-- Published: Sunday, 28 July 2019 | Print | Disqus

Trust Issues

Know Your Customer

Out of the Mattresses

Barriers

Throwing Down the Gauntlet

New York, Maine, and Montana

As I work on my book about the future, I think a lot about the ways possible events will affect our money. But I’m also thinking about something else: What kind of money will we use?

The answer might seem obvious: dollars, euros, yen, all the government-issued fiat currencies that are the economic water in which we swim. Most of us have never known anything else. Yet these currencies aren’t natural phenomena. People created them. People can also abandon them for something else, just as they abandoned older currencies.

I can hear the chorus now: Fiat currencies come and go, but gold is forever. And now there is a drumbeat for Bitcoin. Well, yes, but it’s tough to buy groceries with gold or Bitcoin.

There are good reasons to think we could once again see some fiat currencies disappear. If so, what “something else” will be money in the future? Five years ago, I said that I expected to see a commodity-backed cryptocurrency to eventually emerge and potentially become the currency of the future. Several actually have, too, but without getting much traction for a variety of mostly good reasons.

Facebook’s recently announced Libra project may be the proverbial better mousetrap. On the surface, it seems to address some of the problems encountered by similar offerings. But at this point, it’s really just an idea, and I am not convinced it is ready for primetime. There are a lot of drawbacks, and we will go into some of them.

As you’ll see, Libra may find a place in the new money system, but not without a long fight. Powerful forces have different ideas.

But the point of this letter is not to either praise nor bury Libra, but to think about the future and mechanics of economic transactions.

I can go almost anywhere in the world and use my own form of electronic money: credit cards. Many people are using their phones and in some stores, you simply walk in, pick up the items you want, and leave. The store recognizes your face and bills your account. Yes, you need currency to pay that account. But that transaction happens “behind the curtain.”

Which is what makes Libra interesting and worth discussing. Libra, or something like it, has the potential to reduce the friction behind the curtain. Economic friction is everything that keeps markets from working according to the textbook model of perfect competition: Distance, restrictive regulations, imperfect information. Visible or not, these generate additional costs for consumers.

Some of us of a certain age remember traveling to Europe and paying 10% or more for simply changing dollars into pounds or francs or lira. The “Mama’s” in Kinshasa (back when it was Zaire) would sit in certain areas of the city with currencies in a fold-up device, willing to exchange dollars, pounds, francs, Swiss francs, and others for local currency. That was your international exchange system, and there was lots of friction. Fortunately, I had dollars which were better than any of the local currencies.

The great promise of blockchain technology is its potential to greatly reduce friction of not just currency exchanges but all sorts of transactions. There are literally hundreds (if not thousands) of entrepreneurial businesses trying to apply blockchain to various industries. And it is starting to happen.

Libra is what technology people like to call “vaporware.” No sellable product exists yet—just a concept with some names and money behind it. When I predicted something almost exactly like Libra, Facebook wasn’t on my list of obvious players in that space. It should have been.

Libra is Facebook’s idea, but the company—obviously aware it has public trust issues—has assembled a consortium to manage the project. This “Libra Association” currently has 28 members. They are mostly payment processors, tech and telecom providers, venture capital managers, and a few nonprofits. Facebook itself is represented by a newly-formed subsidiary, Calibra.

Look at the list of the current members of the Libra Association:

Source: Libra.org

The first thing that I noticed—which greatly surprised me until I understood the mathematics of the association—is there are no major banks. My general assumption is still that big banks, in conjunction with government regulators, will bring out the major electronic currency. But then again, notice that MasterCard and Visa are members. As well as PayPal and other financial payment systems. Hmmmm…

Unlike Bitcoin, Libra won’t be “mined” by solving math problems. It will be fully backed by financial assets, which the association says will consist of cash in various currencies, government bonds, and similar short-term debt. All will go into a “Libra Reserve” as users contribute money, and each Libra unit will be a share of that account. Its value will fluctuate against conventional currencies, but not by much (or so they hope).

