-- Published: Sunday, 18 June 2017 | Print | Disqus

The Next Minsky Moment

Natural Instability

Learning the Rules

Chinese Minsky

The Swiss Central Bank Is Doing What?

Getting Married on St. Thomas, Omaha, San Francisco, and Freedom Fest in Las Vegas

“China’s economy has entered a state of new normal.”

– Premier Li Keqiang, 2015

“Success breeds a disregard of the possibility of failure.”

– Hyman Minsky

Welcome to the new, improved, faster-to-read, better yet still-free Thoughts from the Frontline. My team and I have been doing a lot of research on what my readers want. The reality is that my newsletter writing has experienced a sort of “mission creep” over the years. Bluntly, the letter is just a lot longer today than it was five or ten years ago. And when I’m out talking to readers and friends, especially those who give me their honest opinions, many tell me it’s just too much. There are some of you who love the length and wish it were even longer, but you are not the majority. Not even close. We all have time constraints, and I wish to honor those. So I am going to cut my letter back to its former size, which was about 50% of the length of more recent letters. (Note: this paragraph is going to open the letter for the next month or so, since not everybody clicks on every letter. Sigh. Surveys showed us it’s not because you don’t love me but because of demands on your time. I want you to understand that I get it.) Now to your letter…

Hollywood thrives on tropes. Most things that are possible to portray on film have been portrayed at some point in the last century. Today’s producers mostly just rearrange those tropes – and that’s OK.

Much of what we think is new and different is actually one variation or another on ancient themes. My favorite book genre, science fiction, has many archetypal tropes that can be traced back to Greek mythology, which itself must have grown out of tales that must have been told for millennia. Thus it’s little wonder that the “zeitgeist” of our time seems to produce a lot of zombie movies or asteroid movies or bad-alien movies. These and many other tropes just “get in the air” and take on a life of their own.

It’s not just storytelling; it’s inventions, too. You must take a minute to read this quote from Matt Ridley’s critically important book, The Evolution of Everything:

Suppose Thomas Edison had died of an electric shock before thinking up the light bulb. Would history have been radically different? Of course not. Somebody else would have come up with the idea. Others did. Where I live, we tend to call the Newcastle hero Joseph Swan the inventor of the incandescent bulb, and we are not wrong. He demonstrated his version slightly before Edison, and they settled their dispute by forming a joint company. In Russia, they credit Alexander Lodygin. In fact there are no fewer than twenty-three people who deserve the credit for inventing some version of the incandescent bulb before Edison, according to a history of the invention written by Robert Friedel, Paul Israel, and Bernard Finn. Though it may not seem obvious to many of us, it was utterly inevitable once electricity became commonplace that light bulbs would be invented when they were. For all his brilliance, Edison was wholly dispensable and unnecessary. Consider the fact that Elisha Gray and Alexander Graham Bell filed for a patent on the telephone on the very same day. If one of them had been trampled by a horse en route to the patent office, history would have been much the same.

I am going to argue that invention is an evolutionary phenomenon. The way I was taught, technology was invented by god-like geniuses who stumbled upon ideas that changed the world. The steam engine, light bulb, jet engine, atom bomb, transistor – they came about because of Stephenson, Edison, Whittle, Oppenheimer, Shockley. These were the creators. We not only credit inventors with changing the world; we shower them with prizes and patents.

But do they really deserve it? Grateful as I am to Sergey Brin for the search engine, and to Steve Jobs for my MacBook, and to Brahmagupta (via Al Khwarizmi and Fibonacci) for zero, do I really think that if they had not been born, the search engine, the user-friendly laptop, and zero would not by now exist? Just as the light bulb was ‘ripe’ for discovery in 1870, so the search engine was ‘ripe’ for discovery in 1990. By the time Google came along in 1996, there were already lots of search engines: Archie, Veronica, Excite, Infoseek, Altavista, Galaxy, Webcrawler, Yahoo, Lycos, Looksmart . . . to name just the most prominent. Perhaps none was at the time as good as Google, but they would have got better. The truth is, almost all discoveries and inventions occur to different people simultaneously, and result in furious disputes between rivals who accuse each other of intellectual theft.

