-- Published: Monday, 30 March 2020 | Print | Disqus

● The best performing metal this week was palladium, up 37.90 percent, essentially regaining all the losses from the prior two weeks. Platinum and silver also rebounded strongly. Gold headed for its biggest weekly gain since 2008 while platinum and palladium were on track for their biggest weekly increases on record. It was a smashing week for precious metals due to supply concerns over mine shutdowns in top producing South Africa. Palladium surged more than 20 percent on Tuesday, its biggest ever gain, after South Africa announced a 21-day coronavirus lockdown. Dmitry Glushakov, head of metals and mining research at VTC Capital, said the country “accounts for some 70 percent of global platinum mined supply and 35 percent of palladium, with a 21-day lockdown possibly resulting in a 4 percent and 2 percent of 2020 supply reduction respectively.”

● CME Group is planning to offer a new futures contract with expanded delivery options that include 100-troy ounce, 400-troy ounce and one-kilo gold bars, reports Bloomberg News. Derek Sammann, senior managing director and global head of commodity and options products for CME Group, said that “this time of unprecedented market conditions has led to growing demand for a broader range of delivery needs for our clients worldwide.” Silver demand is finally seeing some love. The Perth Mint reported a surge in demand, so much so, that it is diverting production resources to meet demand for the popular one ounce Silver Kangaroo coin. The U.S. Mint sold out of American Eagle silver coins and the closing of the Royal Canadian Mint has squeezed supply even further.

● Gold had its best two-day gain since 2016 on Monday, climbing 3.8 percent since last Thursday, after the Fed announced a huge second wave of initiatives to support the U.S. economy. Ole Hansen, head of commodity strategy at Saxo Bank A/S, says “it’s a really aggressive message made by the Fed” and is a long-awaited relief for risk-on assets and gold, which had suffered recently from deleveraging. Economic damage expected from the virus has boosted bullion’s safe haven appeal.

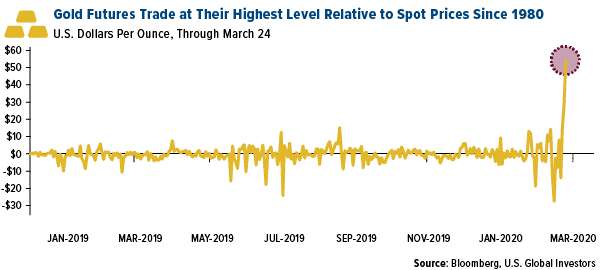

● The worst performing metal this week was gold, up 8.64 percent. The gold market was thrown in a frenzy this week as investors rushed to get their hands on the metal amid a supply crunch. Logistical disruptions led to a wide divergence of prices in the U.S. and London. Contracts for delivery in New York were trading at a $60 premium to London – the highest premium since the 1980s. Bloomberg reports that most banks and traders ship gold around the world on commercial flights. But with most flights canceled and refineries closing due to lockdowns, it has become more challenging to buy and sell the metal.

● Metalor’s gold refinery in Singapore is running at much-reduced capacity due to a manpower shortage. There is a movement-control order in Malaysia where many workers live. Switzerland’s gold refining hub, the biggest in Europe, halted output. Ludwig Karl, a board member of Swiss Gold Safe, an operator of high security vaults, said “It’s absolutely crazy what’s going on. Right now, if somebody wants to buy gold, I wish them all the best in finding it. Most of the bullion dealers are closed.”

● The All India Gem and Jewellery Domestic Council estimates that total purchases of gold jewelry in India are set to fall 30 percent in 2020. Demand had already been hit for months due to high domestic prices and slow economic growth. But now with the added virus threat and the entire county on lockdown, demand could fall to the lowest since 1995. The lockdown will prevent gold shops from opening and a drop in the rupee is keeping local gold prices elevated, reports Bloomberg.

● Gold may reach $2,500 per ounce in the third quarter due to Fed stimulus, says B Riley FBR analysts led by Adam Graf in a note this week. “Regardless of how much longer recession conditions will continue and how much further general equity markets might retreat, extreme monetary and fiscal stimulus policies enacted on a global basis will have repercussions.” Graf upgraded Royal Gold to buy from neutral and recommends that investors be overweight gold and gold equities, reports Bloomberg.

● Goldman Sachs Group said gold bullion is at an inflection point and it is time to buy as the metal extended its rally on a fresh wave of stimulus measures. Goldman says the Fed’s move will help alleviate the funding stress that had driven gold lower and that investors would now pivot to focus on the expansion of its balance sheet, just as it did in 2008, reports Bloomberg. The U.S. finally passed its $2.2 trillion stimulus package on Friday – growing the deficit even further. Lastly, the analysts highlighted the rise in deficits of developed economies and how “this will likely lead to debasement concerns similar to the post Global Financial Crisis period.”

● While ounces produced may be down in 2020 due to the lockdowns, the margins for gold miners may be better, writes Michael McCrae of Kitco News. One-third of NYSE-listed senior gold miners have withdrawn 2020 production guidance as more and more mines are taken offline. Although this setback could be negative, miners are actually in good shape to weather the downturn, especially with oil prices as low as they are. Additionally, gold miners are “cashed up” due to gold performing well in 2019.

● The Rand Refinery in South Africa will operate at reduced capacity during the nation’s 21-day lockdown. If the refinery has to do a complete shutdown, it would have a domino effect on the production across the continent. With the refinery closed, mines would stockpile their mined gold on the surface, which would create heightened security risks.

● Treasury holdings by foreign central banks held in custody at the New York Fed fell $31 billion to a two-year low of $2.9 trillion in the week ended March 18. Bloomberg reports that this is likely due to Middle Eastern countries raising cash to balance their budgets as oil prices plummet. Ye Xie, markets reporter, writes that “with low oil prices and shrinking current accounts in emerging markets and China, President Trump can’t count on foreign central banks to take on more Treasuries.”

● President Trump said that he wants the U.S. economy to “reopen” by Easter, but it could end up having severe health and economic consequences after recently implementing strict social distancing policies and shutdowns. The President, and others, fear that the economic consequences of such a long shutdown will be severe, but the number of lives that could be lost if the virus continues to spread rapidly would also be severe. The U.S. became the country with the most number of cases of COVID-19 this week. Nearly half of all Americans have been ordered to stay at home and avoid contact with others and each state is individually determining lockdown measures.

| Digg This Article

-- Published: Monday, 30 March 2020 | E-Mail | Print | Source: GoldSeek.com