-- Published: Monday, 22 April 2019 | Print | Disqus

- Fiscal Insanity

- Avoiding the Windshield

- The Cost of High Debt

- New Rules, or Moving the Goalpost

- Dallas, Cleveland, Chicago, Puerto Rico, and Washington DC

“But the emperor has nothing at all on!” said a little child.

“Listen to the voice of innocence!” exclaimed his father; and what the child had said was whispered from one to another.

“But he has nothing at all on!” at last cried out all the people. The emperor was suddenly embarrassed, for he knew that the people were right; but he thought the procession must go on now! And the lords of the bedchamber took greater pains than ever, to appear holding up the robes although, in reality, there were no robes at all.

—“The Emperor’s New Clothes” by Hans Christian Andersen

When you write about controversial topics for hundreds of thousands of readers for 20 years, you develop a thick skin. Virtually anything I say will upset someone.

So, when people say something like, “John Mauldin wakes up sucking lemons and then moves onto something sour,” as happened after last week’s letter, it doesn’t bother me. (It actually made me smile.) I write what I believe is correct. Those opinions change over time as I get new information.

I’m not the only one who changes. Laws and policies that may seem etched in stone are often more flexible than generally thought. In last week’s Japanification letter, I described how no one anticipated the various extreme measures taken in the last crisis, from TARP to QE to NIRP. Yet once those ideas were in play, they happened quickly.

I think the next crisis will bring similarly radical, sudden changes. We will think the unthinkable because we will see no other choices. That means the range of possible scenarios may be wider than you think.

To think this may be so is not necessarily bearish.

As of now, my best guess is the US will enter recession sometime in 2020. I may be off (early) by a year or two, but it’s coming. We know two things will happen.

- Tax revenues will fall as people’s income drops.

- Federal spending will rise as safety-net entitlement claims go up.

The result will be higher deficits. Keynesian economics advocated running deficits during recessionary and economically difficult times and surpluses the rest of the time. That’s not what we did.

Last year (fiscal 2018) the “official” budget deficit was $779 billion. The national debt went up $1.2 trillion. The “small” $421-billion difference was more than half the official budget deficit. That is the off-budget spending that Congress doesn’t count. It includes the revenue and spending of certain federal entities that Congress wants to isolate from the normal budget process. Lately it has run in the multiple hundreds of billions of dollars, every year.

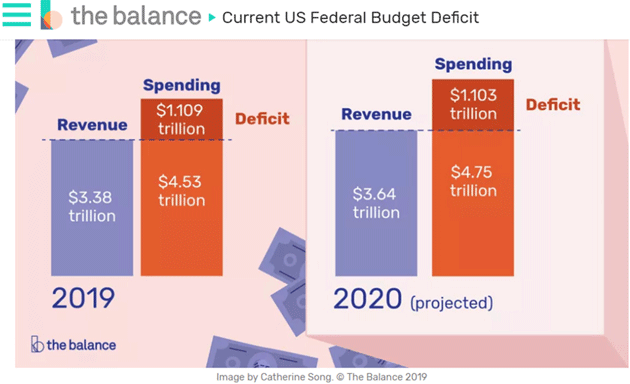

Below is a graph showing the projected budget deficits for 2019 and 2020 from a website called The Balance. You can find similar numbers all over the internet. I’m using the US but the situation is similar in most developed countries (though hopefully not yours).

Now, add another $400 million to each of those numbers. What is called the “unified budget” is now $1.5 trillion.

Next, let’s go to a very handy website called The US Debt Clock. (Scrolling around you can find the debt for your own country and state and other useful data.) We see that halfway through fiscal year 2019, the debt is already well over $22 trillion. It will be $23 trillion before the end of this year. By the end of 2020, Trump’s first term, it will be approaching $25 trillion. And that doesn’t include state and local debt of $3 trillion plus their $6 trillion unfunded pension liabilities.

And as I pointed out before, all that is without a recession. The unified deficit will easily hit $2 trillion and approach $2.5 trillion in the next recession. Within 2 to 3 years later, the total US debt will be at least $30 trillion. Not including state and local debt or unfunded pension obligations (more on those later).

Recognizing that simple arithmetic is not being bearish. It’s recognizing reality.

There are calls for a 70% tax rate on incomes over $10 million. Experts quoted in The Washington Post estimated it would produce about $72 billion a year. And you can guarantee that people will work their income statements to get below that. And in the face of a $2.5-trillion deficit? It doesn’t do very much, let alone pay for any new programs.

