-- Published: Monday, 20 April 2020 | Print | Disqus

Nothing Like Normal

Math Problem

A Few Thoughts on Unemployment

Repricing the World

Staying at Home

The viral fog is starting to thin. US coronavirus case growth appears to be slowing, albeit at a tragically high level. Governments and businesses are thinking about the next stage.

On the other hand, fog tends to return when the weather is right. Might this virus come back, as seems to be happening in Japan and Singapore? We shouldn’t relax just yet.

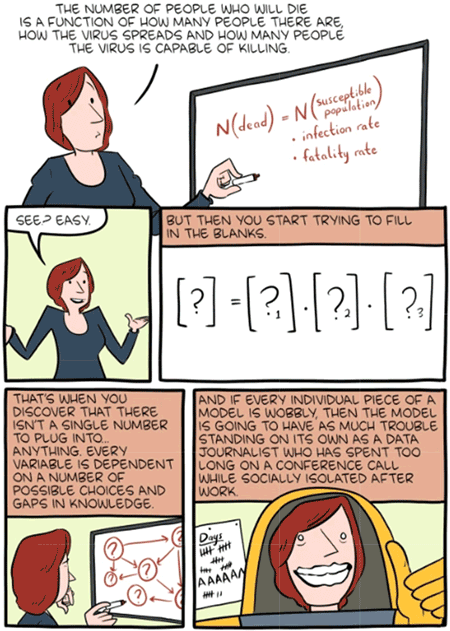

Nate Silver’s FiveThirtyEight site published an information-filled comic about the wide gaps in various “scientific” virus models. Just as in investing and climate change, accurate models are difficult. Just a sample:

Source: FiveThirtyEight

We know everything has changed, but we don’t yet know how. This all happened within weeks instead of unfolding over years like other major crises. We haven’t had time to process it all, much less prepare for it. There’s nothing like a Bretton Woods plan for the next phase. We’re making it up as we go along. So are our leaders. And they are often relying on models everyone knows are flawed, but they have to start somewhere.

My friend Mark Grant summed it up nicely in his letter this week.

We are peering into the void, of the great unknown, and trying to make sense of an array of data that doesn’t fit any economic models, because we have never been here before, and we don’t know how to model for economic conditions that have never existed before, in anyone’s lifetime.

I will readily admit that I use models all the time. I try to understand their limitations. Most business people use models to plan out any new venture or predict the next year or so. The successful ones use a mathematically imprecise tool called “the fudge factor.” They assume that something will go wrong and try to allow for problems. If there is no problem, then they have “excess profits.” But if there is one, they are ready.

I believe we will look back at some of these models and say they were too conservative. But that is in hindsight. What if they weren’t? Unlike a business, it wouldn’t be just a dollar loss, but lost lives. They did the responsible thing and built in a significant fudge factor because the data was all over the place.

All that said, investors and business leaders still need some kind of outlook to guide our strategy going forward. Of course it will be tentative, but we can adjust as we gain clarity. The important part is to not let the uncertainty paralyze us.

Developing our own individual strategy going forward, not being paralyzed, is indeed the primary focus for the first-ever Virtual Strategic Investment Conference. Here’s my official announcement message.

I was disappointed to have to cancel this year’s SIC in Scottsdale. It was clearly going to be the best ever. But as I and my team thought about it, there has never been a more important time for a virtual conference. After a few phone calls, I realized that I could put together an even more powerful gathering of the best minds and thought leaders in the world.

We will present a live virtual conference for five days between May 11–21. Our technology will let you ask questions just as if you were physically there. I have restructured the agenda to focus on what the economy will look like over the next six months and in a post-vaccine world. We know that it will be different. You’ll hear from thought leaders who can separate the signal from the noise, showing you what’s important and where the opportunities are, and of course what to avoid.

I honestly believe this will be the most important SIC I have ever hosted. There has never been a more urgent time as confusion reigns and the need for clarity is paramount.

This conference will not be about hunkering down, but finding opportunities and moving forward. The Age of Transformation is going to accelerate. We will cover every nook and cranny of the investing, geopolitical, and political landscape.