In the early days of electricity, Park Benjamin, author of The Age of Electricity, observed that ‘not an electrical invention of any importance has been made but that the honour of its origin has been claimed by more than one person.

This phenomenon is so common that it must be telling us something about the inevitability of invention. As Kevin Kelly documents in his book What Technology Wants, we know of six different inventors of the thermometer, three of the hypodermic needle, four of vaccination, four of decimal fractions, five of the electric telegraph, four of photography, three of logarithms, five of the steamboat, six of the electric railroad. This is either redundancy on a grand scale, or a mighty coincidence. It was inevitable that these things would be invented or discovered just about when they were. The history of inventions, writes the historian Alfred Kroeber, is ‘one endless chain of parallel instances’.

The Next Minsky Moment

Economics has its overused themes and phrases, too. One is “Minsky moment,” the point at which excess debt sparks a financial crisis. The late Hyman Minsky said that such moments arise naturally when a long period of stability and complacency eventually leads to the buildup of excess debt and overleveraging. At some point the branch breaks, and gravity takes over. It can happen quickly, too.

Minsky studied under Schumpeter and was clearly influenced by many of the classical economists. But he must be given credit for formalizing what were only suggestions or incomplete ideas and turning them into powerful economic themes. I’ve often felt that Minsky did not get the credit he deserved. I look at some of the piddling ideas that earn Nobel prizes in economics and compare them to the importance of Minsky’s work, and I get an inkling of the political nature of economics prizes.

Minsky’s model of the credit system, which he dubbed the “financial instability hypothesis” (FIH), incorporated many ideas already circulated by John Stuart Mill, Alfred Marshall, Knut Wicksell and Irving Fisher. “A fundamental characteristic of our economy,” Minsky wrote in 1974, “is that the financial system swings between robustness and fragility, and these swings are an integral part of the process that generates business cycles.” [Wikipedia]

Minsky came to mind because in the past week I saw yet more signs that financial markets are overvalued and investors excessively optimistic. Yet I still haven’t seen many references to Minsky. That’s a little surprising.

On reflection, I realized I hadn’t mentioned Minsky lately, either. That is a potentially dangerous oversight, because we forget his fundamental insights at our peril. Last week’s brief technology tumble should have been a wake-up call. So today we’ll have a little Minsky refresher and look at some recent danger signs. And I predict that we will soon see Minsky mentions popping up everywhere.

Natural Instability

Hyman Minsky, who passed away in 1996, spent most of his academic career studying financial crises. He wanted to know what caused them and what triggered them. His research all led up to his Financial Instability Hypothesis. He thought crises had a lot to do with debt. Minsky wasn’t against all debt, though. He separated it into three categories.

The safest kind of debt Minsky called “hedge financing.” For example, a business borrows to increase production capacity and uses a reasonable part of its current cash flow to repay the interest and principal. The debt is not risk-free, but failures generally have only limited consequences.

Minsky’s second and riskier category is “speculative financing.” The difference between speculative and hedge debt is that the holder of speculative debt uses current cash flow to pay interest but assumes it will be able to roll over the principal and repay it later. Sometimes that works out. Borrowers can play the game for years and finally repay speculative debt. But it’s one of those arrangements that tends to work well until it doesn’t.

It’s the third kind of debt that Minsky said was most dangerous: Ponzi financing is where borrowers lack the cash flow to cover either interest or principal. Their plan, if you can call it that, is to flip the underlying asset at a higher price, repay the debt, and book a profit.

Ponzi financing can work. Sometimes people have good timing (or just good luck) and buy a leveraged asset before it tops out. The housing bull market of 2003–07, when people with almost no credit were buying and flipping houses and making money, attracted more and more people and created a soaring market. The phenomenon fed on itself. Bull markets in houses, stocks, or anything else can go higher and persist longer than we skeptics think is possible. That is what makes them so dangerous.

Minsky’s unique contribution here is the sequencing of events. Protracted stable periods where hedge financing works encourage both borrowers and lenders to take more risk. Eventually once-prudent practices give way to Ponzi schemes. At some point, asset values stop going up. They don’t have to fall, mind you, just stop rising. That’s when crisis hits.

The Economist described this process well in a 2016 Minsky profile article. (Emphasis mine.)