The simple fact is that raising income taxes on whatever we think of as the wealthy doesn’t get us close to a balanced budget. But what about actually doing a wealth tax? Like 1% of total net worth on the 1% wealthiest in America? Helpfully, The Washington Post article calculates that for us (my emphasis):

Slemrod, of the University of Michigan, said in an email that the wealthiest 1 percent of Americans own roughly one-third of the $107 trillion in wealth in America. This group collectively holds about $20 trillion in wealth above $10 million per household.

From there the calculation of wealth tax is simple: a 1 percent wealth tax on the wealthiest 1 percent of households above $10 million could raise about $200 billion a year, or $2 trillion over 10 years. Tedeschi, the former Obama official, found a 0.5 percent wealth tax on the top 1 percent could raise at most $3 trillion over 10 years.

But this, too, would probably change Americans' behavior and perhaps lead them to try shifting their wealth overseas, and the economists say the actual amount of revenue is likely lower than their estimates suggest. And this is assuming there are no exemptions to what is considered wealth, such as housing assets.

Again, a few hundred billion a year is nothing to sneeze at, but at the rate we’re going would make only a small dent in the deficit.

The real problem? Unfunded entitlement spending. The CBO is projecting literally trillion-dollar deficits in the latter part of this next decade simply because of unfunded entitlement spending. And then there’s the pesky little fact that we spent $500+ billion last year on interest payments.

In a recession and bear market, the $6 trillion of unfunded pension liability on state and local balance sheets could easily rise to $9 trillion, a number most cannot meet. Either firefighters, police officers, teachers, former government workers, etc., would not get their agreed-upon pensions or state and local taxes would have to rise precipitously, or the federal government will have to step in.

All of this will happen in an environment in which the Federal Reserve will be fighting a recession and a slow-growth economy, trying to move those asset prices back up to help the pension funds. So for me to suggest that the balance sheet of the Federal Reserve could grow to $10 trillion by the middle of the next decade and $20 trillion by the end of the decade is not entirely outrageous. And we haven’t really approached Japanese territory yet.

This analysis is not “bearish.” It is simply looking at the numbers, doing the arithmetic, and observing that we’ll have to borrow a great deal of money to meet our obligations.

I might be wrong if politicians from either party run and win with a platform of “I’m going to cut your Social Security and Medicare, slash the defense budget, and zero out a lot of little other pesky expenditures that you probably like.” I feel sure that won’t happen.

The Emperor isn’t wearing any clothes. Maybe I’m that naïve little boy who isn’t smart enough to see the beautiful cloth in which our national budgets are arrayed, and how easily we can raise more taxes from invisible sources.

And like the Emperor in the above story, we just keep walking and telling ourselves that nobody will notice.

The bulk of that debt will end up on the Federal Reserve’s balance sheet, just like the bulk of European debt will end up on the balance sheet of the European Central Bank, the Bank of England, and so on.

Exactly the path the Bank of Japan has already gone.

Let’s examine how that worked for them. From one perspective, it has done quite well. From another, they have paid a cost. Is it worth it? I think many Japanese, likely a big majority, would say yes.

The Bank of Japan has more than 140% of Japanese GDP on its balance sheet. Its laws let it buy equities not just in Japan but all over the world and it has. Yet the currency is roughly the same value as it was when the Bank of Japan got busy with that project.

I am personally well aware of that because I was the one who called Japan “a bug in search of the windshield.” Just like I am predicting that much of the US deficit will end up on the balance sheet of the Federal Reserve, I said the same thing would happen to the Japanese. I also said it would devalue their currency. I actually put real personal money, not just token money, on the prediction. I bought a 10-year yen put option. That trade has not worked out so well. I don’t even want to open the envelopes from J.P. Morgan containing that information.

But I learned a lesson and I had a great deal of company. Many hedge fund managers and other investors made the same bet. In essence, we said that Japan is going to print money and the same thing will happen to it that happened to every other country in the same situation: The currency will lose value.

Instead, it brought one of the most surprising macroeconomic outcomes that I could imagine. Talk about thinking the unthinkable back in 2008. What happened is unthinkable to me, and to a lot of other people.

