-- Published: Monday, 25 February 2019 | Print | Disqus

SWOT Analysis: Will Hedge Funds Ramp Up Their Bullish Gold Bets?

Strengths

- The best performing metal this week was palladium, up 4.74 percent with platinum on its heels up 4.32 percent with the South African mining industry warning of a week-long strike threat. Gold makes a second consecutive weekly gain. Futures of the yellow metal rose as much as 1.6 percent on Tuesday to the highest for a most-active contract since April, writes Bloomberg. Earlier in the week, gold posted its biggest decline in three months after Fed minutes were released, then recovered on news of positive trade talks between the U.S. and China.

- Swiss gold exports rose 29 percent in January to 65.2 tons, up from 50.6 tons in December. Russia increased its official gold holdings to 68.1 million troy ounces, valued at $89.5 billion at the end of January, versus $86.9 billion at the end of December. Kazakhstan also boosted its gold holdings last month to 11.36 million ounces, up from 11.27 million in December. Turkey, however, saw its holdings decline. Its central bank gold reserves slipped slightly by $20 million from the previous week.

- Peru shut down the country’s largest illegal mining zone after years of unregulated mining destroying the surrounding environment. Bloomberg reports that the government sent 1,500 employees to shut down the La Pampa operation in southeast Peru. Illegal mining has long been an issue in the nation, accounting for 7.1 percent of gold output.

Weaknesses

· The worst performing metal this week was gold, which was still up 0.51 percent. After the Fed released minutes of its January meeting, gold fell from a 10-month high on Wednesday. The minutes called into question expectations that the central bank will hold off on rate hikes, which is historically positive for the yellow metal. Fortunately, gold recouped that loss later in the week. Scotiabank analyst Trevor Turnbull wrote that New Gold has “no good options” in the near-term until its Rainy River mine shows some strength. Turnbull said that a potential sale of its operating assets or equity raise wouldn’t be an option for the company at this time. New Gold has seen recent turbulence with the stock falling 26 percent on February 14 after reporting fourth quarter results and its 2019 outlook.

· AngloGold Ashanti Ltd. will be making a decision on its Mponeng mine, the world’s deepest, on whether or not to spend significant capital to extend its life beyond eight years. The number three gold miner rose as much as 10 percent in New York on the news of potentially shutting a higher cost mine. If investors checked AngloGold’s website to value the underlying assets which support the company’s share price, they would be sorely disappointed by lack of disclosure the company provides about its assets. There is no Resource/Reserve Statement prominently displayed and when an investor examines the individual summary of each mine, AngloGold just mentions the number of ounces it thinks there is remaining at the mine. There is no detail on ore tonnage and grades which factor into the risks associated with a mine.

· Just months after the mega merger of Barrick and Randgold was confirmed, Barrick is said to be looking again at a possibility of taking over Newmont, which just announced its own huge deal with Goldcorp. According to sources familiar with the matter, Barrick has looked on and off at the feasibility of an offer for Newmont for some time, including in recent months, writes Bloomberg. Could the gold industry need to “cool off” for some time after two giant mergers? Or is Barrick simply expressing jealousy of Newmont’s deal which places it as the largest gold miner, leapfrogging Barrick? Mergers aren’t easy and perhaps Barrick should think twice about a ménage à trois relationship with Newmont.

Opportunities

· Gold might be getting more recognition from mainstream investors. Bernstein Quants have joined the mix of gold bulls, as miners have gained almost twice the pace of bullion so far this year. Bloomberg writes that Bernstein strategists led by Inigo Fraser Jenkins are seeing a laundry list of reasons to like gold and gold miners just now. Gold’s mysterious rally could be due to liquidity, writes Bloomberg’s Kyoungwha Kim. “Expectations of improving liquidity may be fueling gold’s rally once again.” Mark Cudmore noted that ballooning balance sheets at major central banks could have already foretold what is going to happen to bullion next.

· The price of palladium hit a record high on Wednesday after surging 1.7 percent to $1,505.46 an ounce – breaking above the key $1,500 level. Rules requiring stricter car emissions have tightened global demand for the metal as palladium is a key component for car manufacturers in the new technology. According to Johnson Matthey Plc, a key maker of auto catalysts, the global palladium deficient is set to “widen dramatically” this year. The world’s only “pure-play” for palladium, North American Palladium Ltd., has been the biggest beneficiary, crossing above the C$1 billion mark for the first time in eight years this week.

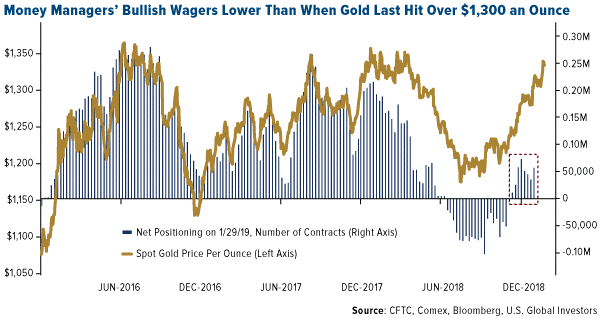

· Bloomberg’s Eddie van der Walt writes that the gold rally could have further to go if hedge fund managers ramp up their bullish bets after last year’s big short. The chart below shows that money managers remain only modestly allocated to the metal, according to futures positions. “Reluctance lingers, and the risk is that with many market participants waiting to buy dips, there could be a lot of catching up to do if positive catalysts extend,” writes Joni Teves, strategist at UBS Group.

Threats

· In a note to investors this week, Morgan Stanley’s Macro Strategy Group lifted its September recommendation to be long gold, despite expectations of a weaker U.S. dollar and lower real interest rates in 2019. The research group bases its decision on two factors. One, because the price of gold has risen “materially” in recent months, it’s left little upside to Morgan Stanley’s earlier forecast of $1,350 an ounce by year’s end. And two, the target of $1,350 is “a price level gold has struggled to break on a sustained basis for the better part of five years.” If the precious metal manages to break above the target price, the analysts write, “We may need to revisit our view.”

· An old deal made with Nicolas Maduro’s regime in Venezuela is causing headaches for Citigroup. According to Bloomberg, the investment bank struck a $1.1 billion swaps contract backed by gold before additional U.S. sanctions were imposed on Maduro’s government, and now Citigroup bankers are holding high-level talks with the U.S. Treasury to determine if the contract can still move forward without violating sanctions. “The sale of gold is another revenue source that the Maduro regime is using, and I know for a fact that Citibank has had multiple meetings with Treasury [officials] seeking guidance, trying to figure out how to avoid exposure,” Florida senator Marco Rubio is quoted as saying.

· A gold correction could be in the cards, writes Bloomberg’s Benjamin Dow. The price of gold made some positive gains this month, even nearing its 2018 highs. However, the 10-year breakeven rate, which measures the difference between the 10-year Treasury bond and Treasury Inflation Protected Securities (TIPS), is down around the same level as in November 2016. “This disconnect,” according to Dow, “suggests the gold price may not be telling the truth.”