Economies dominated by hedge financing – that is, those with strong cashflows and low debt levels – are the most stable. When speculative and, especially, Ponzi financing come to the fore, financial systems are more vulnerable. If asset values start to fall, either because of monetary tightening or some external shock, the most overstretched firms will be forced to sell their positions. This further undermines asset values, causing pain for even more firms. They could avoid this trouble by restricting themselves to hedge financing. But over time, particularly when the economy is in fine fettle, the temptation to take on debt is irresistible. When growth looks assured, why not borrow more? Banks add to the dynamic, lowering their credit standards the longer booms last. If defaults are minimal, why not lend more? Minsky’s conclusion was unsettling. Economic stability breeds instability. Periods of prosperity give way to financial fragility.

Minsky’s conclusions are indeed unsettling. He called into question the belief that markets, left to operate unimpeded, will deliver stability and prosperity to all. Minsky thought the opposite. Markets are not efficient at all, and the result is an occasional financial crisis.

Complacency in the midst of a wanton debt buildup was beautifully expressed in a remark by Citigroup Chairman Chuck Prince in 2007:

The Citigroup chief executive told the Financial Times that the party would end at some point, but there was so much liquidity it would not be disrupted by the turmoil in the US subprime mortgage market.

He denied that Citigroup, one of the biggest providers of finance to private equity deals, was pulling back.

“When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you’ve got to get up and dance. We’re still dancing.” [source]

Minsky wasn’t around to see the 2008 crisis that fit right into his theory. Paul McCulley attached Minsky’s name to it, though, and now we refer to these crises as “Minsky moments.”

Are we closing in on one now?

Learning the Rules

As I mentioned, technology stocks suffered from a little anxiety attack in the markets last week. It didn’t not last long and really wasn’t all that serious. (Yet.) It was nothing worse than what everyone called “normal volatility” ten years ago. But the lack of concern it generated this time is not bullish, in my view. More than a few investors seem to think that “nowhere but up” is somehow normal.

Doug Kass had similar thoughts (there’s that Zeitgeist trope thing again) and reminded us all of Bob Farrell’s famous Ten Rules of Investing. You could write a book about each one of them. I’ll just list them quickly, then apply some of them to our current situation. (Emphasis mine.)

1. Markets tend to return to the mean over time.

2. Excesses in one direction will lead to an opposite excess in the other direction.

3. There are no new eras – excesses are never permanent.

4. Exponential rapidly rising or falling markets usually go further than you think, but they do not correct by going sideways.

5. The public buys most at the top and the least at the bottom.

6. Fear and greed are stronger than long-term resolve.

7. Markets are strongest when they are broad and weakest when they narrow to a handful of blue-chip names. (Sound familiar? Can you say FAANGs?)

8. Bear markets have three stages: sharp down, reflexive rebound, and a drawn-out fundamental downtrend.

9. When all the experts and forecasts agree, something else is going to happen.

10. Bull markets are more fun than bear markets.

I think most of these rules are obvious to investors who experienced the 2008 mess, the dot-com crash, and (if you’re of a certain age) the 1987 Black Monday. Some of us can remember 1980 and ’82. ’82 was especially ugly. (I had just gotten my master of divinity degree, and all I knew was that the job market sucked.) Maybe we mostly forget these experiences, but hopefully we pick up a little wisdom along the way. The problem is that now a new generation of investors lacks this perspective. They had little or no stock exposure in 2008 and experienced the Great Recession as more of a job-loss or housing crisis than a stock market crisis.

Of course, the previous crises are no secret. People know about them, and on some level they know the bear will come prowling around again, eventually. But knowing history isn’t the same as living through it. Newer investors may not notice the signs of a top as readily as do investors who have seen those signs before – and who maybe got punished for ignoring them at the time.

Doug Kass notices. Here’s a bit from an e-mail conversation we had last week.

During the dot-com boom in 1997 to early 2000 there was the promise (and dream) of a new paradigm and concentration of performance in a select universe of stocks. The Nasdaq subsequently dropped by about 85% over the next few years.

I got to thinking how many conditions that existed back then exist today – most importantly, like in 1999, when there emerged the untimely notion of “The Long Boom” in Wired magazine. It was a new paradigm of a likely extended period of uninterrupted economic prosperity and became an accepted investment feature and concept in support of higher stock prices!

