-- Published: Monday, 13 April 2020 | Print | Disqus

Strengths

· The best performing precious metal for the holiday shortened week was silver, up 7.26 percent, likely on the waves of money printing that’s just getting started. Gold rose above $1,700 an ounce for the first time since 2012 on Tuesday after March’s panic selling to raise cash has subsided. ETFs backed by gold added 263,504 troy ounces on Wednesday, bringing net purchases for the year so far to 9.06 million ounces. According to Bloomberg data, this is the 13th straight day of growth.

· European Union (EU) finance ministers failed to agree on a strategy to mitigate the economic impact of the coronavirus, sending sentiment in Europe down and aiding safe havens, reports Bloomberg. Gold has benefited from its status as a perceived safe haven asset. UBS strategist Joni Teves said in a note that gold’s uptrend remains intact. “Further deterioration in economic data, continued policy easing and the compression in real rates should make room for further gains in the weeks and months ahead.”

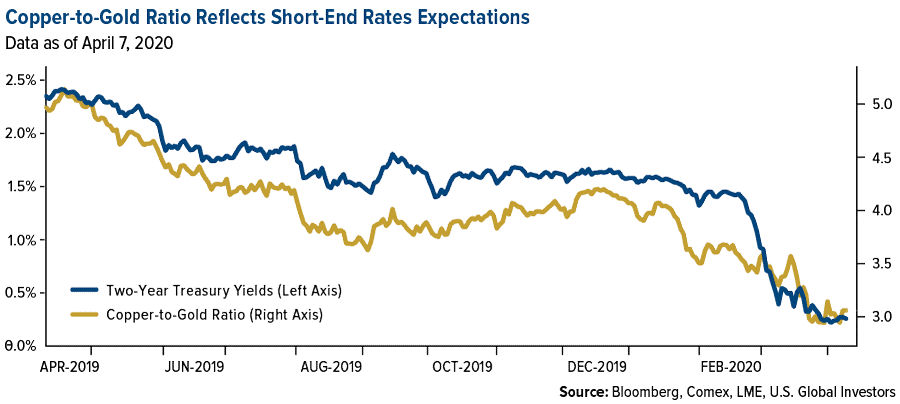

· The current cycle of easing might not be over yet. The copper-to-gold ratio has a strong correlation with 2-year Treasury yields, and with the preference for gold over copper growing, it suggests that rates could fall even further, reports Bloomberg. The preference for one metal over the other gives an idea of expectations for future growth and policy decisions. Copper is often viewed as a pro-cyclical industrial output and gold is seen as a haven.

Weaknesses

· The worst performing precious metal for the holiday shortened week was palladium, up 0.03 percent. India’s biggest jeweler by market value, Titan Co., said in an exchange filing that revenue in March fell by 5 percent due to lost sales, but that in the first two months of the year revenue actually increased by 16.5 percent. The company said total revenue growth was impacted severely by India’s lockdown to contain the spread of the coronavirus. Last week it was reported that the country is bracing for the lowest gold sales in 25 years.

· South Africa shut down its mining industry to contain the virus, which involved sending more than 450,000 workers home in 24 hours. Bloomberg reports that it will take much longer than a day to get its mines back up and running. Impala Platinum Holdings said that it could take three to four weeks for production at the deepest mines to resume as returning employees must be screened by the virus and have temperatures checked. It is positive, though, that operations will resume after South Africa’s 21-day national lockdown.

· Gold prices diverged again this week. Bloomberg notes than an ounce of gold on the Comex was $50 more expensive than an ounce in London on Tuesday. The usual difference between the two should only be a few dollars. This instance is different than two weeks again – there’s no plenty of supply, but traders are staying away due to high risk.

Opportunities

· In company-specific news this week, JPMorgan initiated coverage of Newmont Corp. with a recommendation of overweight. GFG Resources saw its shares double after the company announced on Monday that exploration results from a northern Ontario project showed very high-grade gold mineralization. B2Gold Corp. was up Thursday morning after it reported record total gold production of 262,632 ounces in the first quarter and that revenue was up 44 percent from the year prior. Kirkland Lake Gold said it saw a 43 percent yearly increase in gold output in the first quarter of 330,864 ounces.

· Silver could outperform gold once the world’s manufacturing returns to full speed. Silver is more of an industrial metal than gold, being used widely in solar panels. Bloomberg’s Eddie van der Walt writes that when the world’s engines start turning again, silver should see a pickup in demand. Van der Walt also cites the high gold/silver ratio as a driver. It now takes more than 100 ounces of silver to buy one ounce of gold – meaning silver is oversold.

· Joe Foster, gold portfolio manager at Van Eck, told Kitco News in an interview this week that gold could top $2,000 an ounce soon and that miners are in good shape to weather the coronavirus storm. “Balance sheets are healthy pretty much across the board. Debt ratios… are at a fraction of the average for the S&P 500. Financially, they’re in very good shape.” Foster adds that gold was already in an uptrend before the pandemic began.

Threats

· Peter Kraus, former CEO of AllianceBernstein, said in a Bloomberg TV interview this week that he expects the rout in credit markets to get worse and that prices for goods will eventually start to rise amid government stimulus. Kraus said that, over the long-term, he thinks “this significant amount of fiscal stimulus that we’re having in the world will create an inflationary cycle.” He also criticized the growing trend of passive fund management strategy.

· Jobless claims totaled 6.6 million for the latest period – above expectations for 5 million to 6 million. This was the third straight week that new claims topped 3 million. Although gold rallied on the news, this is a big negative for many Americans and a clear sign that the coronavirus is having a massive impact on the economy. The International Monetary Fund (IMF) director said this week that the pandemic could trigger the worst recession since the Great Depression.

· Oil prices showed some signs of recovery this week but still finished down. Miners had been enjoying the lower fuel costs, as it can be one of the largest operating costs at projects. However, oil prices still remain very low on a historical basis.

| Digg This Article

-- Published: Monday, 13 April 2020 | E-Mail | Print | Source: GoldSeek.com