-- Published: Monday, 15 June 2020 | Print | Disqus

Strengths

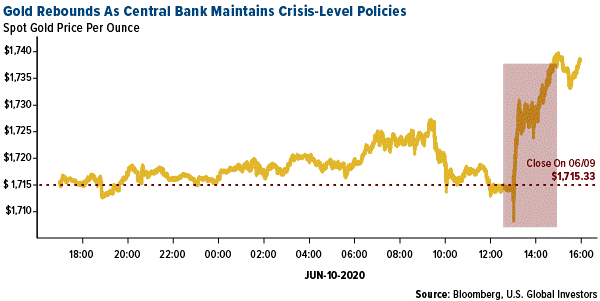

· The best performing precious metal for the week was gold, up 2.78 percent. After its 1.7 percent drop last Friday, gold rose back above $1,700 an ounce this week as investors took advantage of buying the dip. Commerzbank AG analyst Carsten Fritsch told Bloomberg that gold price declines are still seen as a buying opportunity. “Central banks are not expected to reverse their policy of unchecked money-printing. Gold is likely to remain well-supported in this environment.”

· Gold saw its biggest weekly gain since early April as the worsening economic outlook due to a rising number of COVID-19 infections boosted demand for the haven metal. Stocks had their worst day since March on Thursday, with the Dow plunging more than 1,800 points or almost 7 percent. The yellow metal often moves in the opposite direction of the wider stock market.

· Gold futures rallied this week after the Fed announced it would keep interest rates lower for longer and reiterated its dovish view. Officials forecast keeping rates near zero through 2022, which is bullish for the yellow metal. Spot gold finished near $1,740 an ounce on Wednesday after the Fed meeting.

Weaknesses

· The worst performing precious metal for the week was palladium, down 0.77 percent. Gold imports by India fell 99 percent in May, the second straight month of declines, due to COVID-19 restrictions. Bloomberg reports that shipments fell 1.3 tons last month from 105.8 tons a year earlier and follows a record low of just 60 kilograms imported in April.

· The Perth Mint reported that its gold coin and bar sales totaled just 63,393 ounces in May, down from 120,504 in April. Silver sales were also lower – 997,171 ounces in May versus 2.12 million in April.

· Due to extreme disruptions to the gold market earlier this year, banks have shifted some positions out of New York futures and into the London over-the-counter market, according to the London Bullion Market Association (LBMA). “The scale of the dislocation has really made everyone ask questions in terms of the ongoing approach of hedging long London, short Comex,” Ruth Crowell, LMBA CEO, said in a phone interview with Bloomberg. “Certainly in the short to medium future, it’s not an even hedge. So they’re having to either go OTC, or they’re reducing their trading appetite.”

Opportunities

· Artemis Gold is buying the Blackwater Project, one of the largest open-pit gold deposits in Canada, from New Gold, reports Bloomberg. The project has a measured and indicated mineral resources of 9.5 million ounces. Zijin Mining Group is acquiring Guyana Goldfields for a significant premium over what Silvercorp Metals offered in late April.

· Goldman Sach’s Jeff Currie says gold prices could rise beyond $2,000 an ounce if the Fed tolerates above-target inflation. “While this is not our base case, we see the tail risk of above-target inflation as a potential driver for gold prices beyond $2,000.” Roth Capital said precious metals and related equities could significantly outperform the market in 2020 and peak in 2022. Bloomberg reports that Roth sees gold rising to as much as $2,200 per ounce and silver to as much as $27.50. Analysts say that the Fed buying debt and inflating its balance sheet, coupled with the government printing money, bodes well for precious metals and their equities.

· HSBC chief precious metals analyst James Steel said in a note this week that silver could see further gains in this year and next as coin and bar demand “may rise further as investors seek out hard assets.” Although the 2020 forecast was lowered, the bank forecasts a supply deficit of 154 million ounces amid virus disruptions to mining.

Threats

· The five biggest diamond miners are stuck with inventories worth around $3.5 billion, according to Bloomberg. De Beers, the largest, sold just $35 million of stones in May, down from $416 in sales the same period a year ago. Societe Generale said diamond miners are facing “a double whammy of weak prices and a sharp decline in sales volumes on a scale reminiscent of the 2008-09 crisis.”

· South Africa’s mining output fell the most since at least 1981 in April when almost all economic activity was brought to a halt to curb the spread of the coronavirus. Statistics South Africa reported that total production fell 47.3 percent from a year earlier, compared with just an 18 percent decrease in March.

· COVID-19 infections are rising rapidly in several U.S. states after lockdown measures were eased or removed in May. This could spur another round of lockdowns and spell trouble for the industry, again. The gold market disruptions were largely driven by a lack of commercial flights and the closure of refineries. If another global lockdown is enacted, some miners could see the closures of projects just weeks after reopening.

| Digg This Article

-- Published: Monday, 15 June 2020 | E-Mail | Print | Source: GoldSeek.com