[JM note: Here’s the Wired article Doug mentions: “The Long Boom: A History of the Future, 1980-2020.”]

And in 2007 new-fangled financial weapons of mass destruction – such as subprime mortgages that were sliced and diced during a worldwide stretch for yield – were seen as safe by all but a few.

And, just like during those previous periods of speculative excesses, many of the same strategists, commentators, and money managers who failed to warn us then are now ignoring/dismissing (their favorite phrase is that the “macroeconomic backdrop is benign”) the large systemic risks that arguably have contributed to an overvalued and over-loved U.S. stock market.

Doug points especially to Farrell’s Rule 7, on market breadth. A rally led by a few intensely popular, must-own stocks is much less sustainable than one that lifts all boats. We see it right now in the swelling interest in FAANG (Facebook, Apple, Amazon, Netflix, Google). Tesla comes to mind, too. Their influence on the cap-weighted indexes is undeniably distorting the market. These situations rarely end well.

Chinese Minsky

What is behind these distortions? Ultimately, it’s about capital flows. Asset prices rise when demand outstrips supply, which is what happens when stocks or real estate or whatever are perceived as more rewarding than cash. Those with the most unwanted cash compete with each other to buy the alternatives.

The Fed and other developed-country central banks created a lot of liquidity in recent years, so that’s undoubtedly a factor. An even greater one may be China, though.

Consider China’s explosive growth. Its proximate cause is US demand and, to a lesser extent, European demand for Chinese exports. We sent them our dollars and euros; they sent us widgets and doodads. US dollars inside China are undesirable to wealthy Chinese and the Chinese government, so they send the dollars right back to us in exchange for other assets: homes, commercial real estate, stocks, Treasury bonds, entire companies.

Meanwhile, within China, the government aggressively encourages lending for projects a free economy would never produce. Let me make a critical point here: While the central bank of China is not doing much in the way of quantitative easing, the government’s use of bank lending gone wild is essentially the same thing. The banks have created multiple trillions of yuan every year for many years. If you add Chinese bank lending statistics to the quantitative easing statistics of the world’s major central banks, the number is staggering. I think it’s entirely appropriate to perform that calculation.

Beijing thinks this massive bank lending is useful in keeping the population happy, employed, and satisfied with their government. It has worked pretty well, too. It can’t work indefinitely, but the government seems bent on trying. Consider this June 14 Wall Street Journal report.

While Beijing is carrying out a high-profile campaign to reduce leverage in its financial markets with one hand, with the other it is encouraging more potentially reckless borrowing. This week, the regulator put pressure on the country’s big banks to lend more to small companies and farmers, while the government announced tax breaks for financial institutions that lend to rural households. That follows recent guidance that banks should set up “inclusive finance” units.

If the goal of lending to poorer customers sounds noble, the concern is that the execution will only worsen Chinese banks’ existing problems, namely high levels of bad loans and swaths of mispriced credit. Bank lending to small companies is already growing pretty fast, with non-trivial sums involved: It jumped 17% in the year through March to 27.8 trillion yuan ($4.084 trillion). That compares favorably with the 7% rise in loans to large- and medium-size companies over the same period.

Observers like me have been saying for years that China’s banking system is overleveraged and will eventually collapse. We’ve been wrong so far. Beijing’s central planners may be Communists, but they use the capitalist toolbox to their advantage.

China will eventually face a reckoning. When it does, the impact will spread far outside China. What do you think will happen when Chinese money stops buying Vancouver real estate and US stocks? The outcome won’t be bullish.

The Swiss National Bank Is Doing What?

Pity the poor Swiss government. They have run their country well and don’t have a great deal of debt. They are a small country of just 8 million people, but they make an outsized impact on economics and finance and money.

Because Switzerland is considered a safe haven and a well-run country, many people would like to hold large amounts of their assets in the Swiss franc. Which makes the Swiss franc intolerably strong for Swiss businesses and citizens. So the Swiss National Bank (SNB) has to print a great deal of money and use nonconventional means to hold down the value of their currency. Their overnight repo rate is -0.75%. That’s right, they charge you a little less than 1% a year just for the pleasure of letting your cash sit in a Swiss bank deposit.

