-- Published: Monday, 23 March 2020 | Print | Disqus

Strengths

· The best performing metal this week was gold, down just 2.04 percent. BullionStar, a bullion dealer in Singapore, has seen a record number of orders, order revenue and number of visitors to its center over the past month, according to a post on its website and as reported by Bloomberg. “We have managed to replenish a bit of gold on Saturday but it’s very difficult to find any supply anywhere.” A lack of physical gold supply is positive new for buying and a sign that demand is strong. Bloomberg’s Andrew Cinko writes that gold has a love/hate relationship with equity bear markets. At first, havens such as gold are a good bid, but then they are sold to raise cash. This is what happened this week, with investors selling gold to raise cash. Gold traders are also selling out of their futures contracts, which are dragging on gold’s price. Margin calls hit hedge funds on derivative trades and their traders are forced to sell and pony up cash with gold being liquid.

· On Tuesday, the 10-year Treasury yield surged the most since 1982 and the moves in term premium and real rates were the largest in recorded history. Cornerstone Macro writes that those moves reflect a serious lack of liquidity in the market. UBS’ Joni Teves writes that gold’s correction this week coincides with higher real interest rates and a stronger U.S. dollar and is broadly in line with performance during the 2008 selloff. “Gold is down, but not out.”

· Dymon Asia Capital Chief Investment Officer Danny Yong said in a Bloomberg TV interview this week that investors should be long gold as the U.S. dollar strength won’t last. Yong added that periods such as now with extreme volatility serves as a reminder that there is still a place for active fund managers. Australia is expected to overtake China as the world’s largest gold producing country in 2021, according to its Department of Industry, Science, Energy and Resources. Australia hopes to produce 383 tons of gold in 2021, due to higher prices. The coronavirus outbreak is likely to reduce China’s production by 2.9 percent in 2020 to 369 tons. Nord Gold SE said that it submitted a proposal to acquire shares in Cardinal Resources Ltd. that it doesn’t already own. Bloomberg reports that the preliminary takeover proposal is an 83 percent premium to Cardinal’s March 13 closing price.

Weaknesses

· The worst performing metal this week was platinum, down 19.63 percent as hedge funds cut their bullish positioning to a 6-month low. The leveraged loan market fell to levels not seen since the financial crisis, signaling higher default rates and a potential funding crunch ahead, writes Bloomberg’s Lisa Lee. The average price on loans to the riskiest and most-indebted U.S. companies was 84.6 cents on the dollar on Tuesday. In less than two weeks, the amount of distressed debt has doubled to half a trillion dollars. U.S. corporate bonds that yield at least 10 percentage points above Treasuries, as well as loans that trade for less than 80 cents on the dollar, have surged to $533 billion, reports Bloomberg. In another sign that things are trading where they shouldn’t be due to the liquidity crunch is that municipal bonds are twice Treasury yields. Tax-exempt municipal bonds typically return between 80 percent to 90 percent of Treasuries. As of Tuesday, muni bonds were at 1.72 percent.

· Gold has been under pressure due to a higher U.S. dollar. The dollar has been propped up on concern that there will be a global recession and people want to get their hands on cash now. Silver has been hit especially hard as it is seen as more of an industrial metal, rather than used for jewelry. The white metal, also used in solar panels, is down 28 percent in the last eight trading sessions as of Tuesday, according to Bloomberg data. Norilsk Nickel’s partner on a palladium project in the Artic, Russia Platinum, said that it is ending talks on the joint venture due to its second-largest shareholder, Rusal, not approving the participation.

· The State Department is halting most visa processing for Mexican guest workers due to the coronavirus pandemic, creating concerns from U.S. farmers who rely on their labor to harvest crops, reports Business Insider. The restriction could threaten farmers’ ability to put food on American tables if there are not enough workers to pick crops. The Bloomberg Mortgage REIT Index fell on Wednesday to the lowest since 1994 amid discussion of the government to aid borrowers and offer payment forgiveness on mortgages.