And what a lineup of speakers! Here are just a few of the almost 30 already confirmed:

- Celebrated investor Leon Cooperman

- Ian Bremmer and George Friedman on geopolitics

- Michael Pettis coming to us live from Beijing

- Felix Zulauf live from Switzerland

- The entire Gavekal team, Louis and Charles Gave plus Anatole Kaletsky

- Dr. Mike Roizen hosting some of the finest epidemiologists in the world

- Barry Ritholtz and China expert Jonathan Ward

- Political mavens Bruce Bartlett and Bruce Mehlman.

Of course we will have David Rosenberg, Lacy Hunt, and this year Ben Hunt, along with Jim Bianco to give us insights on Federal Reserve policy and bonds. There will be a special focus on technology as my good friend Peter Diamandis has agreed to join us from Silicon Valley along with Karen Harris of Bain and technology wizard Cathie Wood.

There are too many to mention but it will be the biggest collection of forward-thinking brainpower gathered anywhere this year.

The price is less than 10% of the live event, let alone travel and hotel. You will be able to watch the conference from the comfort of your home or office, either live or reviewed at your leisure, plus read the transcripts. Ask your questions.

Again, don’t procrastinate. Click here and register now.

In my experience, finding the right answers often begins with asking the right questions. With so much uncertainty, it’s hard to know where we should look first.

My friend Dave Rosenberg (who now practices independently at Rosenberg Research) recently distilled the issues into three questions. Writing in his morning letter, Rosie said,

There are three issues that economists and strategists have to address for their clients:

1. Trying to predict when the chokehold over the economy will end and what that will look like.

2. How deep a shock is the current recession going to be and what does the recovery look like in the near term.

3. What is the longer-term fallout on the economy, the markets, and society?

These are indeed a good way to focus our thinking. Let’s dig into each. I’ll give you Dave’s quick answer and then add my own thoughts.

Regarding question #1, it is a very tough call and depends on so many medical variables. President Trump hinted that he will be relying on his gut instinct. In any event, if I had to guess, we will be seeing a partial reopening in some areas beginning in May. I sense the one metric that is really important here is health care capacity (hospital beds, ICUs, ventilators).

I believe easing the business and movement restrictions will depend highly on local conditions. The viral outbreaks spread in ways we don’t fully understand. Keeping so many people out of circulation seems to have helped but these closures aren’t sustainable indefinitely. We have to end them fairly soon.

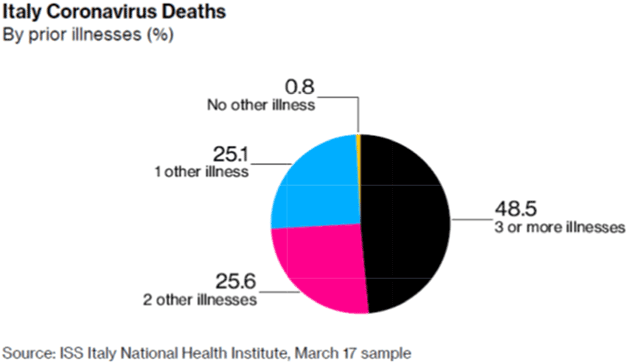

Dave notes, and I agree, that top priority goes to keeping the healthcare system ready for the worst. We need to have facilities, equipment, supplies, and staff to treat a number of patients that may still be quite high plus all the other medical needs that have been sidelined. We can’t allow more of these “overwhelm” situations as occurred in Italy and New York.

Some have suggested we just isolate the most vulnerable people: those over age 60, or with immune system, lung, or other problems. That would probably help but wouldn’t be simple. You’re still talking about a big part of the population, plus the younger caregivers who would come in contact with them, plus the caregivers’ families. That’s not sustainable for long, either.

Dr. Michael Roizen of the Cleveland Clinic is helping prepare a paper for Ohio and other states about how to think about reopening their states. You can see some of his data here. Note that it is data and NOT a written presentation.

He includes this chart about death rates in Ohio, which look much like data from New York, China, and Italy. Clearly the risk of death rises dramatically with age.

But that changes if you factor in other health issues. High blood pressure, smoking, being overweight, lack of exercise, all contribute to increased morbidity. So you can be younger and still be in a high risk category because of your health.

The US still needs to sharply ramp up testing before we can ease the restrictions. It is getting better and some private labs even report excess capacity now that they’ve worked through the initial backlog. But we need much more to be confident, probably millions of tests a day. We just have to bite the bullet and make it happen.