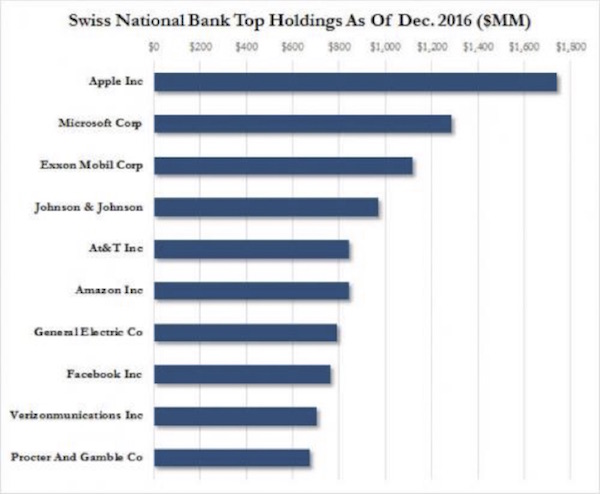

And the SNB is buying massive quantities of dollars and euros, paid for by printing hundreds of billions in Swiss francs. The SNB owns about $80 billion in US stocks today (June, 2017) and a guesstimated $20 billion or so in European stocks (which guess comes from my friend Grant Williams, so I will go with it).

They have bought roughly $17 billion worth of US stocks so far this year. They have no formula; they are just trying to manage their currency. Think about this for a moment: They have about $10,000 in US stocks on their books for every man, woman, and child in Switzerland, not to mention who knows how much in other assorted assets, all in the effort to keep a lid on what is still one of the most expensive currencies in the world. I gasp at prices every time I go to Switzerland. (I will be in Lugano for the first time this fall.)

Switzerland is now the eighth-largest public holder of US stocks. It has got to be one of the largest holders of Apple (see below). What happens when there is a bear market? Who bears the losses? Print just more money to make up the difference on the balance sheet? Do we even care what the Swiss National Bank balance sheet looks like? More importantly, do they really care? We all remember European Central Bank President Mario Draghi’s famous remark, that he would do “whatever it takes” to defend the euro. We could hear the Swiss singing from the same hymnbook, by and by.

The point is that central banks and governments all the world are flooding the market with liquidity, which is showing up in the private asset markets, in stock and housing and real estate and bond prices, creating an unquenchable desire for what appear to be cheap but are actually overvalued assets – which is what creates a Minsky moment.

Now, remember what Minsky said. When an economy reaches the Ponzi-financing stage, it becomes extremely sensitive to asset prices. Any downturn or even an extended flat period can trigger a crisis.

While we have many domestic issues that could act as that trigger, I see a high likelihood that the next Minsky moment will propagate from China or Europe. All the necessary excesses and transmission channels are in place. The hard part, of course, is the timing. The Happy Daze can linger far longer than any of us anticipate. Then again, some seemingly insignificant event in Europe or China – an Austrian Archduke’s being assassinated, or what have you – can cause the world to unravel.

It’s a funny world. We have our rashes of zombie moves and 20 people in all corners of the planet inventing the same thing at the same time. And we have our central banks and governments exhibiting unmistakable herd behavior and continuing to do the same foolish things over and over. They never really intend to have the crisis that ensues.

Remember Farrell’s Rule 3: There are no new eras. The world changes, but danger remains. Gravity always wins eventually. It will win this time, too. And when it does, we will begin undergo the Great Reset.

Getting Married on St. Thomas, Omaha, San Francisco, and Freedom Fest in Las Vegas

Shane and I will be leaving for St. Thomas next Saturday, June 24, and will be married on some beautiful beach on June 26, her birthday. Then I actually intend to relax for a week, enjoying time with my new bride and reading books with no redeeming social value (also known as science fiction/fantasy). I will begin final writing on my new book when I come back. I am finally really ready to attack the topic of what the world will look like in 20 years.

I have a quick trip to Omaha in the middle of June; then I’ll head directly on to San Francisco and Palo Alto for speaking engagements (and have dinner with my good friends Andy Kessler and Rich Karlgaard). I will be speaking the next day, Thursday July 13, in San Francisco at the S&P Dow Jones Indexing Conference at the Omni Hotel from 12 till 4. Here’s a PDF of the agenda.

