-- Published: Wednesday, 22 July 2020 | Print | Disqus

Strengths

· The best performing precious metal for the week was silver, up 3.24 percent and marking six weeks of consecutive gains. Silver was strong again this week as the metal neared $20 an ounce, a level last seen in September 2016. The metal is up 66 percent from its March lows due to stronger demand for use in solar. Silver is also riding the wave of higher gold prices.

· Wheaton Precious Metals CEO Randy Smallwood said that mining companies could raise as much as $3 billion by selling shares of future output. “Any time there’s a bit of financial stress in the industry it always opens up financial opportunities for us,” said Smallwood. Royalty companies such as Wheaton provide upfront payments to miners in exchange for the right to buy metals at a discount in the future, reports Bloomberg. Wheaton says it has been “very active” on potential deals, including one valued at $1 billion.

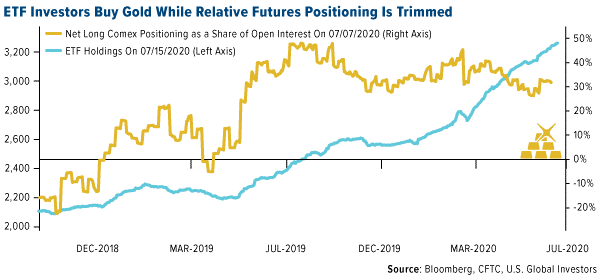

· Gold-backed ETFs had a 17th straight week of net inflows while silver-backed ETFs had a 12th straight week, according to Bloomberg data. However, investors in the gold futures market have been reducing positions. Eddie van der Walt writes that there has been a shift of balance in the gold market where the futures market is being crushed by “big boy” ETFs.

Weaknesses

· The worst performing precious metal for the week was gold, up 0.65 percent; likely investors are diversifying their investment across the other precious metals, particularly silver. Gold futures slipped on Thursday after strong economic data was released. China reported GDP expanding 3.2 percent in the second quarter after contracting 6.8 percent in the first quarter. U.S. retail sales exceeded forecasts in June for a second straight month.

· Barrick Gold said its costs to produce gold and copper rose in the second quarter. The all-in-sustaining cost to produce one ounce of gold was 7 percent to 9 percent higher in the second quarter compared to the first quarter, according to a company statement. Bloomberg reports that Barrick’s production was down for the last three months largely due to COVID-19 disruptions in Argentina and planned maintenance shutdown in Dominican Republic.

· The world’s two largest diamond producers said their combined sales were down 94 percent from a year earlier in the second quarter to just $130 million in rough stones. Bloomberg reports that De Beers and Alrosa PJSC both reported second quarter sales on Thursday.

Opportunities

· Diego Parrilla, the hedge fund manager who runs the “doomsday” fund that has soared 47 percent so far this year, is betting that gold is only getting started. Parrilla believes that gold could rise to $3,000 to $5,000 an ounce in the next three to five years. “What you’re going to see in the next decade is this desperate effort, which is already very obvious, where banks and government just print money and borrow, and bail everyone out, whatever it takes, just to prevent the entire system from collapsing.”

· India’s biggest gold jeweler, Titan Co., said that although it faces a substantial hit from the coronavirus, it does have faith that gold will remain an attractive asset class for protecting wealth. Managing Director C.K. Venkataraman said in a report that “following the outbreak of the pandemic, the perception of gold as an asset class has improved considerably.” The jeweler expects consumers to spend relatively more on gold compared to other discretionary goods.

· EDL Capital, a Swiss hedge fund, plans to offer investments denominated in gold and silver to protect clients against the risk that record stimulus spending will hurt currency values, reports Bloomberg. “With the two new precious metal share classes, we want to offer investors a way to protect themselves against such scenarios” of potential hyperinflation and currency basement, said Jannik Wenger, head of investor relations at EDL Capital.

Threats

· Edward Altman, the creator of the Z-score that predicts corporate bankruptcies, says that this year’s “mega” insolvencies are just getting started. More than 30 companies with liabilities exceeding $1 billion have already filed for Chapter 11 since January, reports Bloomberg. “There was a huge buildup in corporate debt by the end of 2019 and I thought the market would gain some much-needed de-leveraging with the Covid-19 crisis. Now, seems like companies are again exploiting what seems to be a crazy rebound,” said Altman.

· U.S. consumer sentiment unexpectedly turned pessimistic in July with the University of Michigan sentiment index falling 4.9 points. The index had increased by 5.8 points in June. “The decline is a potentially troubling sign for the economy and underlines that confidence and consumer spending will be closely tied to whether the rapidly spreading coronavirus is brought under control,” says Bloomberg’s Scott Lanman.

· The Labor Department reported that 1.3 million Americans filed for first-time jobless claims in the latest week. Although 10,000 lower than the previous week, it is higher than estimates of 1.25 million.

| Digg This Article

-- Published: Wednesday, 22 July 2020 | E-Mail | Print | Source: GoldSeek.com