-- Published: Monday, 6 January 2020 | Print | Disqus

Strengths

· The top performing precious metal for 2019 was palladium, gaining 54.20 percent. In a weekly Bloomberg survey of analysts and traders, gold sentiment remained marginally bullish the first days of the New Year. The survey showed eight bullish, two bearish and seven neutral. At week-end, gold advanced toward a six-year high, climbing 1.5 percent to $1,551 an ounce in London, after a U.S. airstrike killed one of Iran’s most powerful generals, reports Bloomberg.

· Gold had a strong finish to the year, recording its biggest annual advance since 2010 as the dollar weakened, reports Bloomberg, even amid optimism on the trade front along with signs of stabilization in China’s economy. In a statement from the London Bullion Market Association, the amount of gold held in London vaults rose 2.5 percent from a month earlier to 8,228 tons in September. That’s the highest in data going back to July 2016. In related news, Hong Kong’s purchases of gold coins from China surged last month as demand for haven assets soared amid the ongoing social unrest.

· Weekly CFTC data on futures and options show that money managers have increased their bullish platinum bets by 2,655 net-long positions to 41,825, reports Bloomberg. Platinum futures also climbed as much as 1.7 percent to $1,001.40 an ounce in New York. This reached the highest for a most-active contract since February 2018.

Weaknesses

· The worst performing precious metal for 2019 was silver, gaining only 15.21 percent. Gold holdings in Turkey’s central bank continue to fall, reports Bloomberg. The holdings are now worth $25.1 billion, as of December 27, weekly figures report.

· Despite bullion’s rally, it isn’t doing much to aid in the sales of coins made from the shiny metal, reports Bloomberg. Purchases of American Eagle gold coins shrank to 2,000 ounces last month, the lowest since December 2015, according to data from the U.S. Mint.

· A statement by water commission Conagua reports that Newmont Goldcorp’s Penasquito mine, along with the Mexican government, have reached an agreement to protect the Cedros aquifer in the state of Zacatecas. Penasquito had around 80 percent of the aquifer’s volume concessioned, part of which it gave up as part of the agreement.

Opportunities

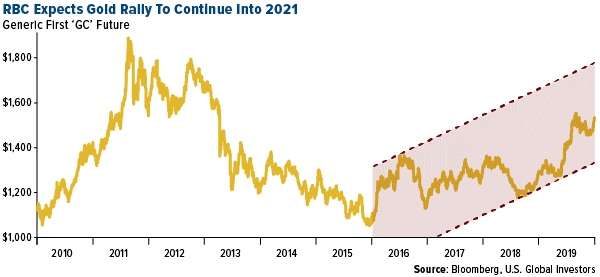

· RBC Capital Markets thinks that the price of gold could tack on another 11 percent to its 19 percent gains over the last year, reports Bloomberg. The bank’s strategists led by Christopher Louney wrote in a note that although gold prices have historically been volatile and could see some fluctuations over the next two years on a quarterly basis, the yearly story could paint a different picture. On a yearly basis, the trajectory is likely higher. And with gold’s rally potentially continuing, silver can also rally further, reports Bloomberg. The two metals are highly correlated, and with a comparative beta 1.3, silver offers greater potential upside.

· Tyler Durden of Zero Hedge provided an analysis this week shedding some light on how the Fed is already conducting “Helicopter Money.” His article notes that the Fed’s charter prohibits it from directly purchasing bonds or bills issued by the U.S. Treasury, but what’s to stop the Fed from purchasing such U.S. debt just after the issuing trade settles? Apparently, that is okay. With some sleuthing, Durden dug through the government filings and traced debt issuance on December 16th, 19th, and 20th where T-Bills were sold to the broker/dealer and as soon as the trade settled, the Fed bought the debt back from the broker /dealer circumventing the hurdle that prohibits direct purchases. Obviously, the broker/dealers aren’t likely doing this for free.

· Several companies have released news of strategic investments heading into the New Year. Manitou Gold Inc., for example, announced the closing of a $3 million financing and strategic investment by Alamos Gold Inc. and 03 Mining, reads one press release. On Tuesday, similarly, Red Pine Exploration said it closed a brokered C$3.78 million private placement of flow-through and common share units that included an investment in the company by Alamos Gold – which took a 19.9 percent stake in the company. Clearly, the established gold mining companies are actively buying stakes in exploration and development companies. Other company news includes drilling numbers from Scottie Resources Corp. of 73.32 g/t gold and 71.01 g/t silver over 4.38 meters, which announced that drilling continues to confirm and expand the Bend Vein target on its Bow Property. Lastly, Bob Moriarty from 321Gold highlighted recently TriStar Gold and its Witwatersrand lookalike deposit in Brazil – check it out in Streetwise Reports.

Threats

· S&P Global Ratings was the most bearish on U.S. corporate debt in 2019 than at any other point in the last decade, reports Bloomberg. In fact, 2019 saw the most credit rating downgrades for U.S. companies relative to upgrades since 2009, according to S&P data. Energy names bore the brunt of the downgrades.

· Thomas Barkin, President of the Federal Reserve Bank of Richmond, says a potential escalation of U.S. tensions with Iran is among the shocks that could threaten America’s record-long economic expansion, reports Bloomberg, which he says for now looks “quite healthy.” “There’s always the possibility of a heart attack or a shock, perhaps caused by global risks,” Barkin explained in a speech on Friday in Baltimore. “Imagine an escalation with Iran or a collapse in international economies.” Such events raise the possibility that the Fed might actually cut rates in the coming year.

· DB Macro, in a research note, outlines six things on Iran for the week that investors should be aware of following the big geopolitical event overnight. While all six points are of important context, the first really stands out to us. Coming from Oliver Harvey, U.K. Macro Strategist: he notes this is by far the most worrying escalation of a simmering conflict between the U.S. and Iran since the U.S.’s withdrawal from the JCPA in May 2018. He says it is almost analogous to Iran assassinating Vice President Pence in terms of importance of Soleimani.

| Digg This Article

-- Published: Monday, 6 January 2020 | E-Mail | Print | Source: GoldSeek.com