-- Published: Monday, 11 May 2020 | Print | Disqus

Strengths

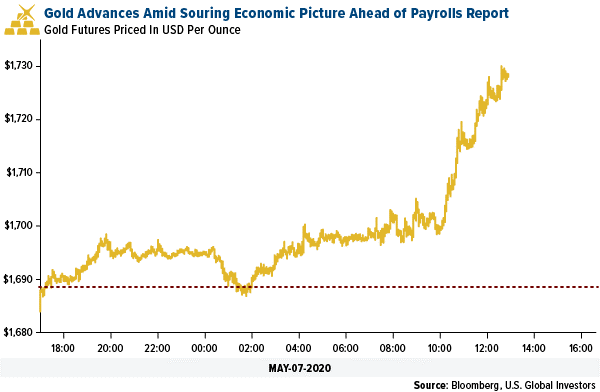

· The best performing metal this week was silver, up 3.34 percent. Gold rebounded on Thursday to steady around $1,700 an ounce as economic data worsened. Unemployment surged to nearly 15 percent in the U.S. Bloomberg notes that the number of Americans filing for unemployment was above 3 million for the seventh straight week, boosting demand for havens as the economic situation continues to deteriorate. According to Bloomberg data, holdings in gold-backed ETFs surged about 3,000 tons to an all-time high this week. Inflows in 2020 so far have already surpassed the volume added in all of 2019.

· South Africa’s Rand Refinery Ltd., Africa’s largest refinery, said it is restarting gold smelting as the country eases a national lockdown. Rand’s CEO Praveen Baijnath said, “We have established a good routine and have been able to ensure that product from our mining clients is shipped to us and that refined product makes its way to bullion banks and end user customers.” Swiss refineries are also ramping up production, which should ease supply concerns that caused gold prices to diverge widely in April.

· Traders are pricing in the possibility that the Federal Reserve will cut its policy rate to below zero by early 2021. This could bode well for gold, as it historically has an inverse relationship with rates. Chinese buyers of gold mining projects took their second bite at the apple this year with Shandong Gold Mining agreeing to buy TMAC Resources at a 52 percent premium to its 20-day trailing average price. A new milling and treatment plant are likely needed to process the TMAC ores as their original engineering design had failed to economically recover enough gold from the circuit. This transaction follows on the heels of Silvercorp’s takeout offer for Guyana Goldfields, another failed project with improper mine planning and engineering design; taken under by braver soul.

Weaknesses

· The worst performing metal this week was palladium, down 1.34 percent despite hedge fund managers raising their net bullish positioning and Bank of America Merrill Lynch forecasting a deficit now for both palladium and platinum on reduced South African supplies. Spot gold trading fell in April due to market disruptions and a disconnect between prices in London and New York. According to the London Bullion Market Association (LBMA), trading volumes fell to 743.5 million ounces last month, down from 1.33 billion in March. Bloomberg notes that trading should return to normal in May as major refineries ramp up projection.

· Swiss refiner Valcambi SA tried for five days straight in April to move a shipment of gold out of Hong Kong, reports Bloomberg. With global air travel at a standstill, the precious metals industry is searching for alternative ways to transport the metal. Limited flights are prioritizing protective equipment, medical items and food over bullion, according to Baskaran Narayanan, vice president of Brink Asia Pacific. India’s gold imports totaled just 60 kilograms in April, down from 13 tons in March. This is about a 99.5 percent drop as the coronavirus curbs air transport for gold.

· Barrick Gold lowered is output forecast after running into a conflict with the government of Papua New Guinea. About 5 percent of the miner’s production comes from the Porgera gold mine in the country.

Opportunities

· Mawson Resources said that it has tripled the size of its Sunday Creek gold project in Australia. The company said its plans to commence geophysical surveys followed by diamond drilling during the second half of this year. Americas Gold and Silver announced a C$25 million bought deal offering. Bloomberg reports that investors led by Pierre Lassonde and Eric Sprott have said they intend to subscribe for shares in the offering totaling C$8.75 million.

· RBC Capital Markets has raised its outlook for gold. Their base-case outlook that has a 50 percent probability is that gold will average $1,663 for 2020 and that the fourth quarter will be the strongest. The high scenario, with a 40 percent probability, is that gold could average $1,788 an ounce, up from prior estimates of $1,614.

· Paul Tudor Jones is buying bitcoin as a hedge against financial instability and money printing. Jones said bitcoin “reminds me of gold when I first got into the business in 1976.” The investor said he remains a big fan of gold and predicts it could rally to $2,400 an ounce or even $6,700 “if we went back to the 1980 extremes,” reports Bloomberg.

Threats

· According to Morgan Stanley analysts including Christopher Nicolson, the plans of South African platinum-group miners to ramp up output could depress prices due to weaker automaker demand. “We see the PGM market moving closer to balance in 2021-22. Given the simultaneous disruption to both supply and demand, the 2020 market balance has become somewhat of a moving target.” Car demand has been hit drastically due to the coronavirus-induced economic harm.

· HSBC reported a $1 million loss in metals trading revenue in the first quarter, compared with a $38 million profit for the same period last year. The bank said that it decreased due to “market volatility and unfavorable valuation adjustments on exchange for physical transactions.” Bloomberg reports that the bank cited in a filing “delivery disruptions in the gold market” as one reason why it breached its value-at-risk limits 12 times in March. HSBC normally only expects this to occur two or three times a year.

· Although the worst of the coronavirus might have already been seen, as more economies reopen more cases and deaths are likely to occur. Internal leaked documents showed the Trump administration projects about 3,000 daily deaths in the U.S. by early June according to the Centers for Disease Control and Prevention (CDC). As President Trump pushes states to ease restrictions to get businesses back up and running, the CDC warns that “there remains a large number of countries whose burden continues to grow.” National Economic Council Director Larry Kudlow said a second wave of Covid-19 will not require a shutdown. Currently the U.S. government, across all agencies, approximates the cost of a single human life at $10 million. Unfortunately, we have to live with the choice of how many lives we can save versus how much economic damage is inflicted on society, a sobering calculation.

| Digg This Article

-- Published: Monday, 11 May 2020 | E-Mail | Print | Source: GoldSeek.com