-- Published: Sunday, 29 March 2020 | Print | Disqus

Federal Reserve: $5 Trillion Heading to $10 Trillion

The Problem with Models and Assumptions

The Cavalry Is on the Way

Speaking of Mortality Rates

Federal Budget Deficits: To $30 Trillion and Beyond

The Unintended Consequences of Doing Good

Tens of Millions of Unemployed

The Post-Virus New Normal

Staying in Puerto Rico and Amanda

Unprecedented events are happening so fast, I barely know where to start. But let’s begin with a small one, noticeable perhaps only to me.

Over the years I’ve received thousands of reader emails responding to my letters. I read and appreciate them all, even the critical ones. Often the readers mention where they were when reading my letter. They read me on planes, trains, golf courses, beaches, campgrounds, limos, offices, hotels, and everywhere else you can imagine.

But today, I can confidently predict almost all of you will read this letter… at home.

At least, I hope you are home. And I hope your home is comfortable because you may be there awhile. I’m in the same position, at home in Puerto Rico. We’re safe and well stocked for now.

With the economic and market situation changing by the day, I decided to approach this letter a little differently. Rather than go deep on one topic, I’ll share brief bullets on the many points swirling in my mind. Think of it as Postcards from the Frontline. These will be in no particular order and may generate even more questions.

But that’s the world as it is now: many questions, few answers.

Before we begin, here’s a way to find some answers, at least. We at Mauldin Economics have decided to give every one of our readers a complimentary three-month subscription to our healthcare investment advisory Healthy Returns. Just click this link and enter your best email address – no strings attached and no credit card required.

We all should focus on our family’s health and safety right now. Consider this some extra help in looking after your financial well-being. Grab your three free months of Healthy Returns here.

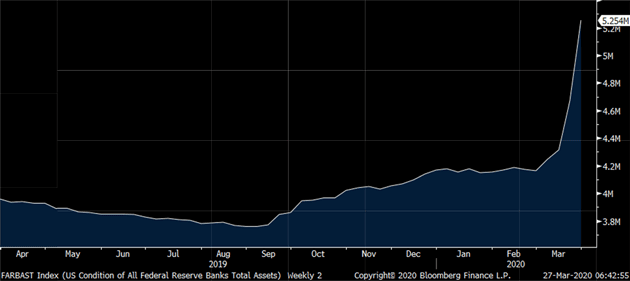

With recent activities, the Federal Reserve’s balance sheet has exploded to $5 trillion plus. My friend Peter Boockvar thinks assets could easily reach $10 trillion, and problems will develop when they try to wind it down. I’m not so sure they will do that. I think this time they may take a page from the Great Depression playbook and simply not worry about winding it down.

Let me go one step further. The 2020s will be the decade of “Whatever It Takes.” I’ve said that before the decade ends, the Fed balance sheet will be $20 trillion and probably approach $30 trillion. I still think that is the case.

While those are staggering numbers, percentage-wise they are no more than Japan has today. We will have to explore later what this will do to the dollar’s value. I can hear the Austrian-school economists screaming it has to be worth less. But that hasn’t been the case in Japan, and only slightly so in Europe and for different reasons. Each country will have its own characteristics when it comes to expanding its monetary base.

Source: Peter Boockvar

The uncertainty we all feel is actually a great deal of the problem. Challenges come and go, but we are all accustomed to having data about them. The data may be wrong or unclear, but we at least have something to focus on and debate. Now we don’t. That leaves us deeply unsettled.

The new coronavirus is what it is. Scientists are studying it but they need data to evaluate its effects. How does it spread, who is susceptible, what percentage of them will become seriously ill or die—we don’t have good answers. Thus, our minds fear the worst.

It’s not that the data doesn’t exist. We (and I mean humans collectively) just don’t collect, analyze, and share it very well. And, to be fair, this is a complex problem. People get sick and die for all kinds of reasons, and sometimes multiple reasons. Whether to attribute them to this virus is often a judgment call.

I have long criticized financial modeling. The financial “planners” who say that you can safely withdraw 5% of your retirement savings every year based on a 100-year model of market performance are guilty of malpractice. There are 20-year periods when you would have run out of money 17 years into retirement (or less). It’s data manipulation of the worst kind.

The coronavirus pandemic has its own kind of modeling mania. I get why we need models. I use them in my own business. But I understand their limits.

Trying to project coronavirus infection and death rates in one country using data from another country can be useful in proper context. But trying to claim as some do (I’m thinking of two Stanford professors) that COVID-19 probably has a death rate no higher than the standard flu, based on layers of assumptions, is just not helpful.