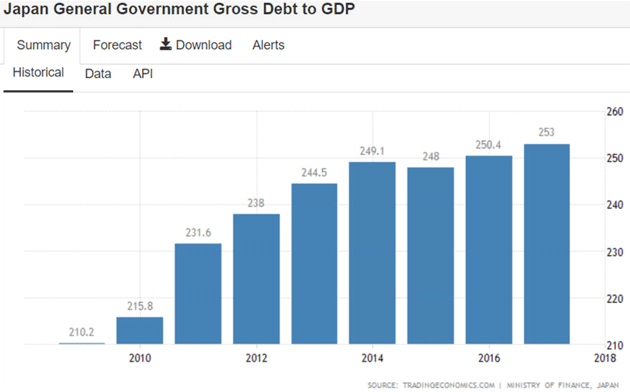

First, let’s realize that Japanese debt-to-GDP has risen to 253%. Notice in the graph below that the increases are much smaller each year. That is a (surprising!!!) point I’m going to make next.

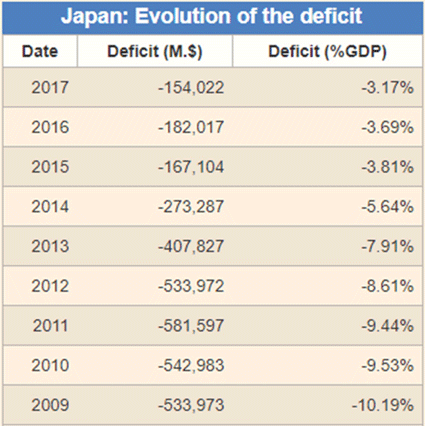

For the last two decades, the Japanese have been promising they would balance their budget in 7 to 10 years—and they’re actually beginning to make progress. Their fiscal deficit is in fact smaller every year in terms of GDP and actual numbers of dollars. Good for them.

Source: Countryeconomy.com

The deficit should fall even further as they have a small sales tax increase kicking in the fall of this year. It is, of course, controversial whether they will actually implement the tax, but I expect them to eventually do so. And sometime in the next decade, it is entirely possible that Japan will actually have a balanced budget, and then a surplus that lets the government begin paying down that debt.

Of course, they have to navigate global recessions, and all the sturm und drang and vicissitudes of life, but they are clearly trying to move in the correct direction. Kudos to Abe and Kuroda-san.

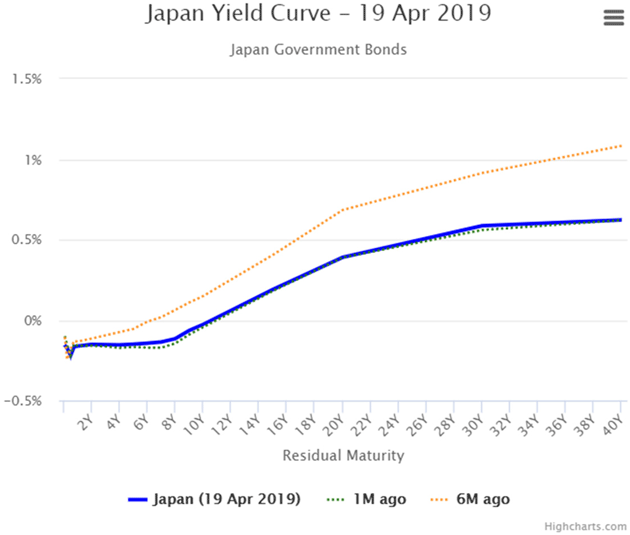

All this has not been without cost. It brought severe financial repression on savers. If you could somehow buy a new Japanese government bond, which is almost impossible because the BOJ buys everything that isn’t nailed down, you would get negative yield. That’s one reason Japanese savers are not selling their bonds. Even 1–2% on bonds bought “back in the day” is a lot more than they can get now.

The Japanese government bond market was once one of the world’s most liquid. Now it trades by appointment. Here is the JGB yield curve right now. Notice it is negative out to 10 years. So if somehow you had bought a 20-year bond 10 years ago, which makes your Japanese bond now a 10-year bond (effectively), you would have a nice capital gain. But then where would you put the proceeds if you sold? That’s why there are very few actual sales in the Japanese bond market.

As Lacy Hunt will demonstrate to us at the SIC (get your virtual Pass here), massively increasing debt actually reduces interest rates, productivity, and GDP growth, exactly as we see in Japan. They ran massive government debt, bringing future consumption into the then-present, and now must live in a world where that future consumption doesn’t happen, GDP growth is negligible if not negative, and investors have to live by new rules.

