|

-- Posted Tuesday, 19 August 2008 | Digg This Article | Source: GoldSeek.com | Source: GoldSeek.com

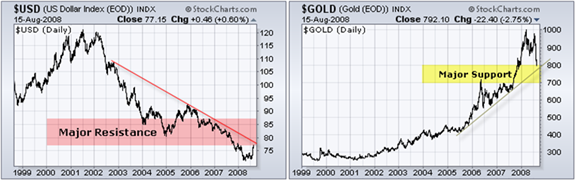

The crumbling state of the financial sector comes as little surprise to readers of GoldSeek.com. The rate at which the process is unfolding is causing high levels of anxiety among those who respect the gravity of the situation but confusion within the gold and silver investment community. Despite some short-term disparity I find tremendous opportunities exist in the precious metals markets in the months and years ahead. The ingredients to take gold and silver significantly higher are in place and soon the manipulative forces within the sector will again be overcome thus resulting in an explosive move. It is truly amazing to still see the level of complacency among the populace when warning lights are going off all around us! The illusion of normalcy is perhaps preferred over the reality of failing banks, government de facto “nationalization” of GSEs, aggressive monetary destruction and the list could go on and on. Highly under-capitalized banks are being injected with hundreds of billions of fictitiously created dollars, euros, pounds, etc accompanied by taxpayers backed bailouts as losses that threaten the integrity of the entire financial system mount. The most insulting aspect of these “bailouts” is the fact that all this freshly printed money is going into the hands of entities that have caused the ongoing financial collapse. Government deficits are increasing dramatically with tax receipts dropping as the velocity of taxable money declines. At the same time government financial obligations are increasing. The recent housing bailout bill allows for the increase of the federal debt limit by over three-quarters of trillion dollars. It also gives literally trillions of financial exposure to the US Treasury as it bails out and nationalizes parts of the housing market. Additionally, it requires fingerprinting of all those who work within as a consolidation of power and destruction of civil liberties persist onwards. Yet the populace remains supportive as the game of confidence and integrity is all which stands between complacency and chaos.

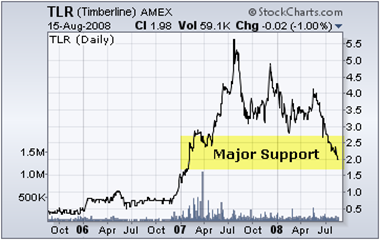

As we understand the current plan of our monetary handlers, a further sacrifice of the faith-backed US dollar is to be the outcome of their attempt to keep their terminally ill financial experiment alive while bailing out their Wall Street buddies. Such actions are almost certainly going to result in further misallocation of capital which will cause greater imbalances and further disregard for the integrity of paper money and the financial system. At a certain point, and perhaps not too far off, the catch 22 Bernanke and Co. will find themselves unable to continue their game plan and trigger a stampede into precious metals and mining stocks. It will take a very minute fraction of the trillions of dollars to ignite what is set to be a tremendous bonanza within the precious metals markets! Yet investors should be selective with their investment decisions and consider some of the following facts. Market conditions over the prior years have demonstrated that access to capital is becoming increasingly more difficult and in turn, this places many mining business models in jeopardy. Nearly all mining exploration companies unfortunately are at much greater risk from our current shaky capital markets, where access to money through public financing has become more restrictive. I believe that the current market conditions allow for some excellent purchasing power for your dollars. For those investors assessing opportunity cost plus risk will find greater rewards from investments that are properly positioned for the next move higher in gold and silver. Allocating Your Precious Capital Your money is always at competition for the best investment opportunities. Today’s depressed precious metals markets have created some tremendous valuation discounts. Your dollars have not had this strong purchasing power in years! When assessing the proper allocation of capital to enhance your portfolio’s returns, I believe there are some tremendous bargains to consider: Timberline Resources Corp. Mining Services & Exploration AMEX: TLR  Timberline Resources Corp.’s business model is rather unique and is the reason I continue to favor it over many other investment choices. As Timberline eloquently states, it has taken the complementary businesses of mining services and mineral exploration and combined them into a unique, forward-thinking investment vehicle that provides investors exposure to both the “picks and shovels” and “blue sky” aspects of the mining industry. Timberline Resources Corp.’s business model is rather unique and is the reason I continue to favor it over many other investment choices. As Timberline eloquently states, it has taken the complementary businesses of mining services and mineral exploration and combined them into a unique, forward-thinking investment vehicle that provides investors exposure to both the “picks and shovels” and “blue sky” aspects of the mining industry.