Opportunities

· Wayne Gordon, executive director for commodities and foreign exchange at UBS Group AG’s wealth-management unit, told Bloomberg TV that now is the time to buy gold. “When I think about what would I buy in the right here and now, I would be buying gold.” Gordon says that gold prices should appreciate over the next three to six months. One positive for gold miners right now is lower oil prices. Morgan Stanley research shows that a 50 percent drop in the oil price could lower costs of production by 10 percent to 20 percent across commodities.

· Contrarian investors are starting to smell the opportunity in gold, because its near-term outlook is improving, writes Mark Hulbert for MarketWatch. Eight Capital writes that volatility in the market has created compelling opportunities for gold stocks, particularly miners with strong balance sheets, greater free cash flow certainty and discretionary spending opportunities, reports Bloomberg.

· An analysis from Baker Steel shows why gold has faltered in the face of the coronavirus and why a recovery is in order. “While the short-term outlook is certainly volatile, we believe gold and gold equities will be substantial beneficiaries of the economic conditions and post-crisis policies which we see beginning to be implemented currently.”

Threats

· JPMorgan writes that market depth has virtually disappeared. Unwinding of risk parity trades was largely accomplished last week but some spillover continues. The trigger event for the unwinding, according to Wall Street strategist David Zervos , was the collapse in the 10- and 30-year yields earlier in the month. Effectively there was no yield on the Treasury curve to keep the risk parity trades alive. Zervos noted “Given that many risk parity folks also hold gold and TIPS as an inflation hedge, the weakness in these two assets can also be explained well by the unwind.” Calculations by Bloomberg show that bond futures positions equivalent to $150 billion in 10-year Treasuries were sold from Friday through Tuesday. Record high volatility has in turn prompted machines to pull liquidity, which triggered a vicious feedback loop of volatility, illiquidity and outflows. However, JPMorgan suggest that in the next 10 days there will be the month-end and quarter-end rebalancing period that should bring significant buying of equities.

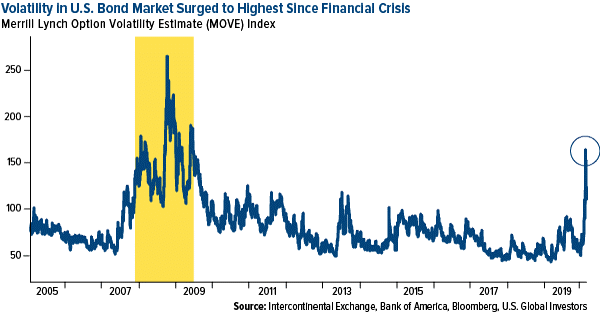

· The Fed is facing a threat that hasn’t been experienced before – a sudden collapse in corporate revenue and household income from a global pandemic. Equity markets are plunging, indicating fear of a global recession, and volatility in the bond market just hit the highest since the financial crisis. U.S. lawmakers are rushing to pass a fiscal package of as much as $1.3 trillion. The U.S. dollar continues to surge, raising speculation that there might be a coordinated effort to weaken the currency. However, currency strategists see little chance that such efforts would succeed, reports Bloomberg. The dollar isn’t surging for any fundamental reasons. It’s only surging due to the liquidity crisis driven by fear of a recession and the desire for cash. Corporate share buybacks will likely come to a halt. Last week, eight major banks stopped the practice and more are expected to follow suit as companies focus more on balance sheets and supporting clients.

· Are Modern Monetary Theory (MMT) supporters about to see it in practice? The idea is that countries with their own central banks don’t need to worry about budget deficits because they can just buy whatever debt the government issues. The U.S. deficit continues to skyrocket, especially after the $1.3 trillion (or more) stimulus package is released. This week the Trump administration floated the idea of a 50-year bond to finance the massive $1.3 trillion package.

| Digg This Article

-- Published: Monday, 23 March 2020 | E-Mail | Print | Source: GoldSeek.com