This is similar to the so-called “stablecoin,” a kind of cryptocurrency designed to deliver the advantages of blockchain technology while tied to conventional low-volatility assets. The leading one, called Tether, seems to work but has encountered some issues. Namely, how do you know the reserve assets are really there? This requires a lot of trust, something Facebook hasn’t exactly earned from the public it supposedly serves. But MasterCard or Visa? Since most of us have at least one of their cards, we seem to trust them.

While I really don’t use Facebook, my wife is an aficionado. (I’m more of a Twitter guy.) It’s a handy way to connect with far-flung family and keep up with community events, which Shane does for me. I know that targeted advertising is why it’s free. I don’t mind—up to a point. The problem is Facebook uses your data in unexpected ways most of us would never consent to if it specifically asked us, which it doesn’t. Not to mention the large, profitable firm’s seeming inability to securely store our data.

It is long since clear that these are not mere mistakes. Mark Zuckerberg founded the company on the principle, “Move fast and break things.” That is the culture and it is not something he can easily change, even if he wants to, and it’s not clear he does. He is, however, making some gestures toward segregating Libra customer information from the Facebook social network. I’m not sure it will be enough to satisfy the public, not to mention politicians and regulators around the globe.

Libra faces another challenge that may be even greater. Much of the “unbanked” economy likes being in the shadows. People use cash and cryptocurrencies as part of tax evasion, fraud, crime, or terrorist plots. Facebook says it doesn’t want to facilitate such activity. But how to stop it?

Regulators have forced the banking industry to adopt robust “know your customer” practices. You must identify yourself to open an account. Banks report any suspicious activity to the authorities. It is a pain to legitimate businesses and investors, but a necessary one.

US and European regulators may not demand that level of scrutiny from Libra, but they will certainly impose some requirements. There is no way they will let it turn into anything like Bitcoin.

Facebook has millions of fake accounts engaged in all sorts of less-than-honest activities. That’s core to its business model, actually; more eyeballs mean more revenue. The firm is beginning to police the audience more rigorously, but its sincerity is questionable at best.

So the Libra project’s DNA, so to speak, tells it to a) collect lots of data b) not worry too much about its accuracy, and then c) use the data to make money. That is inconsistent with the way Libra will have to operate, if it is to do so legally, as Facebook and its partners say is their intent.

But say Libra implements whatever safeguards the various governments demand. That still leaves it holding a lot of sensitive, private information about people’s assets, spending habits, travel and more. Can we a) trust Libra to keep the data out of Facebook’s clutches, and b) trust Libra, Facebook, and whoever else is involved to protect it from cyberthieves?

Just look at all the data breaches that have occurred at large, supposedly sophisticated banks and other institutions that spent billions protecting their systems. Is Libra going to invest that kind of money on security? If so, where will it come from?

Libra itself intends to make revenue from the “float” on its assets. In theory, you will give your dollars or euros to Libra and they will convert it into a basket of currencies, banking assets, and so forth. The organization will live off the interest, paying you nothing while (you hope) not using your information to its own benefit.

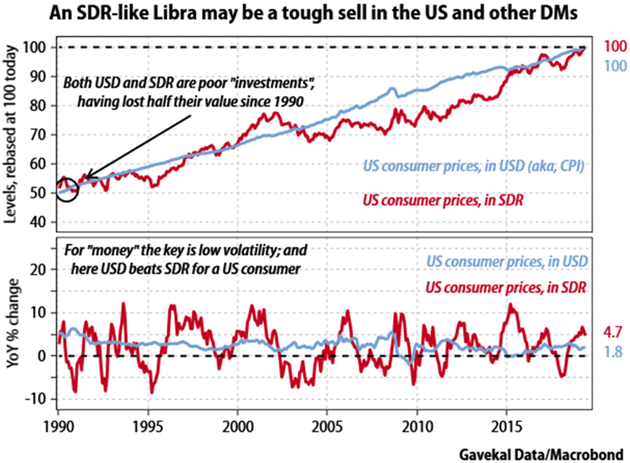

Let’s go back to that stablecoin concept. A basket of currencies is not very stable. Fortunately for me, my friends at Gavekal (the extraordinarily youthful looking Will Denyer in this instance) took the trouble to measure the stability of both the dollar and the IMF’s Special Drawing Rights (SDR). They found that for at least US dollar holders, the dollar would’ve been more stable. It even works out that way for holders of the Indian rupee and other currencies. (Of course, if you live in a country like Venezuela, Libra may be a godsend for you, if you can figure out how to get some.)