Timberline currently is comprised of two contract drilling divisions, Kettle Drilling focusing on the Western U.S. and World Wide Exploration providing core drilling services in Mexico. Revenue growth from both drilling subsidiaries has been very strong. The most recent quarter shows revenues nearly topping $10 million which is about double the revenues from the same period in 2007. Strong growth has come from the increase in the number of drill rigs. Gross profit from both divisions for the latest quarter was just above $2 million. During the past quarter, Timberline has implemented a management transition at Kettle. As part of this transition, Timberline has a new and more focused corporate culture placing greater emphasis from rapid growth to profitability. Also I would like to bring attention to the hiring of Mr. Montgomery as General Manager of all of drilling operations. Mr. Montgomery was most recently manager of drilling services at Newmont Mining. Timberline is looking to further enhance its business growth with the acquisition of SMD, one of the largest underground mine development and production contractors in the United States. The combination is going to accelerate the development of its business model with post-acquisition Timberline looking to bring in large cash flow while its exploration division continues to build shareholder value. Demand for skilled mining services continues to significantly increase as the precious metals and commodity bull markets strain limited resources. From drilling needs to assaying to mine development, the mining industry is facing backlogs and shortages. Timberline is positioning itself as a significant player in this field. Essentially, one of the largest underground mining contractors in the United States – Small Mine Development – is being taken public through Timberline, enhancing their already high-growth business model. The new Timberline is being strategically assembled to provide for a vertically integrated resource company. What this means is that soon you will have a company that has in-house capabilities to explore, permit, drill, develop and mine! Post-merger, Timberline looks to generate around $130-140 million in 2009 revenues which should provide an EBITDA of around $35M. With these high growth rates using an EBITDA expansion multiple of ten would give my estimated valuation for TLR upwards of $6-7 for 2009 (these assumptions are based upon the successful acquisition of SMD along with reasonable financing terms). The price projection is without giving any value to Timberline’s exploration portfolio! Please note that revenue, ebitda and price targets are my personal projections. I also believe that the vertically integrated business model along with their very high growth rates will provide additional market premiums. Therefore I believe that Timberline should be more properly valued around $5-6 post-merger in 2008 and around $7-8 or more for 2009, under current circumstances. I also expect that the history of the company to build shareholder value from M&A will continue to accelerate current projections, especially with strong cash flow and share capital. The further conglomeration of other mining services, as well as exploration projects/companies provide even further upside potential for investors. There are even more positive considerations to contemplate with Timberline, and that will be the scope of investors who will find the post-merger company as a possible investment. I believe the appeal of Timberline will not be limited to both retail and current mining funds, but Timberline will be among the first group of investment choices to be selected by external and new funds that will be entering into gold, silver and commodities. From large institutional types to retail investors, I can foresee that Timberline will see very strong investor interest and the resulting consequence of a well managed share structure should be a very strong share price. To structure a business model in which investors have exposure to “blue sky” potential from mineral exploration, yet greatly reduce the investment risk, uniquely places Timberline Resources Corp. as one of the best risk/reward investments in this marketplace. This is one of my favorite business models and my largest investment holding which I have been recently adding to during this pullback. Gold Resource Corp. Emerging Low Cost Producer OTCBB: GORO  It is difficult not to get excited by the prospects for Gold Resource Corporation. The company headed by experienced management was taken public less than 2 years ago, and has ever since been one of the top performing gold mining investments and for very good reasons. It is difficult not to get excited by the prospects for Gold Resource Corporation. The company headed by experienced management was taken public less than 2 years ago, and has ever since been one of the top performing gold mining investments and for very good reasons.