Afterward, I come home to Dallas, recover for a few days, and then fly with Shane to Las Vegas for the Freedom Fest. It has become one of the largest libertarian gatherings, and I have so many good friends who go that it’s really a lot of fun for me. And while I am not much of a gambler (as in I suck at it and hate losing money to people who are much richer than I am), I really do like the shows. And dinners with friends.

That covers July, and August is, of course, the annual Maine fishing trip; but right now the rest of August looks to be pretty wide open. If I can figure it out, I may go somewhere that has a much cooler climate than Texas does in August and relax and write.

As a last note, I am not sure how many of you are reading my friend and partner and famous geopolitical analyst, George Friedman. The quality of his writing has hit new heights in the last year or so since he formed his own new firm, Geopolitical Futures, a small, elite team of the best geopolitical analysts he knows.

Part of what George brings to the table is a fascinating understanding of history. His team produces a “letter” every few weeks that simply tells you what books they are reading. Their reading is all over the map and brings great breadth to their writing.

I was particularly enamored with George’s description of the Battle of Midway. I have read the books and seen the movies, and I knew that battle was touch and go; but I didn’t realize how much of the future of the world was riding on the outcome. Frankly, the United States got amazingly lucky. When George began to describe to me what would have happened had we lost that battle, I suddenly saw geopolitics in a whole new light. You can read that letter here.

It’s time to hit the send button. This week will be a full-on sprint to try to get everything done before we leave for the Virgin Islands on Saturday. You have a great week.

Your pondering the Great Reset analyst,

John Mauldin

subscribers@mauldineconomics.com

Thoughts From the Frontline is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting http://www.mauldineconomics.com.

Any full reproduction of Thoughts from the Frontline is prohibited without express written permission. If you would like to quote brief portions only, please reference www.MauldinEconomics.com, keep all links within the portion being used fully active and intact, and include a link to www.mauldineconomics.com/important-disclosures. You can contact affiliates@mauldineconomics.com for more information about our content use policy.

http://www.mauldineconomics.com/subscribe

Thoughts From the Frontline and MauldinEconomics.com is not an offering for any investment. It represents only the opinions of John Mauldin and those that he interviews. Any views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with, Mauldin's other firms. John Mauldin is the Chairman of Mauldin Economics, LLC. He also is the President and registered representative of Mauldin Solutions, LLC, a registered investment adviser with the US Securities & Exchange Commission and states unless an exemption is available, President and registered representative of Mauldin Securities, LLC, (MS) member FINRA and SIPC, through which securities may be o ffered. MWS is also a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB) and NFA Member. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Past performance is not indicative of future performance. Please make sure to review important disclosures at the end of each article. Mauldin companies may have a marketing relationship with products and services mentioned in this letter for a fee.

Note: Joining The Mauldin Circle is not an offering for any investment. It represents only the opinions of John Mauldin and Mauldin Securities. It is intended solely for investors who have registered with Mauldin Securities and its partners at www.MauldinCircle.com (formerly AccreditedInvestor.ws) or directly related websites. The Mauldin Circle may send out material that is provided on a confidential basis, and subscribers to the Mauldin Circle are not to send this letter to anyone other than their professional investment counselors. Investors should discuss any investment with their personal investment counsel. John Mauldin is the President of Mauldin Solutions, LLC, a registered investment adviser with the US Securities & Exchange Commission and states unless an exemption is available. John Mauldin is a registered representative of Mauldin Securities, LLC, (MS), an FINRA registered broker-deale r. Mauldin Securities cooperates in the consulting on and marketing of private and non-private investment offerings with other independent firms such as Altegris Investments; Capital Management Group; Absolute Return Partners, LLP; Fynn Capital; Nicola Wealth Management; and Plexus Asset Management. Investment offerings recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with w hich they have been able to negotiate fee arrangements.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER. Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account manager s have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop. You are advised to discuss with your financial advisers your investment options and whether any investment is suitable for your specific needs prior to making any investments.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs may or may not have investments in any funds cited above as well as economic interest. John Mauldin can be reached at 800-829-7273

| Digg This Article

-- Published: Sunday, 18 June 2017 | E-Mail | Print | Source: GoldSeek.com