Source: Gavekal Research

So, if Libra isn’t going to pay me any interest and it’s not really a great store of value, what’s my motivation to “invest?”

Now, if MasterCard will give me a card that uses Libra for my transactions when I go to Europe that offers me less friction than I am currently getting now when I pay with my credit cards, I’m all over that. That’s something that happens behind the curtain. And some very smart young kids will figure out very quickly if that Libra MasterCard is actually a good deal and post it on Twitter where I will read about it.

If it works, this is a form of return on the money you put in Libra. But that “interest,” whatever its amount, may also be a problem… and not just for Libra.

The companies involved in Libra aren’t risking their capital and brand names because they hope for a small success. They want this to work, and work big. But if that happens, its very size will start to have a systemic effect.

Consider the process. Presently, a bunch of money circulates in paper form, Bitcoin, and other under-the-radar channels. How much is unclear—certainly, many billions of dollars/euros/etc., and possibly trillions. Economically, it’s like cash stuffed in mattresses. Banks can’t lend it because they don’t have it on deposit.

Now imagine Libra successfully attracts some of that money. Pick a number—$500 billion is as good a guess as any. Anything less would probably disappoint Zuckerberg and friends. What happens to this $500 billion (in various currencies) that is no longer stuffed in mattresses? It will go in the Libra Reserve and be used to buy low-risk assets like government bonds.

(Now, there’s a separate question about whether Libra can do this without a bank charter, which would certainly complicate its life. But set that aside for a minute.)

What happens to short-term interest rates if a large amount of new capital decides it wants to buy in? Answer: rates fall.

Where, right now, are the rates for government securities in Japan and much of Europe? Answer: already below zero. In fact, there are $13.7 trillion today of government bonds paying negative interest.

Where, right now, are the rates for government securities in the US? Answer: not yet zero but headed that way.

The supply of secure liquid assets that can serve as the “stable” part of Libra’s liquidity is limited. If Libra, or anything like it, successfully pulls formerly underground money into the banking system, short-term rates will drop even lower than they already are. That is a problem for the banks, which in Europe are already on thin ice. It’s also another reason to think NIRP will eventually reach American shores.

That may explain why banks have no interest in backing Libra. To them, the whole idea is toxic. They might love to have more deposits, but not at any cost, and this one would be pretty high.

It might also explain the instant bipartisan outrage from elected officials. They don’t like Facebook in the first place. Politically influential bank officials likely made their Libra displeasure known. Hence the fierce criticism.

And it won’t be lost on regulators and governments that blockchain currencies threaten their “seigniorage” incomes. Bitcoin, like gold, is a small rounding error in the grand scheme of seigniorage. Libra, or something like it, could get big enough to be noticed.

I should note that Facebook executives didn’t do a very credible job of answering all the questions at the last week’s Senate and House hearings. They generated more questions than answers. If I understood what I read correctly, the most interesting point was that they hope Switzerland will somehow regulate Libra, but they haven’t actually talked to Swiss regulators. And last I looked, Switzerland has negative interest rates. This has all the appearance of “move fast and break things.”

That said, it is also possible governments will issue enough new debt to sop up this freshly liberated capital. They have no problem increasing spending. Last week’s budget deal in Washington may have averted a government shutdown, but it was at the cost of continued trillion-dollar deficits, and that’s the optimistic case. All bets are off if recession strikes.

So, Libra has a tough row to hoe. We’ll see how it goes. But the point remains: Fiat currencies aren’t working so well, either. What would work better?

I continue to think a properly designed, well-regulated commodity-backed cryptocurrency is the best option. But it can only work if governments allow it. They don’t need to ban alternative currencies; governments have many ways to render them impractical.

For instance, in the US, the IRS considers Bitcoin an “investment.” Any change in its value between the time you acquire it and the time you spend it, is a capital gain or loss. Tracking that for every cup of coffee you buy would be a chore. Libra will likely face this same problem.