“Not all ounces are created equal!” That is a good description of the kind of ore Gold Resource Corp. has identified and is in the process of expanding in Southern Mexico. Exceptionally high grade gold and silver ore are going to keep this company in an elite class of low-cost producers as we start off 2009. As input costs skyrocket with the average cash cost of gold produced now likely to exceed $500/ounce, producing gold at $100 an ounce cash cost will provide excellent cash flow while margins will hold up well due to the high ore grade. It is not just one factor which goes into building a strong share price. It is a myriad of components which Gold Resource Corp. is assembling that will certainly attract even greater investment capital as they reach their next milestones over the coming months. Having such a large expected profit margin is essential but managements’ plan to distribute 1/3 of positive cash flow to their investors in the form of a dividend just adds to the potential price levels that GORO may head towards. Also consider the positive share structure - roughly 35 million shares with no warrants - no debt and financed to production. Gold Resource Corp. provides investors with a very competitive risk to reward ratio. Year 1 production will provide gold output of 70,000 ounces of gold per year with year 2 expanding to 100,000 ounces gold equivalent and 120,000 in year 3 and beyond. With gold trading back down to around $800, Gold Resource Corp. could begin paying dividends as high as $0.40 or more in its first year and moving higher with increasing production and higher metal prices. Drilling continues to expand the size and prospects for a multi-million ounce high grade deposit. Just recently the company announced it will be updating the estimate for its mineralized deposit which should reach their near term target of 1.3 million gold equivalent ounces. Reviewing the recent drill results does in fact support this target. Continued drilling is likely to expand the size of the deposit in the coming months and years. This is perhaps one of the most exciting epithermal polymetallic deposits that is being uncovered and with near term low-cost production now just months away, I believe Gold Resource Corp. is one of the most undervalued emerging gold and silver stories out there. My prior $14-$16 a share initial production price target, after a couple of successful consecutive production quarters, still stands. Assuming 70,000 ounces of gold in year 1 production with $100 cash cost of production and around $800 gold, the $50 million a year in positive cash flow would support this price target objective.

Timmins Gold Corp. Near Term Gold Producer TSX-V: TMM  In a time and market where many companies have difficulty accessing capital, Timmins Gold Corp. has bucked the trend and has closed its second tranche financing with just over $14 million dollars. The funding was with a large resource fund to bring its San Francisco gold property back into production later this year. In a time and market where many companies have difficulty accessing capital, Timmins Gold Corp. has bucked the trend and has closed its second tranche financing with just over $14 million dollars. The funding was with a large resource fund to bring its San Francisco gold property back into production later this year.

The most interesting part of the financing was not that it was completed during difficult market conditions, but it was done above the market, well above the market price! The company priced 11 million special warrants at C$1.30 per share, about 80% above the current market price!! This is a great testament to the quality of the project when many mining companies must discount financings below the public market price. Back in April, a pre-feasibility was released on the San Francisco project which provided a production cost of roughly $400 an ounce at an 80,000 ounce per year rate from the past producing open-pit mine in Northern Mexico. With current metal prices, Timmins Gold is set to commence production later this year with cash flow from the heap leach operation churning out roughly $35 million annually. With lower grades, Timmins is a slightly more marginal gold producer so as the gold price continues to move to and past $1,000 an ounce, cash flow margins will expand further giving investors even greater leverage to the gold price. Gold prices, even at current levels, should provide strong production cash flow, the current valuations are significantly discounted. Using a conservative 10 times cash flow expansion, Timmins could easily be trading well above the $3 a share level and that is not considering some highly prospective exploration projects in the pipeline. Therefore a $3-$5 share price after consecutive successful production quarters is quite possible in the coming year with gold around $800 an ounce and likely to rise much higher. With over 700,000 ounces of gold 43-101 compliant and with reserves certainly to grow well past the million ounce mark, production now just months away, along with experienced management, financed to the production point and a pipeline of exploration projects, Timmins Gold is a highly undervalued near term gold producer! What’s Next? During the current turmoil within the financial system, the supremacy of the United States, as represented by the value of its paper money, will continue to be challenged. The financial world can no longer continue to operate in the deviously greedy manner which has brought us to this point. We have already moved to and past the financial extremes which can no longer be sustained. This will lead to further movement of capital into precious metals.

