-- Published: Tuesday, 9 April 2019 | Print | Disqus

Strengths

- The best performing metal this week was platinum, up 6.07 percent. Platinum is set for its biggest weekly advance in two years, as its wide discount to sister metal palladium creates interest for the metal. Bloomberg writes that traders are also weighing the potential for labor disruptions in South Africa, the world’s largest producer of the metal. Platinum fell 14 percent in 2018, but is starting to see a rebound this year. Gold traders switch to being neutral on the yellow metal this week after being bullish for three previous weeks, according to the weekly Bloomberg survey. The Perth Mint reports that gold coin and bars sales rose to 32,757 ounces in March, which is up from 19,524 ounces in February. BullionVault’s gold index measuring the balance of buyers against sellers rose to 54.5 in March, up from 52.2 in February, indicating that there are more buyers on the market for gold.

- Gold held steady this week, down just 0.02 percent, as investors await the outcome of the latest round of trade talks between the U.S. and China and as negative economic data was released. The World Trade Organization cut its global trade growth projection for 2019 and orders placed with U.S. factories for business equipment fell in February for the third time in four months, reports Bloomberg.

- Retail investors are also taking notice of platinum. U.S. Mint data shows that first quarter sales of platinum coins surpassed the amount sold in all of 2018. Prices for the metal have climbed more than 13 percent so far this year.

Weaknesses

· The worst performing metal this week was palladium, down just 1.02 percent, as hedge funds cut bullish positioning to a 5-month low. Turkey’s gold reserves fell $154 million from the previous week, with total reserves now worth $20.8 billion, according to central bank data in Ankara. U.S. Mint data shows that American Eagle gold coin sales fell 8 percent in March, marking two straight months of declines after reaching a two-year high in January.

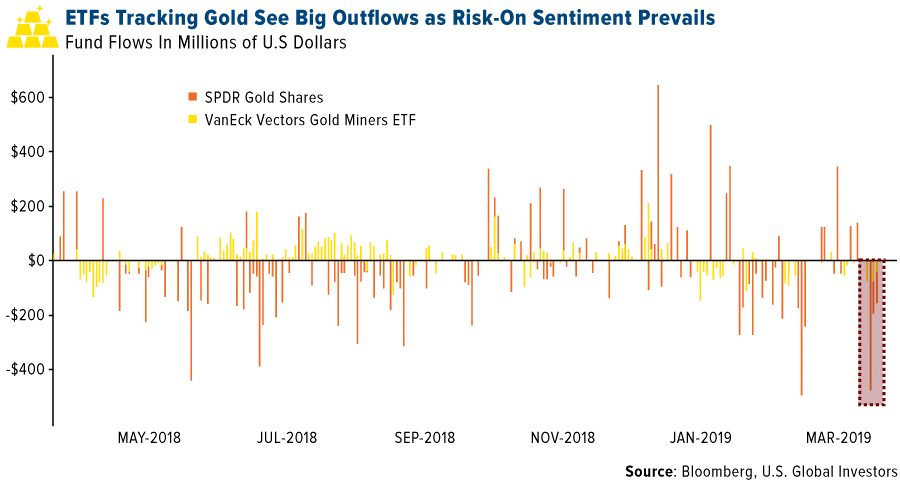

· Improving global growth and surging stocks are luring investors away from gold and into riskier assets, writes Bloomberg’s Vildana Hajric. Outflows from U.S.-listed commodity ETFs totaled $1.25 billion in the week ended April 4, which is a big drop from deposits of $128 million the previous week. Precious metals ETFs saw outflows of $943 for the week. Data compiled by Bloomberg shows that ETFs cut 379,577 troy ounces of gold from their holdings on Tuesday, which is the biggest one-day decrease in at least 12 months.

· Mongolia’s central bank reported on Monday that its purchases of gold in the first quarter declined by 71.6 percent year-over-year. The decline is due to the expiration of the effective period of low royalty taxes on gold. The discount of 2.5 percent ended on January 1 and since then there has been a 5 to 10 percent royalty tax on gold miners. A bank spokesperson told Xinhua, a news agency, that “miners are less willing to sell their gold to the central bank due to this factor.”

Opportunities

· Ronald-Peter Stoeferle, managing partner at Incrementum AG, says that gold is poised to rally to $1,450 to $1,500 per ounce by year end if it breaks through the $1,360 to $1,380 per ounce resistance level. Stoeferle says that one of the drivers will be demand from pension funds, high-net worth individuals and wealth managers. Bloomberg writes that Stoeferle also cities his fund’s own inflation indicator to support his bullish gold view, which is currently showing increasing momentum. Goldman Sachs is also bullish on the yellow metals as it expects a rebound in ETF holdings to continue due to late-cycle worries and negative German 10-year real rates.

· More bullish views of platinum ahead. Bloomberg’s Rupert Rowling writes that the precious metal is set to climb above the $900 per ounce level on speculation of strikes at South Africa mines. Demand is also being driven by platinum being considered as a substitute for palladium for use in autocatalysts. Bloomberg’s Mike McGlone writes that platinum is likely in the early days of its recovery, based on the palladium versus platinum ratio.

· China’s second largest, publicly-listed gold producer, Shandong Gold, is looking to make an acquisition by the end of this year. Chairman Li Guohong said in a briefing in Shanghai that “we are more optimistic on gold prices this year than last year” and that other mergers and acquisitions in the sector are proof of bullish consensus on gold prices. Wesdome Gold Mines Ltd. rose 9.72 percent for the week after announcing that its gold production was up 6 percent year-over-year, producing 19,010 ounces. Higher grades were delivered to the mill and the company maintains a strong cash position.

Threats

· The Eastern Shore community in Nova Scotia is rallying against Atlantic Gold’s proposed open-pit gold mine in the area. The community opposes the project strongly because it could damage a river that has been heavily protected for over 40 years. The Atlantic Gold project would also only operate for six years, but impact the environment significantly for many years after.

· Senators in Italy voted in favor of a parliamentary motion calling on the government to clarify the legal status of the Bank of Italy’s gold reserves, reports Bloomberg. The motion also asks the government to obtain detailed information about the status of the central bank’s gold held abroad. It is unclear what the government is trying to do with the country’s gold. A separate motion by the opposition party that called for the repatriation of gold held abroad was rejected.

· Palladium fell this week after President Donald Trump threatened to close the border between the U.S. and Mexico. A border closing would be negative for the U.S. economy and the auto industry in particular, which is the largest consumer of palladium.

| Digg This Article

-- Published: Tuesday, 9 April 2019 | E-Mail | Print | Source: GoldSeek.com