-- Published: Monday, 13 July 2020 | Print | Disqus

Strengths

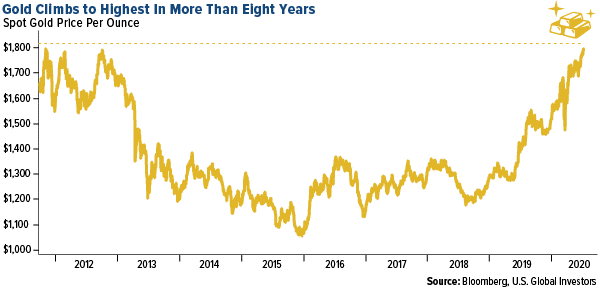

· The best performing precious metal for the week was silver, up 4.25 percent. Investors poured money into silver-backed ETFs this week as the precious metals trade begins to increase in scope. Spot gold prices reached the key $1,800 an ounce level. This milestone could help push the metal closer to its all-time high above $1,900. Bloomberg notes that gold futures traded almost as high as $1,830 an ounce this week.

· The SPDR Gold Shares ETF has seen 15 straight weeks of inflows, the longest streak since its debut in 2004, boosting assets to $68 billion, according to data compiled by Bloomberg. Investors continue to get on the yellow metal on speculation that yields will stay low for years, increasing the appeal for assets that don’t pay interest. Holdings in all gold-backed ETFs rose to 3,234.6 tons on Tuesday, which includes 655.6 tons so far this year, and is more than the total added in 2009.

· It was a strong week for silver, with the metal trading above $19 an ounce after jumping over a dollar in five days. Analysts are expecting the $20 level soon. Demand is being driven by safe-haven appeal and increasing industrial demand in green energy. Silver is outperforming gold. TD Securities said in a note “the white metal outperformed gold by a factor of two, as it jumped some 33 percent over the previous three months.”

Weaknesses

· The worst performing precious metal for the week was gold, still up 1.31 percent. Gold and silver prices were lower in midday U.S. trading on Thursday due to “normal” profit taking, according to Kitco News.

· Russia’s ecological watchdog says that Norilsk Nickel, the world’s largest producer of palladium, should pay $2 billion for its massive Arctic diesel spill in May. The miner said it would fully fund clean-up efforts but estimated the costs at just $150 million excluding fines. Bloomberg notes that Norilsk fell as much as 5.8 percent on Monday and that it is now down more than 5 percent for the year. The company could cut dividends by $1.2 billion to cover the $2 billion requested for clean-up.

· Barrick Gold Corp., one of the world’s two largest gold producers, plans to take Papua New Guinea to international arbitration if it can’t settle a dispute over its giant mine in the country, writes Bloomberg. Back in April, the government said it would not renew Barrick’s right to operate the Porgera gold mine. Now the company has said its local joint-venture unit will pursue all legal options to defend its interests and recover damages.

Opportunities

· Wells Fargo Investment Institute said it predicts gold will rise to $2,000 to $2,300 an ounce by the end of 2021. “We still see a fair amount of upside potential for gold’s price. But breaking above $1,800 and then again the all-time high of $1,900 will be no small feat,” analyst wrote in a note on Monday. Australia & New Zealand Banking Group released a bullish note on gold. “The buoyant gold market has almost perfect conditions. Lower interest rates, ample liquidity and a weaker U.S. dollar are keeping the price afloat.”

· According to analysts at Bank of America, the mining sector was a “buyers’ market” in the second quarter with a total of 12 deal made. The bank said it was the most active quarter since 2012 for M&A. “Mid-tier producers not involved in M&A risk being left behind by their rapidly growing peers.” Kitco News notes that global gold industry reserves have been in decline, pushing miners to acquire rivals or juniors that have deposits.

· The yield on 10-year Treasury Inflation-Protected Securities fell to negative 0.7948 percent on Monday – the lowest since late 2012 and close to the all-time low of negative 0.9269. Bloomberg’s Jake Lloyd-Smith notes that these ultra-low real yields will boost the gold price in the second half of this year.

Threats

· The U.S. hit 3 million coronavirus infections this week – demonstrating that the virus spread is not under control. Another 1.3 million Americans filed for jobless benefits in the past week. Reuters notes that cases are rising in 41 of the 50 pasts over the past two weeks and that many reopening plans have been halted or reversed.

· On Friday, gold prices fell alongside stocks as escalating U.S.-China tensions soured market sentiment, according to Ilya Spivak, Head Strategist at APAC. The risk-off backdrop drove haven demand for the U.S. dollar, as reported by DailyFX, which undermined the appeal of anti-fiat alternatives epitomized by the yellow metal, driving it lower.

· BMO Capital Markets lowered its forecasts for average prices of platinum group metals during 2020, reports Kitco. Analysts reduced the 2020 average platinum price forecast to $875 an ounce from $976 previously, although the bank does look for prices to climb from the mid-morning level of $788 to a fourth-quarter average of $940.

| Digg This Article

-- Published: Monday, 13 July 2020 | E-Mail | Print | Source: GoldSeek.com