The precious mining investors have been largely demoralized by the latest pullback within the sector. This pullback has been magnified by the coordinated Central Bank interventions as desperate times call for desperate actions! But despite buying themselves some more time by their free market manipulations, the process will continue to unravel and sooner than later, the fractional banking system will continue to implode requiring the injection of massive amounts of capital. What is happening should shock us all, but obviously it is not yet bad enough for angry mobs to question why mega profits over the past years have been privatized while we now socialize the mega losses. This is socialism for the ultra-elite on a colossal scale! I believe that the bottom will be put in the precious metals sector over the coming weeks. The pullback is likely to find a sharp reversal as the selling has come into a market with nominal buying support which has exaggerated the moves to the downside. As complacency ends its summer vacation, the renewed destruction of paper currencies will further erode investors’ confidence. Gold, the real money, historically proven money, will return into favor as massive amount of paper money will be exchanged for gold and silver investments. The process is likely to be as vicious as the recent correction has been. Most markets should continue to exert tremendous volatility going forward with precious metals not immune to such extreme moves. If you have investment money on the sidelines the current depressed precious market sector offers great opportunities. If you are fully invested, patience should be rewarding and I believe that the opportunity to reposition your investment capital into lower risk and higher potential opportunities is the upside to this pullback. All investors interested in Timberline Resources, Gold Resource Corp. or Timmins Gold are urged to perform their own due diligence, to discuss this with a financial advisor, and to not simply go on my opinion alone. I do believe your research and conclusions will concur with mine. I have made these companies my largest investments for the coming 12-24 months and expect them to lead the mining investment pack higher. Please note that all three companies mentioned are paying sponsors on websites that I am a proprietor of and that I am positively biased. To keep regularly updated on these and other investment opportunities, please subscribe to the GoldForecaster.com. If you would like to receive further public reports in your email, please sign-up here: http://www.goldseek.com/email/ I would also like to thank all our readers for their interest in GoldSeek.com which has continued to exceed record traffic levels nearly every month and is nearing 200,000 monthly global unique visitors! The GoldSeek.com team looks forward to providing you with continuous updates during the evolution of the precious metals secular bull market including new features that will be released in the coming months. Peter Spina, GoldSeek.com August, 2008 Further research & information: Timberline Resources Corp. Website: http://www.timberline-resources.com Report: http://news.goldseek.com/PeterSpina/1173970800.php Contact: John Swallow, Chairman 208.664.4859 Gold Resource Corp. Website: http://www.goldresourcecorp.com Report: http://news.goldseek.com/PeterSpina/1195488180.php Contact: Jason Reid, VP / Corporate Development 303-320-7708 Timmins Gold Corp. Website: http://www.timminsgold.com Contacts: Bruce Bragagnolo, LLB. Chief Executive Officer (604) 638-8980 Investor Relations Leighton Bocking Corporate Development (604) 638-8977 Email: leighton@timminsgold.com Timmins Gold Corp. - Investor Relations Alex Tsakumis Corporate Development (604) 638-8976 Email: alex@timminsgold.com Peter Spina's Free E-Mail List: www.GoldSeek.com/email Latest Gold Price & Investor Information: www.GoldSeek.com

Latest Silver Price & Investor Information: www.SilverSeek.com Additional Research & Reports:

www.goldforecaster.com

www.silverforecaster.com Disclaimer & Additional Disclosure

The owner, editor, writer and publisher and their associates are not responsible for errors or omissions. The author of this report is not a registered financial advisor. The author has received a compensation fee for research, publishing, distribution along with the marketing services provided on the author's website, www.goldseek.com. Readers should not view this material as offering investment related advice. Authors have taken precautions to ensure accuracy of information provided. Information collected and presented are from what is perceived as reliable sources, but since the information source(s) are beyond our control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The information presented in stock reports are not a specific buy or sell recommendation and is presented solely for informational purposes only. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market. Nothing contained herein constitutes a representation by the publisher, nor a solicitation for the purchase or sale of securities & therefore information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. Investors are advised to obtain the advice of a qualified financial & investment advisor before entering any financial transaction. GoldSeek.com is a leader in precious metals information, established in 1995 and ranked as one of the most visited gold resource website in the world. More information can be found at www.GoldSeek.com and the author may be contacted via: http://www.goldseek.com/contact.php

-- Posted Tuesday, 19 August 2008 | Digg This Article | Source: GoldSeek.com | Source: GoldSeek.com

Sign-Up for Free E-mail list: Peter Spina

Peter Spina's experience with the precious metal markets started back in the mid-1990s, which led to the creation of GoldSeek.com back in 1995. Today GoldSeek.com ranks in the top three most popular global gold websites and its sister site, SilverSeek.com ranks as the most visited silver website in the world. Back at the start of the new secular precious metals bull market, Peter established the technically-focused subscription newsletter, Gold Seeker Report, which at the start of 2005 was merged into the more comprehensive Gold Forecaster (goldforecaster.com) service. In addition to the newsletter and websites, Peter frequently appears in the media including MarketWatch, Reuters, and theStreet.com

Previous Articles by Peter Spina, GoldSeek.com

|