On the flipside, we are not all going to die. Some of the curves we see may reflect the spread of testing capacity more than the spread of the virus. Now if you are New York’s Governor Cuomo, who from all appearances has a handle on the crisis there (as have many other governors), you have to assume the worst and plan for it. Some governors simply have their heads in the sand, and that endangers the whole United States. Not to mention their own states.

I know a gentleman who is responsible for coronavirus testing in several states. He called me yesterday and says he now has access to 40,000 test kits per week, up from almost nothing a few weeks ago. The new test kits can give results in 15 minutes. You walk into the testing tent (they are setting up in Walmart parking lots), take the test and in a short time know your next step.

I assume that other states are likewise getting tests and that production is ramping up. That is clearly happening with masks and other critical items as well. Not as fast as we would’ve liked, but it is happening.

As an aside, in one truly odd sense, humanity is lucky. Unlike many viruses, this one spreads while the patient is asymptomatic. What if it had a (God forbid) 10% or more mortality rate? I believe we must start planning for the next, potentially far worse virus and be better prepared than we were for this one.

Human trials are starting on various medicines to treat the virus. I’m personally aware of several so my guess is that there must be dozens of different medicines being tried. If, as seems likely, some prove effective, it will reduce the mortality rate and the severity of the illness. That will mean shorter hospital stays, freeing up more beds. We may be only a few weeks away from beginning to bend the curve on treatment.

God bless the doctors and healthcare workers who are aggressively working to help mitigate this disease, often risking their own lives. Three cheers for the medical entrepreneurs, too.

This morning I saw an estimate of mortality rates in multilingual Switzerland. An inexplicable (so far) pattern has arisen in the case fatality rate there.

- German speaking cantons: 0.6% CFR

- French speaking cantons: 1.4% CFR

- Italian speaking cantons: 4.4% CFR

Mortality rates seem to be lower in Germany as well. I have no explanation for that, and maybe later some scientists will figure it out. Did the virus travel up with Italians into the Italian speaking cantons? Which are closer to the French speaking cantons? About the only thing I can safely predict is that language won’t be the variable.

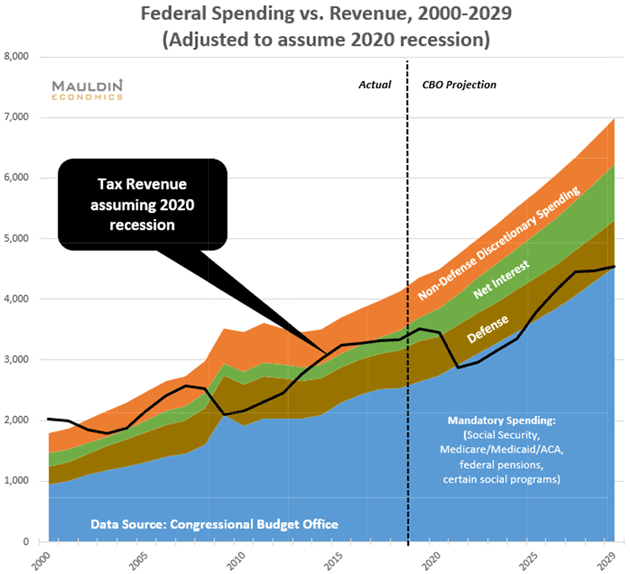

In my decade forecast, I projected that in the next recession the deficit would climb to over $2 trillion. Clearly, that demonstrates I am an optimist. Here’s a chart I shared back in January.

Between reduced tax revenues and increased spending, I now expect this year’s deficit will be at least $4 trillion. I will bet you a dollar to 40 doughnuts that we will see at least another $1 trillion emergency spending bill to be spent in the third quarter.

We could have 2020 and 2021 deficits of a combined $6+ trillion. Add off-budget spending and we should see $30 trillion total national debt by the end of 2021. I naïvely projected total national debt to be $39 trillion by 2030. See, I keep telling you I’m an optimist. We will be in that $40 trillion range somewhere around 2026–27.

We are experiencing a practice round for The Great Reset. Sometime late this year or early next year we need to look at what happened and then think what it will look like in the late 2020s. A number of factors will all converge to give us a true Fourth Turning generational crisis, part of which will be The Great Reset.

The Federal Reserve is buying mortgage-backed securities with the best of intentions. But there are unintended consequences. This week I had a truly horrifying phone call with good friend and real estate expert, Barry Habib. He knows the mortgage business inside and out and he’s very concerned right now.

