-- Published: Monday, 29 April 2019 | Print | Disqus

Strengths

· The best performing precious metal for the week was palladium, up 2.79 percent as hedge funds boosted their net bullish positions. Despite U.S. dollar strength, gold traders and analysts returned to their majority bullish position on the yellow metal this week, according to the weekly Bloomberg survey. The U.S. currency kept pressure on gold up until Canada’s central bank decided to remove a bias to higher interest rates. This pushed long-term debt yields lower than short-term, explains Bloomberg, which is seen by some economists as a sign of a looming recession, potentially good for gold.

· On Friday, some of the underlying numbers in the U.S. GDP report came in weaker-than-expected. This, along with a drop in the dollar, pushed gold toward its biggest advance in more than a month. It extended its one-week high too, as investors assessed corporate earnings.

· The Romanian Parliament has approved the return of gold reserves from the U.K., reports Bloomberg. Lawmakers in the country voted 165 to 90 to approve a law forcing the central bank to bring back Romania’s gold reserves from the Bank of England (BOE), according to Deputy Speaker Florin Iordache.

Weaknesses

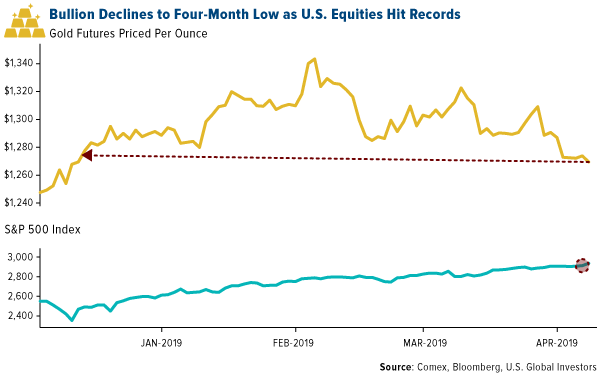

· The worst performing precious metal for the week was platinum, down 0.45 percent as hedge funds cut their new bullish position from the prior week. Demand for bullion as a haven asset has been wavering, reports Bloomberg, as better-than-expected earnings bolster equities and the dollar strengthens. On Tuesday, the yellow metal fell to a 2019 low as U.S. equities climbed to record highs. Other factors hurting haven demand for gold include prospects for a U.S.-China trade deal, Bloomberg continues, along with outflows from exchange-traded funds (ETFs).

· Turkey’s central bank saw its gold reserves fall $473 million from the previous week, according to official weekly figures from the central bank in Ankara. The bank’s gold holdings as of April 19 were $20.4 billion, dropping 20 percent year-over-year.

· When deposits of precious metal form in the earth, geologists often speak of the changes taking place over hundreds of millions of years. Investors in Guyana Goldfields experienced geologic time at a significantly faster pace this spring, writes the National Post. The company previously sat on nearly 4 million ounces of contained gold at its Aurora mine, but by the end of the day that number had fallen by around 1.5 million ounces. “The gold was never there – the new resource model has shown us that,” Scott Caldwell, chief executive and director, told the Financial Post this week.

Opportunities

· Investors who are striving to optimize their portfolios should consider taking cues from the world’s central banks, writes the Financial Express. “Informed money,” such as these banks, is the cash invested by those who have a better understanding of the market, or with access to information channels that a regular investor does not. Furthermore, Bloomberg writes that official sector gold purchases could reach 700 tons this year, “assuming the China trend continues apace and Russia at least matches its 2018 volumes.” India’s central bank is likely to join its counterparts, as the Reserve Bank of Index (RBI) may purchase 1.5 million ounces in 2019, according to Howie Lee, an economist at Oversea-Chinese Banking Corp.

· According to the World Bank, gold prices are expected to remain higher in 2019, on account of strong demand and an extended pause in interest rate hikes by the Federal Reserve. As Goldman Sachs outlines in a note this week, investors should take long positions on gold and short silver in order to benefit from the current “not too hot and not too cold macro environment.” And despite the group lowering its forecast on the yellow metal, it still remains bullish.

· Demand for safe haven assets ensures a “constant flow” of debt buyers, writes Bloomberg, with Treasuries offering positive yield amid a sea of sub-zero rates. Is gold the next safe haven in line as U.S. debt continues to pile up as it is no one else’s liability? Then there’s U.S. housing inflation, which Bloomberg says will make a substantial contribution to a projected acceleration in consumer prices by year-end. At a time when Fed policy makers are losing confidence that inflation will pick up soon, this will help jump-start it.

Threats

· During his speech to some 40 world leaders at the Belt and Road forum in Beijing this week, Chinese President Xi Jinping seemed to aim his thoughts at the U.S.—particularly Donald Trump. A large portion of his speech focused on domestic reforms, pledging to address state subsidies, and so on, writes Bloomberg—all items that the U.S. is addressing in trade talks with Beijing. “He appeared to be offering his personal approval of the concessions that China is likely to make as part of an imminent U.S.-China trade deal,” said Tom Rafferty, the Economist Intelligence Unit’s regional manager of China.

· Bloomberg Businessweek recently outlined the Venezuelan gold trading scheme with Turkey where at least $900 million in gold has been shipped before the U.S. banned anyone from doing business with its gold sales. Gold sales have been vital to Nicolas Maduro abilities to maintain the government in Venezuela and have been a major headwind to gold breaking out of its current sideways trading pattern. Although the U.S. has intensified its focus on stopping the selling of the gold, Turkey and Venezuela show no signs of ending the trade.

· A Reuters analysis found that billions of dollars’ worth of gold is being smuggled out of Africa every year, going through the United Arab Emirates (UAE) in the Middle East. In fact, according to customs data, the UAE imported $15.1 billion in gold from Africa in 2016. This is more than any other country and up from $1.3 billion in 2006, the Reuters report continues. A majority of the gold wasn’t recorded in the exports of African states, and according to trade economists interviewed by Reuters, this “indicates large amounts of gold are leaving Africa with no taxes being paid to the states that produce them.”

| Digg This Article

-- Published: Monday, 29 April 2019 | E-Mail | Print | Source: GoldSeek.com