-- Published: Monday, 24 November 2014 | Print | Disqus

If the answer to that question is no, we have a solution for your investment woes. Not many investors can handle the stress that comes with losing nearly half of their retirement funds and being forced to wait seven years to break even—only to lose another 40 percent a couple of years later.

But that’s precisely what some investors went through when they entered the market in 2000, following the booming 1990s, when the average annualized return for the S&P 500 Index was 18.5 percent.

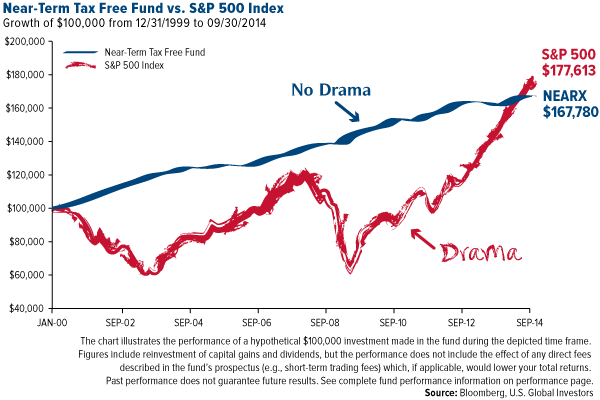

Our solution for avoiding this drama is the Near-Term Tax Free Fund (NEARX), which, starting from January 1, 2000, took the S&P 500 14 years to beat. To illustrate my point, I want to share with you a hypothetical story about two investors, Robert and James.

It’s the year 2000. Two men, both of them in their mid-50s, spend an afternoon playing a round of golf. Between holes, they discuss how they’re coming along with their retirement plans.

Robert, the more aggressive of the two, describes his “failproof” plan to place $100,000 in an S&P 500 Index fund. The 1990s was a gangbusters decade, after all, and he sees no reason to believe that the upcoming decade will be any different.

James, who’s more cautious with his money, nods and says he agrees that the S&P 500 does indeed look attractive. But because he realizes that past performance is no guarantee of future results, he thinks it prudent to invest in a more secure instrument and has been considering short-term, investment grade municipal bonds.

“That’s way too conservative,” Robert says. “You’ll be sipping your meals through a straw before you can retire.”

James chuckles. “Slow and steady wins the race,” he says, driving the ball down the fairway.

“But the market’s been up, with no end in sight.”

“That’s what troubles me,” James says as they watch the golf ball sail through the air and land on the putting green.

The next day, both friends put their $100,000 down—Robert’s in an S&P 500 fund, James’s in a short-term municipal bond fund.

And they watch. And wait.

For Robert, the decade is as breathless as attending an all-night rave party—acid music thumping, neon lights twirling, bodies jumping and gyrating. Some days are fraught with exhilarating highs, soul-crushing lows and every shade of anxiety in between. He celebrates when the S&P hits 1,500, panics when it sinks almost 40 percent, breathes a sigh of relief when it inches its way back to 1,400, sheds actual tears when it freefalls another 40 percent a year later. One calamity follows another, from the dotcom bubble to 9/11 to the Great Recession. What the market gives, the market takes away.

More than a year after the end of the decade, the S&P finally rises back up to the breakeven point. Now 65, Robert’s no closer to retirement than the day he made his investment. And he has the ulcers to prove it.

James, on the other hand, doesn’t go through nearly the same amount of drama and heartache as his antacid-popping friend does. He sleeps better each night knowing that his money has been growing steadily. Like a calm, soothing adagio, his investment continues to climb, unaware of and indifferent to the schizophrenic behavior of the general equity market. Although he doubts his investment strategy from time to time and wonders if he could be receiving better returns, those thoughts tend to dissipate when he sees the craggy wrinkles on Robert’s face.

What shocks both friends the most, as they compare performance notes, is that it took close to 14 years for Robert’s initial $100,000 investment in the S&P to finally catch up to James’s $100,000 investment in U.S. Global Investors’ Near-Term Tax Free Fund (NEARX).

