-- Published: Tuesday, 19 November 2019 | Print | Disqus

A couple of weeks ago, I was in Lima, Peru, attending the Mining & Investment Latin America Summit. I heard from a number of industry leaders that mining in South America has become more challenging in recent years. One of the biggest reasons why is that the burden for taking care of local communities has, in many cases, fallen on the miners’ shoulders. Venezuela’s corrupt socialist president Nicolas Maduro continues to destabilize and finance radicalism throughout the continent using revenue from narcotics, and mining companies often end up having to pay the price.

Chilean lawmakers, for instance, are considering a new tax on mining and mineral extraction to address the country’s social unrest I described earlier.

As you can imagine, this could discourage speculation in the junior mining area. Think of it this way: What if your gambling or lottery winnings were taxed at 50 percent or higher? I suspect there would be fewer people headed to Las Vegas or buying lotto tickets.

But Latin America isn’t the only region causing uncertainty for miners. Late last month, British Columbia (BC) became the first Canadian province to pass legislation based on the United Nation’s Declaration on the Rights of Indigenous Peoples, or UNDRIP. Intended to end “discrimination and conflict” and ensure “more economic justice and fairness,” UNDRIP has some BC-based mining companies wondering if their rights to extract minerals on lands once inhabited by Native peoples could be undermined.

Bullish on Metals and Minerals

Be that as it may, I’m still extremely bullish on metals and minerals. Every year, some 140 million people are born, and each one of them will need a fresh supply of commodities for their homes, automobiles, appliances, smartphones and more. It’s been estimated that each American requires an average 38,449 pounds of various minerals every year.

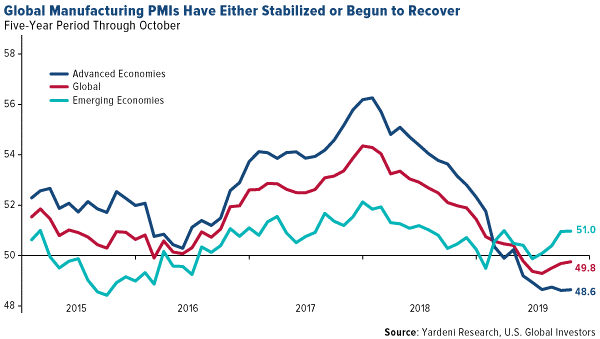

Also driving my bullishness right now is the likelihood that the global manufacturing purchasing manager’s index (PMI) looks to have either stabilized (in advanced economies) or begun to recover (in emerging economies). As I’ve explained many times before, the PMI is a leading indicator of commodities demand from factories and manufacturers.

In a research note dated November 10, Cornerstone Macro founder and economic analyst Nancy Lazar writes that the firm’s model suggests a PMI “upturn is underway, supported by lower global interest rates… and the modest improvement in China.”

A sign that reports of China’s slowdown have been overdone includes the news that sales of excavators by Chinese manufacturers hit a record high this year as hopes escalate that the government will stimulate the economy by boosting infrastructure spending.

According to Caixin Global, Chinese manufacturers sold 196,222 of the earth-moving machines, essential for large construction projects. Almost 90 percent of these excavators were purchased by domestic firms.

Investors Have a Serious Case of FOMO

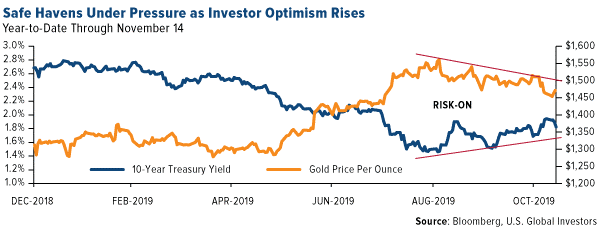

To Nancy’s point, I might also add that progress in the U.S.-China trade dispute has been constructive for commodities demand expectations, not to mention trade. This has helped spark a year-end stock rally as investors catch a case of “fear of missing out,” or FOMO.

Fund managers’ cash levels have dropped in November to their lowest since June 2013 on improved optimism. According to Bank of America Merrill Lynch’s most recent survey of managers overseeing more than $500 billion in assets, cash levels fell from 5 percent in October to only 4.2 percent this month. That’s the biggest one-month drop since Donald Trump was elected president.

Safe haven assets, including gold, U.S. Treasury bonds and the Japanese yen, have normally receded in “risk-on” environments, and this cycle has been no exception. Gold prices have fallen around 6.3 percent from their six-year highs of more than $1,565 an ounce in early September.

Consequentially, investors have been taking money out of gold-backed ETFs at a rapid pace. In the week ended November 8, as much as $620.7 million was withdrawn from SPDR Gold Shares (GLD), the world’s largest ETF backed by physical gold. That amount was the most for a single week since October 2016.

I see this decline as a healthy correction, and I urge investors to consider taking advantage of the discount. After all, we wait to buy certain items until Black Friday or Cyber Monday, when they go on sale and are more affordable. We should have the same buying habits with regard to gold and other assets.

Thinking about buying the dip in gold? Watch my interview with Kitco’s Daniela Cambone by clicking here!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission ("SEC"). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC. This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

| Digg This Article

-- Published: Tuesday, 19 November 2019 | E-Mail | Print | Source: GoldSeek.com