And speaking of taxes, the IRS accepts only dollars. You must have enough of them to pay your taxes. Similarly, the government pays its millions of workers and contractors in dollars. Ditto Social Security and other benefits. An enormous part of the economy won’t use any Libra-like alternative money. This will further limit its growth.

Those barriers will fall eventually, but it won’t be tomorrow. I think we will see a lot of experimentation in the next decade. New money is coming. We just don’t know what it will be.

All that being said, I wouldn’t bet against Libra actually making it. While you and I, gentle reader, may be a tad skeptical of our privacy in Facebook’s hands, hundreds of millions if not billions of millennials won’t even think about it.

And if you are one of the major banks that has been working on a blockchain crypto currency? Many are doing so.

Facebook’s just sounded the starting gun. And they are doing the banks the courtesy of running the regulatory gauntlet first. Will that give Facebook a first mover advantage? Hard to say. Remember MySpace? Not all first movers are created equal.

Will it happen? I absolutely believe it will. Does it make a huge difference to you and me which one of the big players (expect many) out there are the eventual winners? Not really. All we want is less friction or transaction costs. The sooner the better.

Here are some links for those who want a deeper dive. The last two are especially thought-provoking.

Early August sees me in New York for a few days before the annual economic fishing event, Camp Kotok at Leen’s Lodge in Grand Lake Stream, Maine. Then maybe another day in New York before I meet Shane in Montana. Palo Alto is calling, too.

I arrived back in Puerto Rico to find the embattled governor had resigned. A 900-page report compiled by the Center for Investigative Journalism revealed a private email/text system in which he and his friends had denigrated anybody and everybody. Whether you are conservative or liberal, the revelations were nauseous. He had to leave.

Things are kind of up in the air right now, but this is a wonderful place and it would be awesome if we could actually get a transparent government. The FBI has arrested some former government officials for corruption. There is never just one cockroach, so I suspect others are probably in their crosshairs.

Yes, there are a lot of problems, but this is a great place with wonderful people, and it is paradise (if you like warm tropical paradises). The people clearly want more openness and less corruption. Let’s hope it happens…

And with that, I’ll hit the send button. You have a great week!

Your wondering if I should check my Facebook account analyst,

| John Mauldin

Chairman, Mauldin Economics |

P.S. Want even more great analysis from my worldwide network? With Over My Shoulder you'll see some of the exclusive economic research that goes into my letters. Click here to learn more.

Thoughts From the Frontline and MauldinEconomics.com is not an offering for any investment. It represents only the opinions of John Mauldin and those that he interviews. Any views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with, Mauldin's other firms. John Mauldin is the Chairman of Mauldin Economics, LLC. He also is the registered Principle of Mauldin Securities, LLC, a FINRA and SIPC, registered broker-dealer. Mauldin Securities LLC is registered with the NFA/CFTC, as an Introducing Broker (IB) and Commodity Trading Advisor (CTA).

John Mauldin, Chief Economist and Investment Advisor Representative, CMG Capital Management Group, LLC, provides investment management services through its affiliated mutual fund, the CMG Mauldin Solutions Core Fund (the “Fund”), a series of Northern Lights Fund Trust, an investment company registered under the Investment Company Act of 1940. CMG receives a management fee as the investment manager to the Fund a portion of which is paid to John Mauldin.. A complete description of the Fund, its strategy, objectives, and costs is set forth in the Fund prospectus, a copy of which is provided to all clients that engage the Registrant’s services through the Fund.

This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Past performance is not indicative of future performance. Please make sure to review important disclosures at the end of each article. Mauldin companies may have a marketing relationship with products and services mentioned in this letter for a fee.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER. Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor's interest in alternative investments, and none is expected to develop. You are advised to discuss with your financial advisers your investment options and whether any investment is suitable for your specific needs prior to making any investments.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs may or may not have investments in any funds cited above as well as economic interest. John Mauldin can be reached at 800-829-7273.

| Digg This Article

-- Published: Sunday, 28 July 2019 | E-Mail | Print | Source: GoldSeek.com