-- Published: Friday, 27 February 2015 | Print | Disqus

By Steve St. Angelo, SRSrocco Report

The world is heading towards an economic and financial collapse of epic proportions. Individuals who are currently invested in this system fall into two categories. We have the overwhelming majority invested in paper-digital assets and a fraction of the populace holding physical assets such as the precious metals.

Currently, the financial system favors those invested in PAPER & DIGITS, while it punishes the precious metal enthusiast. Of course, this is only for a short time period, but it seems like an eternity since gold and silver hit their highs in 2011.

However, there is light at the end of the tunnel as cracks are beginning to appear in the very industry that is propping up the Highly Leverage Fiat Monetary Debt Based Financial System.

I will repeat myself once again… ENERGY drives the markets, not FINANCE. Finance is supposed to steer the economy in a straight line on the road, not full speed over the cliff. Without a growing energy supply, there would be no U.S. Dollar Fiat Monetary System.

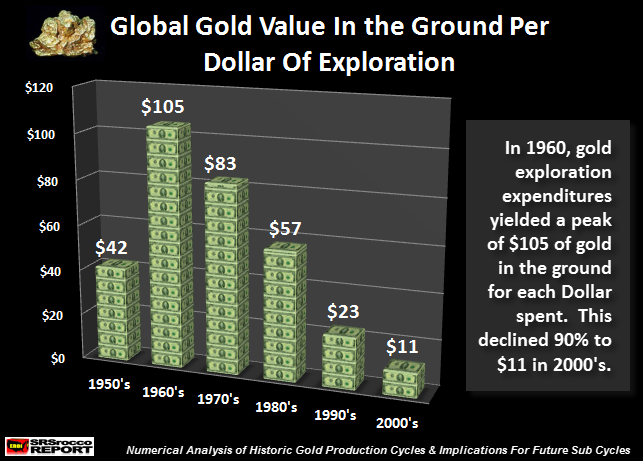

That being said, the global gold mining industry is now in serious trouble as the current low market price impedes exploration which would guarantee future production. How bad is it? Well, let’s look at the following chart:

In the 1960’s global gold exploration expenditures yielded a peak of $105 worth of gold in the ground for each $1 (Dollar) spent. This continued to decline over the next four decades from $83 in the 1970’s, down to $57 in the 1980’s, $23 in the 1990’s and $11 in the 2000’s.

Basically, global gold value in the ground per dollar of exploration spent fell 90% since the 1960’s. Thus, we had a collapse of the Gold EROI (Energy Returned On Invested) since the 1960’s. The reason I call it the Collapse of the Gold EROI has to do with the fact that everything we do is based on energy.

Why the Falling Gold EROI Is Important

To grasp why the falling Gold EROI is important, we need to understand the basics of the EROI. EROI stands for Energy Returned On Invested. Some like to use EROEI, or Energy Returned On Energy Invested. Either one works, even there are individuals who like to waste time on pointing out one is more correct to use than the other.

Charles Hall, one of the top minds studying this subject used the four letter EROI, in most of his scientific abstracts. Regardless, the EROI ratio is the fundamental equation that allows LIFE or DEATH of a human, plant, animal or economic system.

It takes energy to produce energy. Here are some EROI ratios:

1930 U.S. Oil & Gas Industry = 100/1

1970 U.S. Oil & Gas Industry = 30/1

2000 U.S. Oil & Gas Industry 11/1

Hunter Gatherer = 10/1

Human agriculture = 5/1

U.S. Shale Oil Industry = 5/1

Oil Shale Resources 1-2/1

Human, Horse & plow farming = 1-2/1

U.S. Modern Food Industry = 1/10

In the 1930’s the United States produced 100 barrels of oil for the market for each barrel of oil consumed in the process. This fell to 30/1 in 1970, 11/1 in 2000 and shale oil production has an average EROI of 5/1. Now, the supposed 1 trillion barrels of oil shale resources in the U.S. western states, has a lousy EROI of 1-2/1.

