-- Published: Thursday, 3 August 2017 | Print | Disqus

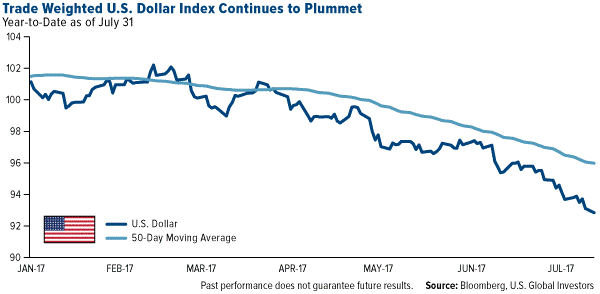

Spot gold finished July up more than 2 percent, its best month since February, when it returned 3.7 percent. The yellow metal responded to a struggling U.S. dollar, which has lost more than 10 percent so far this year relative to other currencies and is currently at a 15-month low. The dollar could very well continue to slide on additional political uncertainty surrounding President Donald Trump and his administration. This would mean further upside for gold and gold stocks.

Also contributing to gold’s price appreciation was lackluster economic data that, I believe, lowers the likelihood of another interest rate hike in 2017.

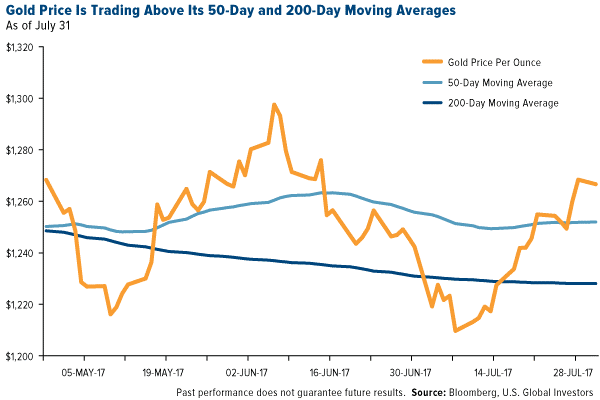

The yellow metal is now trading above its 50-day and 200-day moving averages, ordinarily seen as a bullish sign.

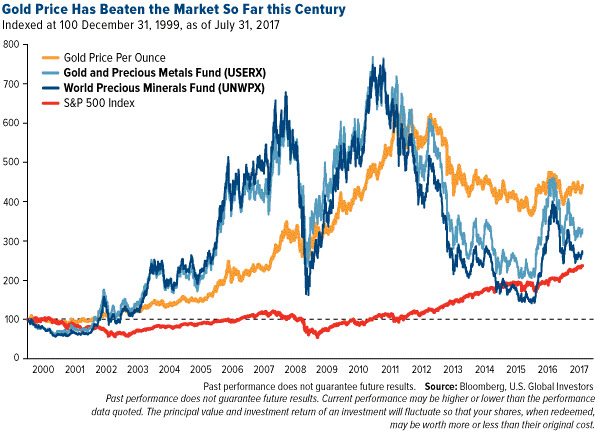

More impressively, the price of gold has outperformed the S&P 500 Index so far this century, returning 86 percent more than the market if we index both asset classes at 100 on December 31, 1999. Over the past 17 years, the S&P 500 has undergone two major contractions, both of them resulting in a loss of around 40 percent. Gold, meanwhile, has held its value well, boosting its appeal as a portfolio diversifier.

Our two gold funds have similarly outperformed the market so far this century, as you can see above. The Gold and Precious Metals Fund (USERX) and World Precious Minerals Fund (UNWPX) are co-managed by myself and precious metals expert Ralph Aldis. Not only do Ralph and I rely on fundamentals to make stock selection and weighting decisions, but we also maintain close, productive relationships with mining company management teams across the globe.

Gold Could Be the Solution for a Vulnerable Stock Market

In a telephone interview with Reuters this week, DoubleLine Capital CEO Jeffrey Gundlach, known on Wall Street as the “bond king,” said that he still has exposure to gold, which he predicts will see continued upward price momentum in the short term.

“Gold looks cheap compared to markets that have rallied a lot, including bitcoin and including Amazon,” said Gundlach, whose firm oversees $110 billion in assets.

Indeed, information technology stocks such as Amazon, Facebook, Apple, Microsoft, Google (Alphabet) and others—the imprecisely named FANG or FAAMG stocks—have been on a tear so far this year, propelling the market higher. This has been a detractor for gold, as many investors have moved out of “safe haven” assets and into risk assets.

I should point out, though, that the stocks I just mentioned disproportionately account for up to a third of the market’s gains in 2017, according to CNBC. As of August 1, the S&P 500 is up around 10.5 percent. But if we remove tech stocks, it’s up only 7.5 percent. The market is moving higher nearly every day, but on the backs of only five or so tech stocks. This makes the market particularly vulnerable, should those stocks see a correction, and adds to gold’s investment case as a potential store of value.

What’s more, we’re only weeks away from India’s two most prolific gold-buying sprees, Diwali in October and the wedding season late in the year. Historically, now has been a good time for investors to enter the gold and precious metals market to capture the potential price appreciation that has often occurred during these important festivals.

Explore investment opportunities in gold and precious metals!

Gold and Precious Metals Fund

World Precious Minerals Fund

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Past performance does not guarantee future results.

Total Annualized Returns as of 6/30/2017:

Fund | One-Year | Five-Year | Ten-Year | Gross Expense Ratio |

Gold and Precious Metals Fund | -20.33% | -7.46% | -2.30% | 1.86% |

World Precious Minerals Fund | -19.09% | -8.55 | -5.98% | 2.10% |

S&P 500 Index | 17.90% | 14.63% | 7.18% | n/a |

Expense ratios as stated in the most recent prospectus. The Adviser of the World Precious Minerals Fund has voluntarily limited total fund operating expenses (exclusive of acquired fund fees and expenses of 0.11%, extraordinary expenses, taxes, brokerage commissions and interest, and advisory fee performance adjustments) to not exceed 1.90%. With the voluntary expense waiver amount of 0.04%, total annual expenses after reimbursement were 1.95%. U.S. Global Investors, Inc. can modify or terminate the voluntary limit at any time, which may lower a fund’s yield or return. Performance data quoted above is historical. Past performance is no guarantee of future results. Results reflect the reinvestment of dividends and other earnings. For a portion of periods, the fund had expense limitations, without which returns would have been lower. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance does not include the effect of any direct fees described in the fund’s prospectus which, if applicable, would lower your total returns. Performance quoted for periods of one year or less is cumulative and not annualized. Obtain performance data current to the most recent month-end at www.usfunds.com or 1-800-US-FUNDS.

Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar.

You cannot invest directly in an index.

Diversification does not protect an investor from market risks and does not assure a profit.

Fund portfolios are actively managed, and holdings may change daily. Holdings are reported as of the most recent quarter-end. Holdings in the Gold and Precious Metals Fund and World Precious Minerals Fund as a percentage of net assets as of 6/30/2017: Amazon.com Inc. 0.00%, Facebook Inc. 0.00%, Apple Inc. 0.00%, Microsoft Corp. 0.00%, Alphabet Inc. 0.00%.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

| Digg This Article

-- Published: Thursday, 3 August 2017 | E-Mail | Print | Source: GoldSeek.com