Again, with the caveat that local schedules will vary, I think Dave is right that we can begin reopening in May. But note how carefully Dave said it (my emphasis):

“A partial reopening in some areas beginning in May.”

We are not all going to emerge from our holes, blink at the sunlight, and proceed merrily into spring. I expect a drawn-out process, possibly interrupted in some places if new cases begin growing again.

Some governors are talking about allowing restaurants to open at 50% capacity. How’s that going to work for their cash flow? Not to mention jobs? Still, we have to start somewhere, cautiously. Everything is a trade-off.

In the near term, it’s going to look quite different. Masks will be mandatory some places and socially expected in others. Most people will stay close to home. Even if you’re willing to get on a plane or train, you’ll risk being caught in someone else’s outbreak and unable to get home. Few will want to do that.

Just a few weeks ago, my 2020 plans included 8–10 trips to New York City (and train rides to Philadelphia). Now? No plans at all. It’s all up in the air.

And that’s another big unknown. Governments can’t simply order the economy reopened. Consumers and businesses have to agree and all will make their own choices. Like everything else, it will be a cost-benefit analysis. Is the benefit of going to that restaurant worth the risks of going out in public, in proximity to possibly infected strangers? Maybe so, but fewer will want to as long as this virus is still a threat.

Life will be nothing like the “normal” we knew just a few months ago until we have an effective vaccine and most people are inoculated. That’s at least eight months away, maybe longer. Talk of a V-shaped recovery is fantasy. Some recovery, yes, but we aren’t going to just pick up where we left off. Social distancing is incompatible with the kind of economy we have always known. As long as it persists, the old economy is gone.

Dave’s second question was about how deep the shock will be, and what are the near-term recovery prospects. His answer:

As for #2, it looks now as if the US economy has contracted as much as 40% at an annual rate for the second quarter. Canada could be even worse, as the aggregate index of hours worked plunged at an 80% pace alone in April. The stimulus from the Fed, Treasury, and Congress is significant in size, but is still more to ensure survival rather than classic Keynesian demand-side effects.

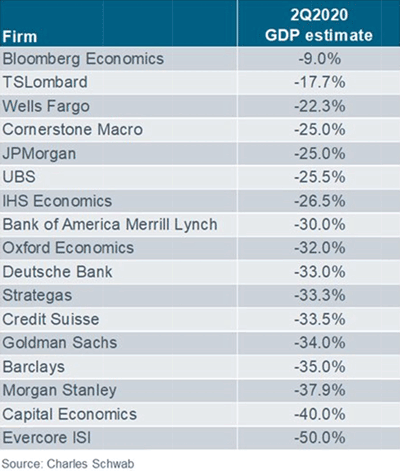

I don’t disagree with any of that, except to note that GDP is an imprecise yardstick for reasons I described just two months ago. We use it because we have nothing better. But whatever the yardstick’s flaws, the economy’s direction is clear. Experts differ only on the downturn’s magnitude.

Here, courtesy of Schwab’s Liz Ann Sonders, is a roundup of GDP forecasts.

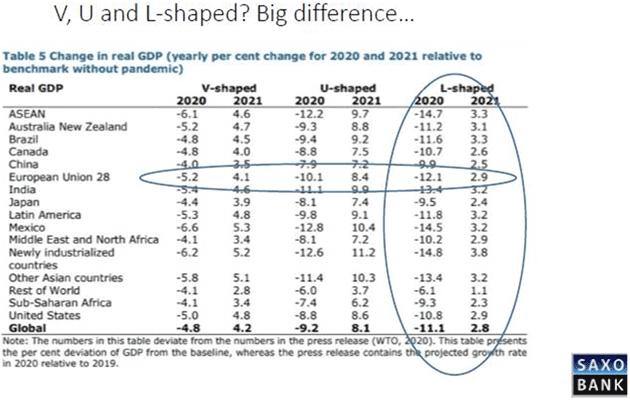

We are in such uncharted waters, any of these could be right. The average forecast seems to show a 30% to 35% drop. That’s as good a guess as any. It will be bad, whether it is V, U, L, or W-shaped.