Why are these EROI ratios important? Charles Hall believes the minimum EROI energy requirement to run a modern society such as ours needs to be at least 10/1 and more like 11-12/1. Charles Hall in a Scientific American article “Will Fossil Fuels Be Able To Maintain Economic Growth?”, stated the following:

What happens when the EROI gets too low? What’s achievable at different EROIs?

If you’ve got an EROI of 1.1:1, you can pump the oil out of the ground and look at it. If you’ve got 1.2:1, you can refine it and look at it. At 1.3:1, you can move it to where you want it and look at it. We looked at the minimum EROI you need to drive a truck, and you need at least 3:1 at the wellhead. Now, if you want to put anything in the truck, like grain, you need to have an EROI of 5:1. And that includes the depreciation for the truck. But if you want to include the depreciation for the truck driver and the oil worker and the farmer, then you’ve got to support the families. And then you need an EROI of 7:1. And if you want education, you need 8:1 or 9:1. And if you want health care, you need 10:1 or 11:1.

In addition, Hall didn’t include entertainment, sports or etc. If you look at the bottom of the EROI ratio list, you will see that our modern Food Production-Processing-Distribution system has a 1/10 EROI. This means, for every 10 energy calories of energy consumed in this process, we put 1 calorie of food on the dinner table.

Basically, our modern system of getting food to the dinner table is a NET ENERGY LOSER by a factor of 10.

The only reason this(net energy losing) modern food system works has been due to the relatively high energy EROI in the past. As we can see, advanced technology did not increase the EROI ratio of our food production system, it devoured it. Simple hunter gatherer and human simple farming practices are much more efficient at producing food than our modern system food production-processing-distribution system.

So, how does this EROI factor into GOLD?? Gold used as a monetary metal or store of value, takes energy to produce a 1 ounce coin. If we add up all the costs involved in the process to produce that 1 oz gold coin, the overwhelming majority of the cost is ENERGY.

This is not just the diesel, natural gas or electricity used in the exploration, mining or smelting of gold. This also includes all the materials, equipment and human labor which are nothing more than ENERGY DERIVATIVES.

A gold mining truck may look like a capital cost on the company’s balance sheet, but its value came from all the energy consumed in the materials, manufacturing, labor and shipping of that truck. We must look at the economy as an ENERGY MATRIX.

Once we understand that all we are doing in this economy of ours, is trading ENERGY for ENERGY, then the value of Gold is just an extension of energy. Some individuals argue that Gold is gold and energy is energy. While that may be true on face value, how much gold are we going to get out of the ground without the use of ENERGY… in all forms and in all stages?

Gold is nothing more than STORED ENERGY VALUE embedded into a metal coin. No, a gold coin does not contain energy, rather acts as a store of energy value which the precious metal community labels STORE OF WEALTH.

The falling Gold EROI spells real trouble for the gold mining industry going forward. This means, at some point (soon) global gold production will peak and that will be the end of it. This will be due to a peak and decline of global oil production on top of falling gold ore grades.

If you haven’t read my recent energy article below, I highly recommend it. Click on image below to read article:

The notion that Shale Oil & Gas will allow the world to continue business as usual for the next 2-3 decades losses a great deal of credibility as many major oil companies are pulling up stakes in Europe and abroad. Not only is Chevron exiting all shale exploration in Europe, it’s spending more money on CAPEX than it makes from operations. Again, the article explains this in more detail.

There is good chance, especially at the current low price of oil, that the world will peak in global oil production 2015/2016. This will put severe stress on the Financial and Paper Asset system (Fiat Money, Stocks, Bonds & most Paper Assets) going forward. Why? All those so-called paper money-assets needs a growing energy supply to sustain itself.

Thus, a falling energy supply will cause a chain-reaction collapse of this highly leveraged debt based paper system. The Falling EROI of gold is just another clue for an investor to realize GOLD’S VALUE IS GOING MUCH HIGHER in the future.

Please check back for new articles and updates at the SRSrocco Report. You can also follow us at Twitter below:

| Digg This Article

-- Published: Friday, 27 February 2015 | E-Mail | Print | Source: GoldSeek.com