Briefly (this is complex so forgive me, Barry, if I miss some nuance), the Federal Reserve and other bank regulators have relaxed some rules so lenders can be more patient with people who fall behind on their loan payments. It’s called “forbearance.” I think we all agree that’s necessary under the circumstances.

The problem is they didn’t grant forbearance to mortgage servicers, the companies who collect payments, handle tax escrows, etc. They also take risk as mortgages wind through the system from origination to the investors who actually own them. The servicer must make payments to Fannie Mae, Freddie Mac, and especially Ginnie Mae, even if the mortgage is delinquent. Normally the risk is small. Suddenly it is not.

The problem is that the mortgage service providers are the fan belt of the economic engine. It is a $3 part (or was when I was a kid and installed them myself) but the entire engine freezes up if it breaks. The mortgage belt has snapped and we are weeks away from the entire housing engine collapsing. This morning we learned that Treasury Secretary Mnuchin is aware of this “minor issue” and is trying to decide what to do. He needs to decide quickly.

(You can read Barry and Dan Habib’s longer explanation of the problem here.)

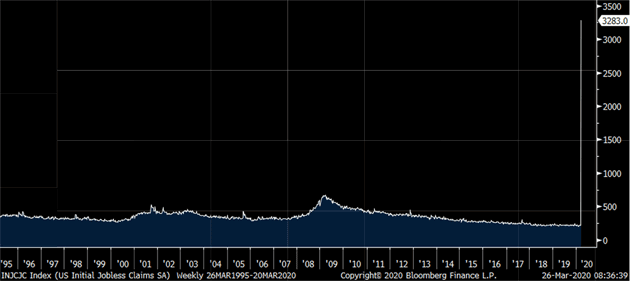

Speaking of data, Thursday morning brought the sobering but unsurprising news that US initial jobless claims had jumped to a mind-boggling 3.3 million from just 211,000 two weeks ago. If there were any doubt whether recession is here, this should dispel it. We are in a crisis worse than 2008. Some are already calling it a “Depression” and they may be right.

Source: Peter Boockvar

Let me put the number in an even scarier light. Many who lost jobs either aren’t eligible for benefits, or haven’t applied because they think they aren’t eligible, or tried to apply and couldn’t. I suspect the real number of newly unemployed is well north of 10 million and will climb over the next few weeks. Having 20 million unemployed is possible if these lockdowns persist.

Whatever you call it, the economic downturn will damage us on top of the virus damage, which is already bad enough. The stimulus programs may cushion the blow but they won’t eliminate it. This is going to hurt.

It’s already hurting investors, who face massive revaluation. As my friend Mish Shedlock put it,

We woke up in February and the market said, "Oops, everything is at the wrong price and I will correct that immediately."

Mish has a fascinating blog post you should read in which he documents a conference call with Jim Bianco of Bianco Research. He explains why the bond market’s locked up and what is coming next. Hint: None of us are going to like it. His summary of Jim’s work is must reading.

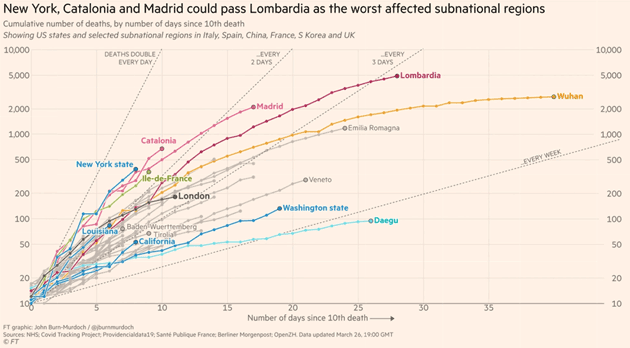

The news media is keeping us all well-informed (perhaps overly so) on the number of coronavirus cases and deaths in each country. That’s good to know but viruses do not carry passports or respect national borders. So that framework doesn’t really tell us much.

Financial Times has an interesting tracker page (free to view) with this graphic and lots of other interesting data. They update it daily. Instead of nations, it shows subnational regions with notable outbreaks, scaled to the number of days since the 10th death.

(Click to enlarge)

Basically, the steeper the line, the faster the number of deaths is growing. What it shows is disturbing. New York, Paris (labeled “Ile-de-France”) and both Madrid and Catalonia in Spain all have as many or more deaths than either Wuhan or northern Italy (Lombardia) did at the same point. The New York line is disturbingly close to vertical. Louisiana is fast becoming a hotspot, too.

When I say we lack data, I don’t mean we lack information. We have plenty and the hard part is sorting through it. On that part, I’m finding Twitter pretty useful. You can filter out most of the noise by being careful who you follow. You can start by following me, @JohnFMauldin.