These numbers are so large we start running into a math problem. If you lose 33% and then make 33% the next quarter, you are still in the hole. Recovering from a 33% loss requires a 50% gain. Anything less and you are still in the hole.

I am trying to imagine how such a sharp recovery could happen between now and October. The only scenario that comes to mind would be some kind of magic-bullet COVID-19 treatment that keeps people out of intensive care and which we can quickly deploy at scale. That would let everyone breathe easier until we have a vaccine. And it could happen, too. Gilead just reported positive results from their Remdesivir drug, for instance. But do you bet your life on it? Not yet, which means recovery will be a lot slower.

Here are the WTO’s full-year GDP estimates for various areas, via Saxo Bank.

To get a V-shaped GDP recovery, we need to see a V-shaped demand recovery, and that’s just not in the cards. Here’s Ian Bremmer.

There's also the broader question of getting people to participate in the economy. Obviously, in this environment you're not going back to crowded bars and restaurants, movie theaters, concerts, and sporting events any time soon. All of these can be reconfigured with fewer consumers, health check screening, improved health measures, and the like, though whether they can remain profitable at that level is another question entirely.

And then you have the question of how many people have the money to spend, even under those circumstances. With businesses under stress across the economy, they need to improve efficiency. And they will—most every CEO I know has been telling me how they'll be able to make more money with fewer people over the coming decade. They're now being pushed to figure out those cost savings immediately, all at once.

As one Fortune 100 CEO said last week: "I guarantee that our company, like many others, will operate with fewer people, smaller buildings, and far more efficient ways of doing business." So the fourth industrial revolution is about to become the post-industrial revolution for large numbers of former workers; medium term, that feels to me like a minimum of 10% of the economy. Consumption across the board will be hit accordingly.

I am not so sure of that last part. If operating more efficiently with fewer people, smaller buildings, etc. were so easy, these CEOs would (and should) have already been doing it. I’m not sure they appreciate how different life will be.

I completely agree with Ian that employment will not come back to previous levels any time soon. Government benefits aren’t going to replace all the lost income, either. The hit to demand will be severe and suppress GDP growth for a long time.

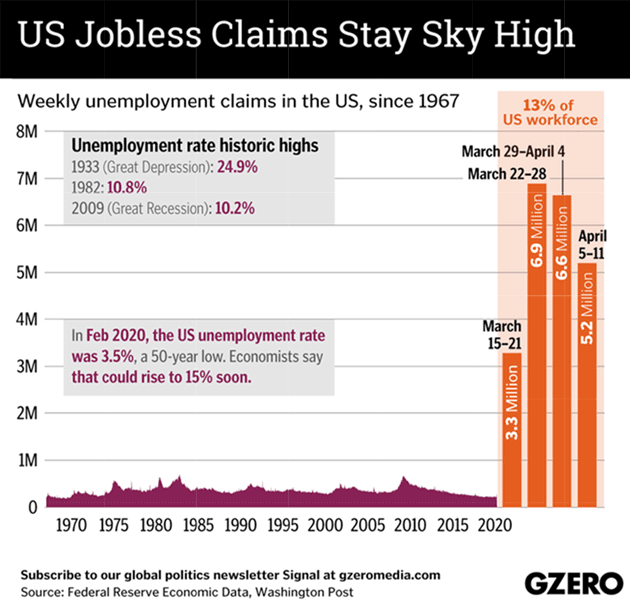

The economic data not only doesn’t fit the models, it doesn’t fit the charts. Literally. You’ve probably seen the recent weekly jobless claims in bar chart form. Here is one example.

Source: GZERO Media

We know from unemployment insurance claims we have lost at least 22 million jobs in the past four weeks. Unemployment in the 20%+ range, perhaps even approaching Great Depression levels of 25%, would not be surprising, depending on how fast we begin to open the economy back up.

The unemployment insurance model was created in a world that has long since passed. So many of our children and indeed, consultants and the self-employed, are in what has come to be called the gig economy. They had been making a living in the gig economy, often doing 2 to 3 different jobs, none of which paid unemployment insurance and none of which gave them enough money or verification to be able to claim it. Yes, some of it was under the table. But it makes no difference if they are hungry and can’t eat or find a place to sleep. In one sense, if we can bail out companies and their corporate bonds (which is often private equity) which are indeed going to be zombie companies in the post-vaccine world, as everything will change, are the people working in the gig economy any less necessary or worthy?

