-- Published: Monday, 27 April 2020 | Print | Disqus

Strengths

· The best performing metal this week was gold, up 2.78 percent. ETFs added 36,334 troy ounces of gold to their holdings on Thursday, bringing this year’s net purchases to 12.2 million ounces, according to Bloomberg data. That marks the 24th straight day of increases for ETFs backed by the yellow metal. Newmont, the world’s largest gold company, increased its quarterly dividend by 79 percent to signal how gold’s status as a haven is helping producers weather the coronavirus, reports Bloomberg. The U.K. Mint said sales of gold bullion coins and bars jumped 736 percent in March compared with a year earlier. The mint added that a fifth of new customers were under 35. Gold exports from Switzerland to the U.S. rose to 43.2 tons in March – the most since data going back to 2012, according to data from the Swiss Federal Customs Administration. The U.S. Mint reopened its West Point facility in New York this week after temporarily closing the plant last week.

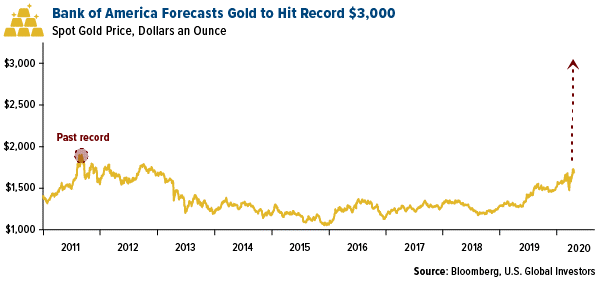

· Bank of America made two very bold precious metal price predictions this week. The bank said silver could rally to $20 an ounce due to a rebound of economic growth later in the year. Spot silver last traded at $20 in 2016 and is down 14 percent so far in 2020. Secondly, the bank says gold could nearly double to $3,000 an ounce over the next 18 months as central bank stimulus and economic turmoil drives record interest in the metal. The bank released this forecast in a report titled “The Fed can’t print gold.”

· The silver market surplus is set to shrink by more than half in 2020 due to shuttered mines. Total silver supply is expected to top consumption by 14.7 million ounces this year, down significantly from 31.3 million last year, according to estimates by Metals Focus for the Silver Institute. Silver coin and bar demand is set to rise 16 percent – the most since 2013.

Weaknesses

· The worst performing metal this week was palladium, down 6.11 percent on the large drop in automobile buying, which could push the market to surplus this year. Precious metals fell early in the week as the broader market weakened along with oil prices. Gold futures for June delivery fell 1.4 percent to $1,687 an ounce by Monday afternoon, but then rose back above $1,700 later in the week.

· Capital Economics said in a report that a decline in gold prices is looming in the month ahead as economies will come back online and demand for haven assets will fade. The firm predicts gold will fall back to $1,600 an ounce by year-end.

· The coronavirus pandemic continues, and mine shutdowns have plagued metal prices and miners. China, the world’s top commodities buyer, recorded its first contraction in decades, reports Bloomberg. Miners globally are struggling to relocate workers amid mine shutdowns while facing the challenges of disrupted supply chains.

Opportunities

· Although gold jewelry buying In India has been down for months, a new love for gold has emerged. The World Gold Council (WGC) wrote in a report this week that nearly 29 percent of retail investors who had never bought gold, now look forward to buying gold in the future. The report adds that gold is now a preferred investment option in the country.

· K92 Mining share price got hit on Friday as Barrick Gold announced it was challenging the Papua New Guinea’s (PNG) government decision to not renew their special mining permit for their Poregera Mine. This initially weighed heavy on K92 Mining as its gold mine is also located in PNG and investors worried “was PNG changing their mining policy?” Apparently, the PNG government has specific issues with Barrick Gold that remains unresolved. St. Barbara Ltd. renewed its mining license recently and K92’s does not come up for renewal till 2024. The pullback in K92’s share price could be an attractive entry point. GFG Resources announced a non-brokered private placement to raise gross proceeds of up to C$5 million with Alamos Gold has committing to purchasing those securities to obtain a 9.9 percent interest in GFG. Roxgold Inc. released strong drilling results from its gold project in Cte d’Ivoire. Highlights include 12 meters at 13.8 grams per ton of gold and five meters at 28 grams per ton of gold.

· A senior fund manager at Alternative Investments, Quantum AMC wrote their five reasons why gold can help investors get through a recession. 1) Counterparty risks in paper assets like bonds tend to increase during a recession, while gold cannot default. 2) Gold’s value is not dependent on revenues and profits, as equities are. 3) As central banks cut rates, fixed-income instruments will yield less. 4) Central banks are injecting massive amounts of liquidity, increasing the probability of higher inflation, which is historically good for gold. 5) Lastly, gold benefits from economic distress as people flock to perceived safe-haven assets.

Threats

· Palladium could be looking at a small surplus in 2020 after years of a deficit that led to skyrocketing prices. Kitco News reports that palladium fell from an all-time high of $2,700 at the end of February to nearly $1,400 in mid-March on demand concerns surrounding coronavirus. The world’s top palladium producer, Norilsk Nickel, said that it expects a small surplus of around 0.1 million ounces. The surplus is projected to be temporary and that a deficit will resume once the world fully reforms after the pandemic subsides.

· The seriousness of the coronavirus-fueled recession is reflected in April’s preliminary PMI readings. The composite PMI plummeted to 27.4, a new series low, as companies were shuttered and millions of non-essential workers were furloughed or laid off. A staggering 26.4 million people, or about 15 percent of the U.S. workforce, have now lost their jobs since mid-March.

· Adding to the global stress of the coronavirus spread and efforts to treat infected patients, President Trump said on Thursday that scientists might investigate inserting cleaning agents into the body to cure COVID-19. White House Press Secretary Kayleigh McEnany said in a statement the next day: “President Trump has repeatedly said that Americans should consult with medical doctors regarding coronavirus treatment.” There has been contrasting information coming from the President and some of his top advisors surrounding the pandemic.

| Digg This Article

-- Published: Monday, 27 April 2020 | E-Mail | Print | Source: GoldSeek.com