To some degree, we already see the first evidence of that in the US. My good friend Ben Hunt notes that the S&P 500 companies have the highest earnings relative to sales in history.

Source: Ben Hunt

Quoting Ben:

This is a 30-year chart of total S&P 500 earnings divided by total S&P 500 sales. It’s how many pennies of earnings S&P 500 companies get from a dollar of sales… earnings margin, essentially, at a high level of aggregation. So at the lows of 1991, $1 in sales generated a bit more than $0.03 in earnings for the S&P 500. Today in 2019, we are at an all-time high of a bit more than $0.11 in earnings from $1 in sales.

It’s a marvelously steady progression up and to the right, temporarily marred by a recession here and there, but really quite awe-inspiring in its consistency. Yay, capitalism!

Ben goes on to say many people think that is because of technology. He argues it is the financialization of our economy and the Fed’s loose policies. I agree 100%. If you think they haven’t changed the rules since the 1980s and 1990s, you aren’t paying attention, boys and girls!

It goes without saying that those profits are not going to labor, and the same monetary policies that were supposed to enhance the economy have contributed mightily to wealth and income disparity. When you muck around with the markets, don’t be surprised if you get unintended consequences. We have them in spades, and everybody wants to blame “the rich” rather than the incentives the government and Federal Reserve created.

I don’t think it is bearish to notice the political and arithmetic implications of our budget process. I want to help my readers understand that the rules are going to change. That is not necessarily a bad thing. It is just what it is.

The massive increase in debt, huge quantitative easing programs, and increased financialization of the investment process are going to change the rules of investing we have lived under for the last 50 years.

It is going to be difficult, more difficult than now, to get a positive return on your bonds without taking significant risk. And your returns are going to be lower. Think Japan. Think Europe. For that matter, think the US.

If somehow the gods of American football changed the rules so you needed 12 yards for a first down, the field was now 120 yards long, and gave a few advantages to receivers, the nature of the game would change. It would still be recognizable as football but it wouldn’t be the game we know.

That’s not unprecedented. Football in my father’s day was significantly different from now. I’m sure there are people nostalgic for the way it was. I just want to watch the game as it is today. And when it comes to investing, if I have to change my style and look for different opportunities, it is just acknowledging a rule change.

I am not being bearish when I say there is the potential for future rule changes. I am simply pointing out what I see.

I think I am truly the most optimistic man in the room. Everywhere I turn I see opportunities. But then, I’m looking beyond my Bloomberg or business TV.

The world is changing around us and we have to adapt. Many won’t notice the changes and end up like the dinosaurs. That is very sad. What will happen to people who are counting on pension funds is also going to be very sad. Or we taxpayers are going to have to step in and bail them out. As a taxpayer, that is also sad.

Is there a way out of all of this? Absolutely. We can overhaul the tax system like I wrote two years ago, actually balance the budget, fund all the entitlement spending, and watch GDP growth once again become part of our national conversation.

But it will take a crisis before we consider that. In the meantime, let’s pay attention to how the rules are changing and adapt.

Now, how is that bearish?

The rules really are changing and past performance is not, and will not be, indicative of future results.

Travel just seems to happen to me. I have to go back to Dallas to have my root canal checked and get a new cap, then run to the airport to get to Cleveland to have my eyes checked because of the cataract surgery (which seems to have gone well), then run to another airport to get to Chicago for a speech, some meetings, and a dinner the next night, then back to Puerto Rico and finish next week’s letter before flying off to Washington DC to do a video with my friend Neil Howe.

Almost every day I have one if not two conference calls with speakers who will appear at the Strategic Investment Conference, going over what they will say and how the panels will interact. It is hard for me to curb my enthusiasm. There will be so much important information conveyed that will help you understand the changes that are coming. We will discuss China, Europe, geopolitics, debt, central bank policy, all sorts of market and market opportunities, real investment ideas, and much more. And hopefully have a lot of fun while we are doing it. If you can’t make it (get on the waiting list if you think you might be able to change your schedule), then you really should get the Virtual Pass. It’s the best deal out there.

One of the best things about going to Dallas is that I will get to see some of my kids. Maybe even catch an action movie with the boys. And a few friends have time slotted as well. Sunday will be a full day. You have a great week!

Your calling it as I see it analyst,

John Mauldin

Chairman, Mauldin Economics |