Many private surveys indicate between 25 and 30% of workers had engaged in non-traditional or gig work on a supplementary or primary basis in the preceding month. Since large-scale public surveys, like those administered by the Bureau of Labor Statistics, tend not to ask about supplemental work, these private surveys are some of the best estimates we have of supplemental or occasional gig workers.

Dear gods, we are all in this together. If we ignore that large a percentage of the labor force, we are digging a deeper recessionary hole than we can ever imagine, one that will not show up in the data that economists so very much love until much later. When it is too late to do anything about it.

Think on these things as we worry about things like deficits and debts. We are trying to rebuild not only the US economy, but that of the world. Bill Gates is very correct in this: We have to defeat this virus globally in order to be able to be safe locally. Or accept a much-reduced growth in the economy.

Dave’s final question was about longer-term fallout.

Now for #3, we are going to be in for a prolonged period of social distancing and our personal and commercial lives will remain restricted. The focus will be on savings, cash conservation, ensuring adequate essentials on a personal basis, and inventory/working capital on a corporate basis. The government dis-saving via massive deficits will be offset by rising precautionary savings rates in the private sector.

Economic change begins with individual changes in behavior. People respond to new incentives and eventually the responses add up. I have written about the Paradox of Thrift, where individual savings are good but everybody saving actually reduces GDP. I think after this current crisis/recession the propensity to save will be much higher. Our spending incentives will be different. So what are the new incentives, and how will they change us?

Well, most obviously, we are seeing that personal safety isn’t easy or guaranteed. It is no longer enough to drive carefully, take your vitamins, and avoid rough neighborhoods. The threat is invisible and anyone, even the people you love, could be carrying it. This will have a deep and long-lasting effect on personal relations and spending patterns.

We are going to think very differently about some previously well-established things, and it will certainly affect their prices. Right now, crowded concerts or sporting events are simply off limits. Soon we may allow them with modifications: wear a mask, stay six feet apart, and so on. But being in a crowd, being shoulder-to-shoulder with your fellow fans, is part of the experience. It won’t be the same. And because the product has changed, the price will likely change, too.

That’s a problem not only for artists and athletes, but also the many people whose jobs revolve around such events. Ditto for restaurants, hotels, many other businesses. They will be repriced, probably downward.

But right now, the Federal Reserve is spending trillions to make sure companies don’t default. Maybe in some cases that makes sense, but it also calls into question who is bearing credit risk. Why should bondholders get paid for risk someone else is bearing?

Then again, if we allow the high-yield and leveraged loan market to collapse, we guarantee a deeper recession. Is that what we really want? Just so we can punish the “bad guys” who overleveraged? Another trade-off…

The same is true for stocks. This week the US government spent billions bailing out airlines. What should have happened—and did happen in the past—is the airlines go bankrupt and courts sort out their obligations. Not this time, and maybe not ever again. If so, there is no reason stock valuations should reflect risk shareholders aren’t taking.

We don’t know how this will develop, or how quickly, but I think it is far more likely to bring asset price deflation than inflation. We are going to reprice the world. Probably including your part of it.

Like most of you, I am staying at home. But I seem to be busier than ever. This will be a short ending with a link to a fun musical presentation about the coronavirus experience. But before you click on that one, register here for the Virtual Strategic Investment Conference. As I said, it will be the most important conference I’ve ever hosted. You really want to attend in the safety of your own home or office. I guarantee it will be powerful and change your life.

Have a great week. I assume you are doing what I’m doing, calling old friends and catching up. That part of the quarantine has been very rewarding.

And assuming that you’ve already signed up for the SIC, here is that link I promised.

Your thinking it is time to end the lockdown analyst,

| John Mauldin

Co-Founder, Mauldin Economics |

P.S. Want even more great analysis from my worldwide network? With Over My Shoulder you'll see some of the exclusive economic research that goes into my letters. Click here to learn more.

READ IMPORTANT DISCLOSURES HERE.

YOUR USE OF THESE MATERIALS IS SUBJECT TO THE TERMS OF THESE DISCLOSURES.

| Digg This Article

-- Published: Monday, 20 April 2020 | E-Mail | Print | Source: GoldSeek.com