Take a look at the following chart. Whereas Robert went through undue stress and drama by repeatedly losing and gaining, losing and gaining, James enjoyed close to 14 consecutive years of conservative returns. Unlike Robert, he never had to worry about what he’d do if he needed the money for an unexpected event, and most important, he didn’t worry nearly as much about meeting his retirement goals or having to lower his lifestyle savings.

If Robert were given the chance to do it all over again, which do you think he’d choose? To reinvest in the equity market and suffer through the unexpected Internet bubble, 9/11 and Great Recession, constantly anticipating another crisis? Or avoid the drama as his friend James did and invest in NEARX?

How many of you reading this would choose the conservative, “boring” path if you could redo your decision?

While you’re contemplating and reflecting on that question, make sure to check out NEARX, which has delivered close to a decade and a half of positive total returns. The fund has recently received the coveted 5-star overall rating from Morningstar, among 164 Municipal National Short-Term funds as of 10/31/2014, based on risk-adjusted return. Although you shouldn’t reasonably expect the fund to keep pace with the S&P 500 over the next 10, 15 and 20 years, NEARX has historically shown a greater likelihood of dodging the dramatic swings the equity market has often experienced in times of uncommonly high volatility, such as we saw in the first decade of the century.

What this comes down to, then, is a question of risk/reward tradeoff. How much risk, not to mention stress and anxiety, are you willing to assume in order to capture reward? If the answer is “not much,” then NEARX might be the solution.

Also, remember to diversify your asset allocation. One simple strategy to consider is to allocate 50 percent of your portfolio in equities, the other 50 percent in NEARX.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

5 Stars: Overall/164

5 Stars: 3-Year/164

5 Stars: 5-Years/137

4 Stars: 10-Years/103

Morningstar ratings based on risk-adjusted return and number of funds

Category: Municipal National Short-Term Funds

Through: 10/31/2014

Total Annualized Returns as of 9/30/2014

Fund | One-Year | Five-Year | Ten-Year | Gross Expense Ratio | Expense Ratio After Waivers |

Near-Term Tax Free Fund | 3.26% | 2.59% | 2.97% | 1.21% | 0.45% |

S&P 500 Index | 19.72% | 15.68% | 8.10% | n/a | n/a |

Expense ratio as stated in the most recent prospectus. The expense ratio after waivers is a contractual limit through December 31, 2014, for the Near-Term Tax Free Fund, on total fund operating expenses (exclusive of acquired fund fees and expenses, extraordinary expenses, taxes, brokerage commissions and interest). After December 31, 2014, this arrangement will become a voluntary limitation that may be changed or terminated by U.S. Global Investors at any time, which may lower the fund’s yield or return. Performance data quoted above is historical. Past performance is no guarantee of future results. Results reflect the reinvestment of dividends and other earnings. For a portion of periods, the fund had expense limitations, without which returns would have been lower. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance does not include the effect of any direct fees described in the fund’s prospectus which, if applicable, would lower your total returns. Performance quoted for periods of one year or less is cumulative and not annualized. Obtain performance data current to the most recent month-end at www.usfunds.com or 1-800-US-FUNDS.

Bond funds are subject to interest-rate risk; their value declines as interest rates rise. Though the Near-Term Tax Free Fund seeks minimal fluctuations in share price, it is subject to the risk that the credit quality of a portfolio holding could decline, as well as risk related to changes in the economic conditions of a state, region or issuer. These risks could cause the fund’s share price to decline. Tax-exempt income is federal income tax free. A portion of this income may be subject to state and local taxes and at times the alternative minimum tax. The Near-Term Tax Free Fund may invest up to 20% of its assets in securities that pay taxable interest. Income or fund distributions attributable to capital gains are usually subject to both state and federal income taxes.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

Morningstar Ratings are based on risk-adjusted return. The Morningstar Rating for a fund is derived from a weighted-average of the performance figures associated with its three-, five- and ten-year Morningstar Rating metrics. Past performance does not guarantee future results. For each fund with at least a three-year history, Morningstar calculates a Morningstar Rating based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund’s monthly performance (including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. (Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages.)

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Diversification does not protect an investor from market risks and does not assure a profit.

| Digg This Article

-- Published: Monday, 24 November 2014 | E-Mail | Print | Source: GoldSeek.com