-- Published: Tuesday, 25 November 2014 | Print | Disqus

Last month kicked off a new long-term Kress cycle. The Kress cycle, which answers to the Kondratief wave of inflation/deflation, is responsible for the overall climate of economic and financial market conditions in the U.S. This long-term cycle also influences the course of central bank monetary policy by creating the conditions which the Federal Reserve must tailor its policy response to.

The final 10-12 percent of the 120-year cycle is characterized by deflation. For the last 14 years or so the financial system has indeed struggled with periodic episodes of deflation, and these episodes have often taken the form of ripples in the global economy. The final 12 percent of the 120-year cycle began in 2000, a year of major transition for the U.S. equity market and the economy. That year witnessed the end of the great 1990s bull market and the start of a period of secular stagnation that has continued until now.

During the 14-year period beginning in 2000 the U.S. suffered two economic recessions and two major bear markets in the stock market. The most telling influence of the 120-year cycle during this time was the feverish attempt of central bankers and policy makers at countering the deflationary undercurrents created by this cycle. At times these attempts at countering deflation with monetary policy resulted in temporary pockets of inflation in commodities prices. Far from helping alleviate deflationary pressure, Fed-created inflation only put more stress on the economy.

The long-term inflation/deflation cycle is salutary and beneficial to both savers and consumers when it’s allowed to naturally run its course. When central banks interfere, however, the effects can be catastrophic for both groups.

The successive policy interventions of the Fed between 2000 and 2014 did great harm to the middle class, a much lamented development among politicians and commentators. Retail food and fuel prices were elevated to unnaturally high levels in the years between 2004 and 2008, and again in 2010-14. Instead of receiving a much needed respite, consumers paid higher prices for basic necessities during these years while savers were punished by the Fed’s weak dollar policy.

It’s clear that this trend can’t persist for long given that the Fed refused to let the Kress cycle run its course, which would have healed consumers’ finances. The Fed-sponsored Wall Street bailout came at the expense of Main Street which meant many years of paying unnaturally high prices on the retail level for most Americans. Thankfully, though, Main Street is finally getting a much needed respite in the form of a strengthening dollar and falling fuel prices. Food prices should also begin to slowly decline from here.

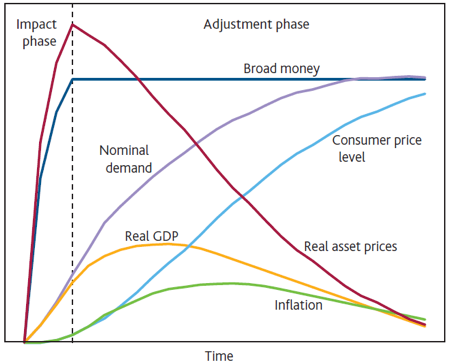

Far from being planned by the Fed, this is a natural reaction as the economy enters the post-QE adjustment phase. Now that the Fed’s money printing program known as QE has ended, interest rates along with the inflation rate will seek their natural levels. A 2011 report by the Bank of England highlighted the influence of QE on the economic system. The following chart shows the qualitative impact of QE divided into two phases: the Impact phase and the Adjustment phase.

The Impact phase is when QE (money creation) has the most effect on lowering interest rates, increasing asset prices and stimulating economic activity. All of these were features of the years immediately following the 2008 credit crash. The second phase is known as the Adjustment phase, which is the current phase. This is the period after QE ends when the inflation rate reverts back to its natural level since it isn’t being actively manipulated by central banks.

To give one example of what could happen during the Adjustment phase, consider the following assessment by Robert Campbell in the November 15 issue of The Campbell Real Estate Timing Letter (www.RealEstateTiming.com). Campbell is specifically discussing the impact of mortgage rates, a critical component of the U.S. economy:

“Even though mortgage rates had been in a long-term downtrend since 1982, a substantial body of empirical research has found that the Fed’s massive bond buying purchases since 2008 has significantly lowered mortgage rates and long-term Treasury yields. Hence, without QE mortgage rates could likely be 2.0 to 2.5 percentage points higher than they are today – which means most of the people who made money in real estate in the last 3-4 years would not have done so if housing prices weren’t driven higher by artificially low mortgage rates.”

Campbell suggests with the end of QE, the bull market in housing may also soon end due to the diminished purchasing power of mortgage owners thanks to rising mortgage rates. Mortgage rates are still in decline, however, and it could be a while longer before the Adjustment phase forces them higher. Sooner or later, though, the inflationary impact of the new long-term Kress cycle will begin working its magic by pushing interest rates higher across the board.

Whether or not the U.S. economy is strong enough to handle higher rates is debatable. A more likely scenario in my view is a period of low inflation which persists for at least the next 1-2 years, thanks in large part to soft overseas economies. Meanwhile the major engine of global economic growth will continue to be the U.S. since our long-term economic cycle has bottomed while other major industrialized countries are still in the throes of deflation. Eventually, the U.S.-led recovery will gain enough traction so that QE will become a distant memory.

Mastering Moving Averages

The moving average is one of the most versatile of all trading tools and should be a part of every investor’s arsenal. The moving average is one of the most versatile of all trading tools and should be a part of every investor’s arsenal. Far more than a simple trend line, it’s a dynamic momentum indicator as well as a means of identifying support and resistance across variable time frames. It can also be used in place of an overbought/oversold oscillator when used in relationship to the price of the stock or ETF you’re trading in.

In my latest book, “Mastering Moving Averages,” I remove the mystique behind stock and ETF trading and reveal a completely simple and reliable system that allows retail traders to profit from both up and down moves in the market. The trading techniques discussed in the book have been carefully calibrated to match today’s fast-moving and sometimes volatile market environment. If you’re interested in moving average trading techniques, you’ll want to read this book.

Order today and receive an autographed copy along with a copy of the book, “The Best Strategies For Momentum Traders.” Your order also includes a FREE 1-month trial subscription to the Momentum Strategies Report newsletter:

http://www.clifdroke.com/books/masteringma.html

Clif Droke is a recognized authority on moving averages and internal momentum. He is the editor of the Momentum Strategies Report newsletter, published since 1997. He has also authored numerous books covering the fields of economics and financial market analysis. His latest book is “Mastering Moving Averages.” For more information visit www.clifdroke.com

| Digg This Article

-- Published: Tuesday, 25 November 2014 | E-Mail | Print | Source: GoldSeek.com