-- Published: Monday, 25 March 2019 | Print | Disqus

Strengths

- The best performing metal this week was platinum, up 1.85 percent on Citi recommendation and hedge funds boosting the net long position in the past week. Gold traders and analysts are bullish again this week, according to the weekly Bloomberg survey, as the Federal Reserve adopted a more dovish tone and indicated it won’t raise interest rates this year. Several countries went shopping for the yellow metal this week. Turkey’s gold reserves rose $224 million from the previous week and are now worth $20.7 billion as of March 15, according to official weekly figures from the central bank. Colombia increased holdings to 0.61 million ounces in February and are now at the highest level since 1992. Qatar’s holdings climbed to 1.31 million ounces, Ukraine’s reserves are up to 0.79 million ounces and the Kyrgz Republic’s rose to 0.38 million ounces in February. Palladium continues to shine as it topped the $1,600 per ounce level for the first time on Tuesday.

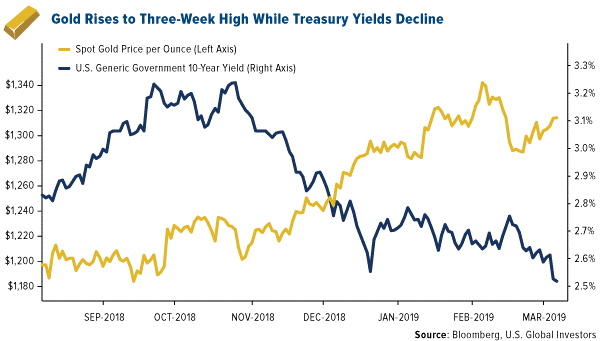

- Gold traded up to its highest level in three weeks after Fed Chairman Jerome Powell announced on Wednesday that interest rates could be on hold for “some time.” Bloomberg reports that the yield on 10-year Treasuries fell to a 14-month low of 2.52 percent and a gauge of the dollar fell the most since January. Nicky Shiels, commodity strategist at Scotiabank, says that gold will be an outperformer in the longer run during this cycle of monetary policy in which the Fed applies a prolonged pause on interest rate hikes. Investors and traders are weighing the latest U.S.-China trade developments as some familiar with the matter are concerned that China is pushing back against American demands. China may prefer to keep rebuffing President Trump, knowing he desperately needs a deal going into elections.

- Copper mining continues to gain traction in Ecuador. BHP Group has agreed to invest about $75 million for copper exploration on a deposit owned by Luminex Resources. Bloomberg reports that Luminex has already attracted interest from other miners with both Anglo American and First Quantum Minerals agreeing to back other projects it owns. Ecuador’s Deputy Mining Minister Fernando Benalcazar said this week that Lundin Gold’s Fruta del Norte gold project and Tongling Nonferrous Metal Group’s Mirador copper project will both start producing by the end of this year. These projects mark the country’s first two large-scale mining operations.

Weaknesses

· The worst performing metal this week was palladium, up just 0.04 percent as money managers cut their bullish outlook to the least bullish in the past 19 weeks. The yield spread between 3-month bills and 10-year Treasuries fell to zero this week as a surge of buying pushed long-end rates sharply lower, writes Bloomberg. This is the first time this section of the Treasury yield curve has turned negative since 2007 and is a closely watched recession gauge. Kathy Jones, chief fixed-income strategist at Charles Schwab, said that “it’s clearly a sign that the market is worried about growth and moving into Treasuries from riskier asset classes.”

· St. Barbara shares plunged more than 30 percent on Friday after it downgraded production guidance for its flagship Gwalia mine in Western Australia, reports the Australian Financial Review. CEO Bob Vassie says that the company is working on a list of merger and acquisition opportunities and isn’t put off by the big plunge in company shares. Vassie also said that the production disruption is simply short-term pain for long-term gain. St. Barbara had been considering a hydraulic lifting system to get ore to the surface faster than current trucking system. It was a smart decision to not risks the capital on this new ore moving system as there are more attractive uses of capital identified.

· Franco-Nevada stock fall as much as 5 percent after reporting revenue and earning miss this week. Short-interest ratio in shares of the company rose 333 percent, according to Toronto stock exchange data leading up to the miss. Bloomberg reports that the number of days needed to close all short positions in Franco-Nevada increased to 9.1 on March 15 from 2.1 on February 28.

Opportunities

· One of last year’s best-performing hedge funds, the Global Macro Fund by Crescat Capital, says the “trade of the century” is to buy gold and sell stocks as risk assets are due for another meltdown, writes Bloomberg’s Sarah Ponczek. According to the firm, it’s only a matter of time before bearish bets pay off as indicators are warning that a recession is imminent in the coming quarters. Crescat says that corporate insiders are currently selling stocks hand over first, which indicates a potential stock bubble burst. Two gold miners are buying back their shares – a sign of responsible management. Roxgold announced that it recently purchased for cancellation a total of 4,949,000 common shares at an average price of C$0.84 per share. Golden Star Resources said on Monday that it will buy back up to 5.4 million common shares, or 5 percent of issued and outstanding shares.

· Citigroup is bullish on platinum because its sister metal, palladium, continues to surge. Although platinum’s volatility surged to a six-month high, the bank believes the investment case for the metal is strong. It thinks substitution will eventually occur, which would raise demand and tighten supply further. Analysts including Max Layton wrote in a March 19 report that “platinum currently appears to embed an in-the-money call option on palladium.”

· Wheaton Precious Metals rose 4.3 percent on Thursday after it reported higher profits and higher sales than estimated, reports Bloomberg. National Bank of Canada writes that Wheaton is primed for future growth due to stronger than anticipated production at several of its mines. Bloomberg Intelligence highlighted this week that silver complacency is as low as it gets with lowest-for-longest implied volatility since 1993. Mike McGlone writes that “when commodities reach such extremes, up is typically the path of least resistance.” Silver could also see a boost from steady solar demand out of the European Union, which may need about 100 gigawatts of new photovoltaic power capacity by 2030, according to National Energy and Climate Plans from the bloc’s members.

Threats

· South Africa continues to experience rolling blackouts that pose big risks for the mining industry. In an effort to avoid a total grid collapse, state-run Eskom has implemented rotating blackouts and is working to assess the breakdowns across the grid. Bloomberg reports that many of Eskom’s coal-fired plants are old and unplanned breakdowns have increased. The company is also spending massive unplanned amounts on diesel to run turbines. Miners in the nation risk sending workers underground when the electricity supply is unstable.

· Bloomberg reports that Citigroup has settled a Venezuela gold swap transaction. The bank plans to sell the gold it received as collateral while also depositing about $260 million into a U.S. account that was previously controlled by President Maduro’s central bank. This is negative for the yellow metal, as distressed central bank selling usually hurts the gold price.

· Although palladium continues to be one of the hottest metals, some believe the rally will end soon. Georgette Boele, co-coordinator of FX and precious metals strategy at ABN Amro Bank, says that palladium “is the most overrated precious metal” and that the shortage is more than reflected in its price. Palladium prices rose as auto catalyst manufactures scrambled to get their hands on the metal to meet tightening emission controls. However, passenger car sales fell 17 percent last month and could signal weakening demand for the metal, writes Bloomberg’s Rupert Rowling.

| Digg This Article

-- Published: Monday, 25 March 2019 | E-Mail | Print | Source: GoldSeek.com