-- Published: Monday, 14 January 2019 | Print | Disqus

Strengths

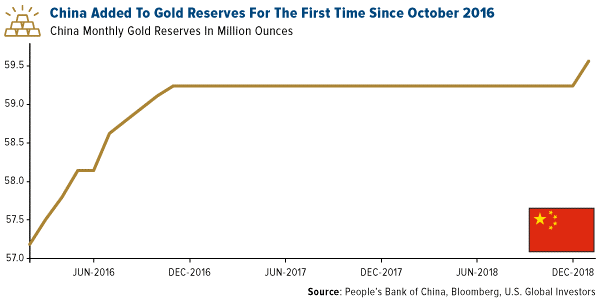

- The best performing metal this week was palladium, up 1.71 percent, and now the most expensive precious metal. Gold, meanwhile, is set for its fourth weekly gain, marking its longest rally since October. Traders surveyed by Bloomberg are bullish on the yellow metal for a ninth straight week. In December, China added to its gold reserves for the first time since October 2016, according to the People’s Bank of China. Reserves now total 59.56 million ounces, or $76.331 billion. China – the world’s top producer of gold – adding to its reserves is a bullish sign for the precious metal.

- ETFs backed by gold saw 10 straight days of inflows, adding 37,174 troy ounces on Thursday alone. This year’s net purchases so far are 762,975 troy ounces, according to data compiled by Bloomberg. The price of gold finished 110 rupees higher on Wednesday due to increased wedding season buying by jewelers to meet seasonal demand.

- Ascot Resources announced this week that it will be acquiring IDM Mining to create a gold development and exploration company. The merger will consolidate Ascot’s Premiere Gold project and IDM’s Red Mountain project in northwestern British Colombia’s Golden Triangle. Tanzanian President John Magufuli directed its central bank to buy some of the nation’s gold produced for its reserves saying that “we should get to a point where we are reserving our gold, because gold is similar to money.”

Weaknesses

· The worst performing metal this week was silver, down 0.64 percent on no particular news but it is noteworthy that ETFs that invest physical silver, unlike gold, have seen their holdings drop. According to Bloomberg data, investments in ETFs that focus on commodities fell by 66 percent this week. However, gold ETFs still saw positive inflows, with the iShares Gold Trust seeing a big inflow of $175 million. Gold imports in India have dropped 23 percent in December, with imports totaling 762 tons in 2018, versus 951 tons the year prior. High domestic prices for gold have deterred buyers in the world’s second largest consuming country, as the falling rupee makes it more expensive to purchase the yellow metal.

· BullionVault’s gold index, measuring the number of buyers against sellers, fell to 51.8 in December, the lowest reading since August 2017, reports Bloomberg. However, any reading above 50 indicates that there are more buyers than sellers in the market. The Perth Mint reported that gold coin and minted bar sales dropped to a six-month low in December to just 29,186 ounces sold. Annual gold sales were still up 9 percent year-over-year.

· The core consumer price index, measuring inflation, rose 2.2 percent from a year earlier for a second month and increased 0.2 percent from November, reports Bloomberg. Fed Vice Chairman Richard Clarida said in a speech this week that “inflation has surprised to the downside recently” and that it is unclear if inflation has moved back to the central bank’s target. U.S. Mint data showed this week that U.S. gold coin sales were down in December to the lowest level in three years.

Opportunities

· BlackRock Inc. portfolio manager Russ Koesterich is bullish on gold and said in an interview this week that “we’re constructive on gold”, as the group has been raising bullion holdings since the third quarter of last year through ETFs. He continued to say that “we think it’s going to be a valuable portfolio hedge” and “what we see value in right now is gold’s value as a diversifier.”

· Goldman Sachs continues to be bullish on commodities in 2019 even as oil prices fell in the fourth quarter and led to a selloff. Bloomberg reports that the bank has also raised its 12-month price forecast for gold to $1,425 an ounce, up from $1,350. Analysts including Jeff Currie wrote in a note this week that “a mid-cycle pause is a buy signal for commodities.”

· Palladium finished 2018 strong and UBS analysts continue to be bullish on the most expensive precious metal. Palladium forwards eased more than 700 basis points since Monday, which might provide a buying opportunity, however both Jaguar and Ford announced layoffs this week indicating some weakness in the sector. UBS writes that palladium is in a multi-year deficit with demand growing and supply remaining contained. Joni Teves says that “the long-trend upward journey is intact” for palladium prices.

Threats

· Bloomberg writes that bond demand is falling drastically. The bid-to-cover ratio is at its lowest point since 2009 and that of the $2.4 trillion of notes and bonds the Treasury issued last year, investors submitted bids for just 2.6 times that amount, according to Bloomberg data. Torsten Slok, chief international economist at Deutsche Bank, writes that “all fiscal crises begin with a declining bid-to-cover ratio.”

· Due to the ongoing trade war with China and U.S. government shutdown, economists surveyed by Bloomberg put the risk of a U.S. recession at the highest in more than six years. The survey this week showed a median 25 percent chance of a slump in the next 12 months, which is up from 20 percent in last month’s survey.

· President of the Federal Reserve Bank of St. Louis, James Bullard, said he is concerned that more interest rate increases could push the economy into a recession, writes Bloomberg’s Brendan Murray. Bullard said in an interview with the Wall Street Journal that the Fed is “bordering on going too far and possibly tipping the economy into recession.”

| Digg This Article

-- Published: Monday, 14 January 2019 | E-Mail | Print | Source: GoldSeek.com