I don’t think anyone believes we will go back to anything like January 2020 normalcy anytime soon. We have no idea, even if restaurants and everything open, what shopping patterns will look like. Are we learning to live on less in our isolation? Seeing your 401(k) become a 201(k) may postpone a car buying decision or two.

My daughter (see below) works for a cheerleading gymnastics company. Nationwide this is a multi-hundred-million-dollar industry. Will they just open back up and expect all the girls to go back on day one? Will their parents be able to afford it? We’re talking many tens of thousands of jobs. Personal trainers? Many jobs will be under pressure.

There are 47,000 retail stores just in the US. We already knew there were too many as closings were becoming more frequent. My friend professor Michael Pettis in Beijing (who has lived there for 20+ years) has been documenting the return of life in Beijing. He sees people on the streets but not many in the shops, except where the young go to hang out rather than buy. Will that be the case in America and Europe?

And speaking of stores, many are not paying their rent. Cheesecake Factory, for one. Ryanair, EasyJet, and British Airways have stopped paying most rents and vendors. Group 1 Automotive reports a 50% to 70% decline in March sales across its 428 dealerships in the US and the UK. The company has laid off 3,000 US employees and 2,800 UK employees.

How fast do we start traveling and vacationing again? That matters to hotels, airlines, and their employees. I believe this experience will emotionally scar a generation. It is going to make the political divide even worse, especially along wealth and income lines. Ugh.

The US and other governments can artificially prop up GDP, but for how long? At some point, it really does start affecting the currency’s buying power. We just don’t know what that point is in the developed world. The Federal Reserve has properly opened swap lines with many emerging markets as they need dollars in order to pay bills and buy necessary supplies. But many of their citizens are going to want a “safer” fiat currency. I think many emerging markets will enact capital controls sooner rather than later. That will really screw with their markets. But what else can they do?

Next month’s earnings season will be truly abysmal. Close to half of S&P 500 profits come from outside the US. Every business is going to have a new valuation. It is just my guess, but I doubt we have seen the stock market bottom yet.

Let me close with some good news. Even though the number of deaths is rising in the US and the developed markets every day, the rate of increase is slowing in many places. I think we will see a giant collective sigh of relief when the infection and death rates are not only dropping but the drop is accelerating. That will be the time to think about gradually getting back into the markets. Meanwhile, maintain your watchlist of things you want to buy at cheaper prices.

In closing, let me leave you with this link to an apocryphal letter from F. Scott Fitzgerald on his supposed quarantine during the Spanish flu virus:

The officials have alerted us to ensure we have a month’s worth of necessities. Zelda and I have stocked up on red wine, whiskey, rum, vermouth, absinthe, white wine, sherry, gin, and lord, if we need it, brandy. Please pray for us.

Thanks for all the letters of support and well wishes for my daughter Amanda. She had a full-blown stroke last week, losing all control of her right side. She is recovering in fits and starts, and is now scheduled for two weeks in the rehab center. The therapist is hopeful since she was a college athlete (All-American cheerleader) and has stayed in good shape.

In a truly scary way, the lockdown was a godsend. Her husband Allen would otherwise have been away at pilot school. As it happened, he found Amanda within a few minutes and had her at the emergency room where they were able to treat her quickly. Every neurologist will tell you that’s of utmost importance with a stroke. If he had been at school? It could have been hours. She was about to drive to the store with one of my granddaughters. What if she had the stroke in the car?

The reality of this quarantine is brought home to me through the eyes and experiences of my children. It is so very real and some are rightfully very worried for their future. Will their jobs even exist? Others are seeing their work hours rise due to the “essential” nature of their jobs, but how long will that last?

I do know that we will adjust and that we will all Muddle Through. I will be here with you.

As I was about to hit the send button, I got a plea from an old friend (nurse and her emergency room doctor husband) for ventilators and tests. They work in a midsize hospital in Chicago. The academic hospitals are getting what they need, but the outlying hospitals aren’t and it is a life-and-death situation. I put them in touch with a friend who has excess 15-minute tests. We are all just doing what we can to get through.

Final thought: Millions of entrepreneurs are trying to figure out what to do when the world is turned on again. They will figure it out. I can tell you that in my businesses we intend to move forward and grow. Forget about retreating or retrenching.

That is what entrepreneurs and business people do. And it is why, even though it will be a Post-Virus New Normal, we will find our own new normality. And it will be one where friends and family will be as important as ever. So let me close this letter to my best friends, and wish you a great week.

Your lord, I may need some brandy analyst,

| John Mauldin

Co-Founder, Mauldin Economics |