-- Published: Monday, 15 April 2019 | Print | Disqus

Strengths

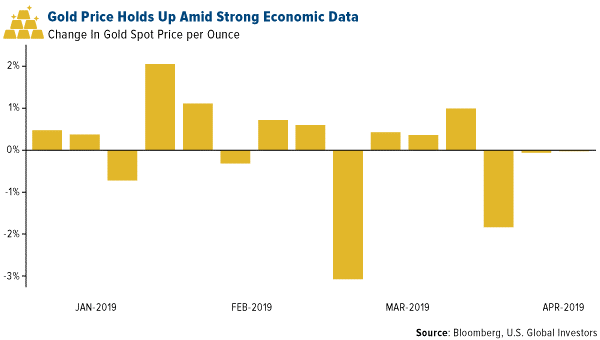

- The best performing metal this week was palladium, up 0.24 percent as hedge funds cut bullish positioning to a six-month low, perhaps resetting expectations. Gold traders turned heavily bullish this week after being neutral last week as the Federal Reserve signaled interest rates will be on hold, according to the weekly Bloomberg survey. China is on a four-month gold buying spree after raising reserves to 60.62 million ounces in March from 60.26 million ounces in February. The nation’s continued purchases of gold are boosting investor sentiment that central banks globally will keep adding to reserves. The yellow metal has held up quite well this week despite stronger-than-expected U.S. economic data trimming gains.

· The International Monetary Fund (IMF) cut its outlook for global growth to the lowest since the financial crisis, which could boost investor demand for safe haven assets. Gold rose to a near two-week high on the news.

· Google Pay is launching gold buying in India. Google has partnered with bullion refiner MMTC-PAMP India to allow users to buy and sell 99.99 percent 24 karat gold through its mobile app in the country. India is the world’s second largest consumer of gold.

Weaknesses

· The worst performing metal this week was platinum, down 1.07 percent, which is ironic as hedge funds boost their bullish positioning to a 13-month high. Commodity ETFs continue to see outflows this week. Precious metals ETFs in particular have seen big outflows with $129 million in losses this week on top of $943 million in outflows the previous week. Investors are becoming impatient with gold and are instead putting their money into the stock market, which has rallied 15 percent this year, compared with just a 1.2 percent gain for the yellow metal. Agnico Eagle CEO Sean Boyd said that global generalist investors have not returned to the gold mining space yet, but they are taking meetings, doing their homework, and likely waiting for gold to break out to the $1,360-$1,370 per ounce range before jumping in.

· Turkey’s gold reserves fell $207 million from the previous week to bring its total holdings to $20.6 billion for the week ended April 5, according to central bank data from Ankara. Bloomberg reports that money managers are fleeing the palladium market and that holdings are to the lowest since October. This is likely due to the threat of President Trump closing the U.S.-Mexico border that would hurt the auto industry, which is a top market for palladium.

· South Africa’s gold production has now fallen for a seventeenth straight month in February, which is the longest run of contractions since the financial crisis, according to data from Statistics South Africa.

Opportunities

· Oliver Allen of Capital Economics writes that the group expects the S&P 500 to drop by roughly one-fifth in 2019 and that gold will come to the fore again as a safe haven asset. The research firm forecasts gold to rally to $1,400 per ounce by the end of the year. AO Chong of CITIC Securities cites a number of risk events that should bring gradual haven demand up for gold. The analyst says the IMF cutting global economic growth outlooks, rising geopolitical uncertainty, the downward trend of real interest rates and the continued central bank gold buying should all be positive for the yellow metal.

· Anglo American Platinum CEO Chris Griffith said at a conference this week that the platinum industry cannot boost output on rising prices and that investors should expect the deficit to remain. Griffith cites unreliable and costly power supply and higher tariffs as the main threats to South Africa’s mining industry, which is a substantial producer of the precious metal. Johann Wiebe, an analyst at GFMS, said in a phone interview this week that silver is seen averaging $16.75 per ounce this year, up from $15.71 per ounce last year.

· Successful investing may require you to think outside the box. As investors have learned, the market tends to do that one thing that disappoints the most investors. When it comes to gold mining ETFs, two products have dominated the space: the VanEck Vectors Gold Miners ETF and the VanEck Vectors Junior Gold Miners ETF with $9.95 billion and $3.83 billion, respectively, in assets. The problem is that now investors have anchored their money to passively managed ETFs that have no view on what is going to happen with regard to consolidation in the sector. If one company gets taken over by another, investors will likely own more of the buyer than the takeout candidate, as a natural function of company size. This could mean the delivery of suboptimal performance. In the gold mining sector, there are a number of mutual funds that have significantly outperformed the two gorillas in the room, despite their higher expense ratios. And in referring to these two ETFs as gorillas, let that not be mistaken for disrespect; there are no actively managed gold mining mutual funds that come close to the size of these two behemoths. There in is the problem, “If everyone is thinking alike, then somebody isn't thinking,” -- George S. Patton

Threats

· Marko Kolanovic, global head of macro quantitative and derivatives research at JPMorgan Chase & Co., says that a negative feedback loop between volatility and liquidity is the reason for topsy-turvy markets. “As volatility rises, market depth declines exponentially, exacerbating price moves,” he said. This can make markets more vulnerable to price spikes. For concentrated bets where everybody owns the same group of stocks this can be a problem.

· Bloomberg writes that quant strategies for picking stocks have misfired as the market rally has driven up the cost of safety. Factors such as investing based on share attributes like profitability and market capitalization are behaving in similar ways but these are vastly different factors. “The market isn’t going up because of cyclical reasons, the market is going up because there’s no alternative in bonds. We’re in a mechanical bull market, not a growth bull market,” said Lode Devlaminck, managing director of global equities at DuPont Capital Management.

· Goldman Sachs strategists led by David Kostin explored what the world would look like without stock buybacks, as the political scrutiny of the practice grows. Federal Reserve data shows that net buybacks averaged $420 billion annually since 2010, while demand from households, mutual funds, pension funds and foreign investors was less than $10 billion for each category. “Repurchases have consistently been the largest source of U.S. equity demand. Without company buybacks, demand for shares would fall dramatically,” the strategists wrote in a note.

| Digg This Article

-- Published: Monday, 15 April 2019 | E-Mail | Print | Source: GoldSeek.com