-- Published: Monday, 6 May 2019 | Print | Disqus

Strengths

- The best performing precious metal this week was gold, after closing out the week on a strong uptick on Friday. Gold traders were split this week on the yellow metal as it headed for another down week, according to the weekly Bloomberg survey of traders and analysts. However, gold futures rose on Friday after a report showed slower-than-expected U.S. wage gains support the Federal Reserve’s patient stance on interest rate hikes.

- Russia’s central bank emerged as the biggest buyer of gold in April, purchasing 19.4 tons, according to data from the World Gold Council (WGC). China also bought 11.2 tons and Kazakhstan bought 5.4 tons. India is considering reducing the import tax on gold from the current 10 percent to 4 percent. Bloomberg reports that the proposal is being reviewed by the Central Board of Indirect Taxes and Customs.

- Turkey’s central bank turned bullish on gold this week after selling last week. The nation’s central bank reserves rose $51 million from the prior week to now be worth $20.4 billion. The bank introduced a new swap instrument that will allow it to bolster its international reserves by borrowing gold from commercial lenders in the country in exchange for lira, writes Bloomberg’s Kerim Karakaya.

Weaknesses

· The worst performing metal this week was palladium, down 6.29 percent on weak April auto sales and a Reuters survey that indicated prices are expected to fall in 2020. American Eagle gold coin sales fell for a third straight month after hitting a two-year high in January, according to U.S. Mint data. Australia’s Perth Mint also reported that gold coin and bar sales fell in April to just 19,991 ounces, down from 32,757 ounces in March. Bloomberg data shows that commodity ETFs suffered a fifth week of outflows with precious metals funds leading the decline. A program to refund tourists for value-added tax in the United Arab Emirates (UAE) has failed to reverse a slump in gold and jewelry sales. Sales saw a 6 percent year-over-year increase in the first quarter of this year, but that compares poorly to the 23 percent drop in the same period last year, according to WGC data. Reportedly, potential Indian buyers in the UAE are worried about their buying will be reported back to Indian authorities and both the UAE and Saudi Arabia are actively removing expatriates from their borders.

· Gold was on a wild ride this week after Fed Chairman Jerome Powell’s comments. The yellow metal rose sharply on Wednesday after Powell said the Fed will keep rates unchanged, but then those gains disappeared minutes later when Powell said low inflation may be transitory. Bloomberg writes that hedge funds are shorting the VIX at rates not seen in at least 15 years as they’re betting that low volatility will continue, which could be seen as complacent the rise further. It also did not help that the embattled Venezuelan leader Nicolas Maduro remained in power this week, potentially leaving the door open for more gold sales from the county.

· Macquarie Group, Australia’s largest investment bank, will be exiting its 50 employee equities research, sales and syndication business in Canada, reports Bloomberg. The Globe and Mail’s Andrew Willis writes that this retreat signals the streamlining of investment banks. Willis says “the restructuring should be a wakeup call to both small-cap Canadian companies, which traditionally look to independent dealers for capital, and the entire investment-banking community.”

Opportunities

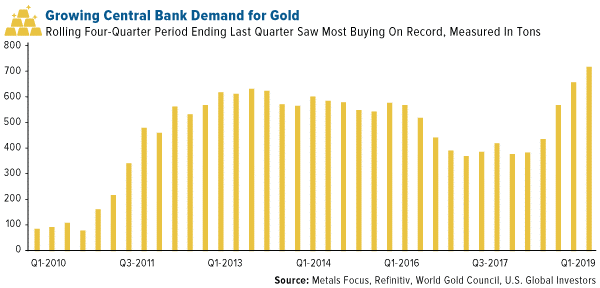

· World Gold Council data shows that central bank gold purchases were the highest in six years in the first quarter of this year with reserves rising 145.5 tons. This marks a 68 percent increase from a year earlier with Russia remaining the largest buyer. The council expects gold jewelry demand to rise only marginally in 2019 and they expect a plunge in the S&P 500 Index to spur safe haven demand later in the year boosting prices to $1,400 per ounce.

· Bloomberg’s Carl Riccadonna writes that analysts should be cautious not to write off the employment cost index (ECI) report as evidence of muted inflation pressures. The year-over-year rate of change in employment costs had the strongest start of any year of the past decade. Riccadonna says “this is a compelling signal that employers’ labor costs are increasing” and that “barring a substantial pickup in capital investment and productivity, price pressures will be passed along the supply chain.”

· Billionaire hedge fund manager Ray Dalio says that central banking as we know it is on its way out and that it is “inevitable” that something like modern monetary theory (MMT) will replace it. Bloomberg’s Ben Holland writes that MMT is the idea that governments should manage their economies through spending and taxes, instead of relying on independent central banks to do it via interest rates. Dalio writes that one of the risks of MMT is that policies could put the power to create and allocate money, credit and spending into the hands of politicians.

Threats

· According to Polymetal CEO Vitaly Nesis, the Russian gold industry is too isolated from the rest of the world to join the global merger and acquisition rush. Nesis said in an interview last week that it doesn’t make sense for Russian gold producers to merge with each other or to make acquisitions abroad.

· Sonal Desai, chief of Franklin Templeton Investments’ $150 billion fixed-income unit, warns of a rate hike later this year. A contrarian to most right now, Sonal believes that 10-year Treasury yields will climb to 3 percent or more this year. Sonal says that “markets are overestimating the Fed’s ability to anchor long-end rates – they’re also over-estimating the Fed’s fear about the underlying real economy.”

· Seven of the world’s biggest diamond miners released figures on everything from emissions to taxes in an attempt to show that man-made diamonds are creating a bigger greenhouse footprint than digging diamonds from the ground. Bloomberg’s Thomas Biesheuvel writes that “the publication of so much information from the industry highlights the growing awareness of the threat posed by diamonds made in laboratories.”

| Digg This Article

-- Published: Monday, 6 May 2019 | E-Mail | Print | Source: GoldSeek.com