, maybe today was another set-up by the Fed to smack gold and the shares down this week in knowing they can get officially dovish again very soon, only days away essentially (April 27 – 28). Again, this all guess work, however with open interest put / call ratios on precious metal shares ETF’s non-supportive of further price gains (the ratio on GDX should rise towards unity for this to be the case), one thing is for sure, this is not a good time to be bold going into options expiry on Friday. The machines will want to take prices back down to equilibrium pricing in a hurry off the right headline. So all those people who bought precious metals on Friday off the sensationalistic story on Zero Hedge touting an ‘emergency Fed rate meeting’ on Monday would be hoodwinked again. I don’t know of this will be the case as I am writing this Sunday, however this why one should always question the source of sensationalism – especially in American media.

But perhaps the biggest reason you should be afraid of Americans is because the crazies in Washington who are used to getting their way won’t like it one bit once it becomes visible they are losing the economic (cold) war. (i.e. against China, Russia, and themselves.) You will know there’s big trouble in The Banana Republic of America when the $ starts falling off a cliff, heading towards the c-wave target (30ish) denoted in Figure 1. This is when all the derivatives will implode, and society will regress back out of the Twilight Zone – a place better known as reality. This would of course be a dangerous condition for Neocon Hillary and her buddies, where if they were still in control, nuclear war would not be out of the question if the gloves come off. (i.e. to deflect responsibility away from themselves.) This is why (and whom) you should be afraid of Americans – the crazies in charge.

Good investing is possible in precious metals once again.

See you next week.

Captain Hook

The following is commentary that originally appeared at Treasure Chests for the benefit of subscribers on Monday, April 11, 2016.

Treasure Chests is a market timing service specializing in value based position trading in the precious metals and equity markets, with an orientation primarily geared to identifying intermediate-term swing trading opportunities, which is an investing style proven to yield successful outcomes in the longer term. Specific opportunities are identified utilizing a combination of fundamental, technical, and inter-market analysis. This style of investing has proven to be very successful for wealthy and sophisticated investors, as it reduces risk and enhances returns when the methodology is applied effectively. Those interested discovering more about how the strategies described above can enhance your wealth should visit our web site at http://www.treasurechests.info.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Comments within the text should not be construed as specific recommendations to buy or sell securities. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities. Do your own due diligence regarding personal investment decisions.

Copyright © 2016 www.treasurechests.info. All rights reserved.

Unless otherwise indicated, all materials on these pages are copyrighted by www.treasurechests.info. No part of these pages, either text or image may be used for any purpose other than personal use. Therefore, reproduction, modification, storage in a retrieval system or retransmission, in any form or by any means, electronic, mechanical or otherwise, for reasons other than personal use, is strictly prohibited without prior written permission.

| Digg This Article

-- Published: Tuesday, 26 April 2016 | E-Mail | Print | Source: GoldSeek.com